filmov

tv

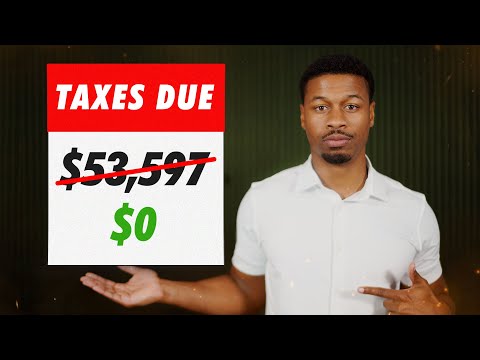

How to Legally Avoid Paying Capital Gains on House Flips!

Показать описание

In this video, you will learn How to Legally Avoid Paying Capital Gains on House Flips! we dive into the complexities of capital gains taxes and how house flipping profits can sometimes be treated as ordinary income.

Discover how this tax treatment can potentially lower your tax rate when starting a house flipping business and what you need to know to navigate the IRS rules. Whether you're a seasoned house flipper or just starting out flipping houses, this information is crucial for maximizing your earnings and minimizing your tax burden. Don't miss out on these essential tips to keep more of your hard-earned money and how to not pay as much taxes when you flip a home.

Discover how this tax treatment can potentially lower your tax rate when starting a house flipping business and what you need to know to navigate the IRS rules. Whether you're a seasoned house flipper or just starting out flipping houses, this information is crucial for maximizing your earnings and minimizing your tax burden. Don't miss out on these essential tips to keep more of your hard-earned money and how to not pay as much taxes when you flip a home.

How the rich avoid paying taxes

How to AVOID paying taxes (LEGAL)

How to LEGALLY Avoid Paying Any Taxes

15 Ways Rich People AVOID Paying Taxes

How to Avoid Paying Taxes LEGALLY

How To Avoid Paying Taxes...Legally

Taxes are Theft. Here's How to Stop Paying Them (Legally)

How Rich People Avoid Paying Taxes - Robert Kiyosaki and Tom Wheelwright @TomWheelwrightCPA

How the rich avoid paying taxes - the Augusta Rule LOOPHOLE

Get An LLC To Avoid Paying High Taxes?

How The Rich Avoid Paying Taxes

CPA EXPLAINS How To Avoid Paying Taxes (LEGALLY) Do This Now!

Real Estate Revealed: How to AVOID Paying Taxes...(Legally, of course)

How To Legally Avoid Paying Taxes

How to LEGALLY Avoid Paying Taxes This Year

How The Rich Avoid Paying Taxes (And How You Can Too)

How to legally stop paying taxes and being a sucker!

HOW TO STOP PAYING COUNCIL TAX LEGALLY

How to legally avoid paying taxes! 💸

How to AVOID PAYING TAXES legally!. Do this 8 ways!

How to Travel the World and Not Pay Taxes (Legally)

How to AVOID PAYING THE IRS

How To Avoid Paying Taxes (5 Legal Methods)

Tax tips: How to legally avoid paying taxes | FOX 7 Austin

Комментарии

0:06:07

0:06:07

0:00:46

0:00:46

0:16:48

0:16:48

0:20:19

0:20:19

0:07:20

0:07:20

0:00:41

0:00:41

0:18:58

0:18:58

0:10:29

0:10:29

0:03:59

0:03:59

0:04:00

0:04:00

0:11:08

0:11:08

0:11:32

0:11:32

0:17:54

0:17:54

0:16:42

0:16:42

0:50:37

0:50:37

0:08:59

0:08:59

1:57:26

1:57:26

1:10:45

1:10:45

0:00:59

0:00:59

0:14:40

0:14:40

0:05:49

0:05:49

0:03:19

0:03:19

0:07:26

0:07:26

0:04:24

0:04:24