filmov

tv

How to File your Nonprofit Taxes

Показать описание

If your nonprofit grossed less than $50K/year, then you likely qualify to file your nonprofit taxes using form 990-N. This is sometimes refered to as the e-postcard.

Form 990-N can only be filled out online. It is super easy AND it is FREE!

This video walks you through the basic filing process. It only takes 5 minutes to file your taxes. Pretty awesome, eh?

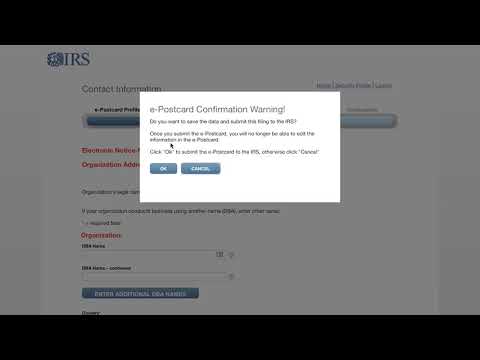

The filing is done via the IRS website. Here are the links & info:

WHEN DO YOU FILE

Form 990-N is due every year by the 15th day of the 5th month after the close of your tax year. You cannot file the e-Postcard until after your tax year ends.

Example: If your tax year ended on December 31, the e-Postcard is due May 15 of the following year. If the due date falls on a Saturday, Sunday, or legal holiday, the due date is the next business day.

ABOUT FORM 990-N

WHO CANNOT USE FORM 990-N

START FILING (LOGIN & ACCOUNT CREATION)

Form 990-N can only be filled out online. It is super easy AND it is FREE!

This video walks you through the basic filing process. It only takes 5 minutes to file your taxes. Pretty awesome, eh?

The filing is done via the IRS website. Here are the links & info:

WHEN DO YOU FILE

Form 990-N is due every year by the 15th day of the 5th month after the close of your tax year. You cannot file the e-Postcard until after your tax year ends.

Example: If your tax year ended on December 31, the e-Postcard is due May 15 of the following year. If the due date falls on a Saturday, Sunday, or legal holiday, the due date is the next business day.

ABOUT FORM 990-N

WHO CANNOT USE FORM 990-N

START FILING (LOGIN & ACCOUNT CREATION)

How to File your Nonprofit Taxes

How to Start a Nonprofit Organization in 2023 (Step-by-step)

How to Start a Nonprofit Organization - 501c3 Organization

How to Start a Nonprofit with No Money

How Do You Start a 501(c)(3) Nonprofit?

How to File Your Articles of Incorporation | Nonprofit Filing

The Truth About Nonprofits

How to file IRS Form 990N( E-Postcard) for your Nonprofit Organization

Bored with Your Board? 3 Key Traits for a Successful Nonprofit Board

How to File your Nonprofit Information Return - IRS Form 990-N

4 documents to start your nonprofit #501c3

Starting a Nonprofit Organization? 3 Things You MUST do First

How To Start Your Own Nonprofit

How to Start a Nonprofit in the USA 501(c)(3) [Step by Step]

How to start a nonprofit in Utah - 501c3 Organization

3 things you can get for free for your nonprofit

How To Start A Nonprofit Organization Step by Step in 2024

Sales and income tax for your nonprofit

What’s the Difference Between a Nonprofit and a 501(c)3? | Q&A #1 | Specialist Nicole

How to start a Nonprofit Organization in 2024 | What they don't tell you

How To Write Off Your Nonprofit EXPENSES (Reimburse Yourself!)

7 Mistakes I Made Starting a Non Profit

How To File A Nonprofit Tax Return? - CountyOffice.org

How to Apply for Federal Tax Exempt Status for Your Nonprofit

Комментарии

0:06:35

0:06:35

0:19:26

0:19:26

0:08:44

0:08:44

0:20:28

0:20:28

0:08:29

0:08:29

0:11:38

0:11:38

0:09:06

0:09:06

0:03:50

0:03:50

0:31:45

0:31:45

0:02:51

0:02:51

0:01:00

0:01:00

0:12:24

0:12:24

0:14:43

0:14:43

0:16:00

0:16:00

0:08:04

0:08:04

0:16:07

0:16:07

0:19:57

0:19:57

0:11:50

0:11:50

0:01:44

0:01:44

0:19:15

0:19:15

0:04:32

0:04:32

0:17:16

0:17:16

0:01:04

0:01:04

0:16:53

0:16:53