filmov

tv

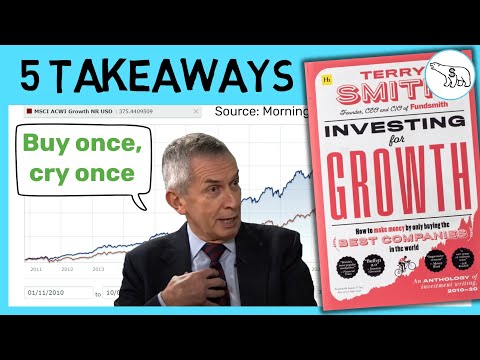

INVESTING FOR GROWTH (BY TERRY SMITH)

Показать описание

"Buy once, cry once" is the preferred strategy of the British fund manager Terry Smith, who has returned more than 500% in the stock markets since the inception of his "Fundsmith" back in 2010.

Terry Smith, a British fund manager, has, since the inception of his Fundsmith T Class, kept on buying only the equivalent of quality cars in the stock market. This video will explore his methods for buying quality without overpaying. Fundsmith has been a 6-bagger in a little over a decade, so his investment strategy has served his investors well.

---

(If you sign up I earn a small commission)

---

Timestamps for growth:

00:00 Intro

01:45 Great Car? Great Choice!

04:30 Don't Pay Extra for Unnecessary Gadgets

07:28 Wait for the Discount

10:57 Don't let the Paint Job Fool You

13:03 No Car is a True All-Rounder

---

Many thanks to my friend Richard Dykes who helped me in making this video possible.

---

My goal with this channel is to help you make more money and improve your personal finances. How to become a millionaire? There are many ways to get there – investing in the stock market, becoming a stock trader, doing real estate investing, or why not becoming an entrepreneur? But whether you are interested in how to invest in stocks or investing strategies for creating passive income with rental properties – I hope to be able to provide you with a solution (or at least an idea) here. Warren Buffett - the greatest investor of our time - says that you should fill your mind with competing ideas and then see what makes sense to you. This channel is about filling your mind with those ideas. And in the process – upgrading your money-making toolbox.

Terry Smith, a British fund manager, has, since the inception of his Fundsmith T Class, kept on buying only the equivalent of quality cars in the stock market. This video will explore his methods for buying quality without overpaying. Fundsmith has been a 6-bagger in a little over a decade, so his investment strategy has served his investors well.

---

(If you sign up I earn a small commission)

---

Timestamps for growth:

00:00 Intro

01:45 Great Car? Great Choice!

04:30 Don't Pay Extra for Unnecessary Gadgets

07:28 Wait for the Discount

10:57 Don't let the Paint Job Fool You

13:03 No Car is a True All-Rounder

---

Many thanks to my friend Richard Dykes who helped me in making this video possible.

---

My goal with this channel is to help you make more money and improve your personal finances. How to become a millionaire? There are many ways to get there – investing in the stock market, becoming a stock trader, doing real estate investing, or why not becoming an entrepreneur? But whether you are interested in how to invest in stocks or investing strategies for creating passive income with rental properties – I hope to be able to provide you with a solution (or at least an idea) here. Warren Buffett - the greatest investor of our time - says that you should fill your mind with competing ideas and then see what makes sense to you. This channel is about filling your mind with those ideas. And in the process – upgrading your money-making toolbox.

Комментарии

0:15:34

0:15:34

0:18:42

0:18:42

0:06:04

0:06:04

0:10:52

0:10:52

0:53:20

0:53:20

0:01:55

0:01:55

0:11:17

0:11:17

0:08:44

0:08:44

0:04:20

0:04:20

0:10:08

0:10:08

0:04:35

0:04:35

0:52:16

0:52:16

0:15:21

0:15:21

0:00:48

0:00:48

0:11:49

0:11:49

0:00:27

0:00:27

0:14:32

0:14:32

0:08:39

0:08:39

0:06:28

0:06:28

0:08:49

0:08:49

0:34:41

0:34:41

0:07:52

0:07:52

0:19:22

0:19:22

0:00:17

0:00:17