filmov

tv

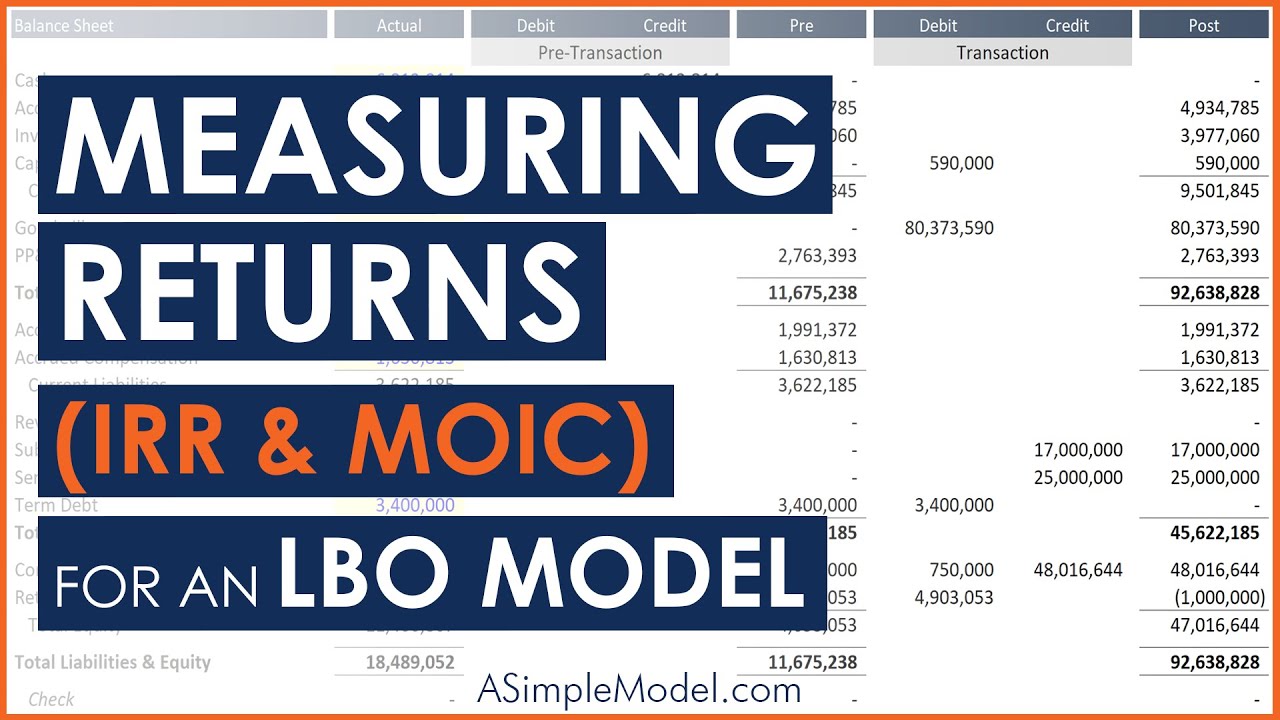

LBO Returns Analysis: Measuring IRR and MOIC

Показать описание

This video explains how to measure returns in an LBO model using both the Internal Rate of Return (IRR) and Multiple of Invested Capital (MOIC).

The primary output that we are targeting through the construction of this Excel worksheet is expected return on investment, which is critical to understand in any process, since it is the ultimate measure of investment success. Expected rate of return is generally measured as both an internal rate of return (IRR) and multiple of invested capital (MOIC) under a variety of scenarios.

To develop the framework required to measure potential returns for this investment, we need to do three things:

(1) Calculate Enterprise Value

(2) Calculate the Value of Common Equity

(3) Determine the Implied Internal Rate of Return (IRR) and Multiple of Invested Capital (MOIC)

LBO Case Study Referenced in the Video:

LBO Case Study Solution (subscriber content):

What is the Internal Rate of Return (IRR)?

Introduction to Private Equity:

MORE ASM PRIVATE EQUITY CONTENT ON YOUTUBE

An Introduction to Private Equity:

Private Equity Industry Due Diligence (Real Example)

Private Equity Bidding Strategy

Private Equity Sourcing Funnel

Favorite LOI Negotiation Story

The Working Capital Adjustment Explained

The Stock Purchase Agreement

Purchase Price in Private Equity

The primary output that we are targeting through the construction of this Excel worksheet is expected return on investment, which is critical to understand in any process, since it is the ultimate measure of investment success. Expected rate of return is generally measured as both an internal rate of return (IRR) and multiple of invested capital (MOIC) under a variety of scenarios.

To develop the framework required to measure potential returns for this investment, we need to do three things:

(1) Calculate Enterprise Value

(2) Calculate the Value of Common Equity

(3) Determine the Implied Internal Rate of Return (IRR) and Multiple of Invested Capital (MOIC)

LBO Case Study Referenced in the Video:

LBO Case Study Solution (subscriber content):

What is the Internal Rate of Return (IRR)?

Introduction to Private Equity:

MORE ASM PRIVATE EQUITY CONTENT ON YOUTUBE

An Introduction to Private Equity:

Private Equity Industry Due Diligence (Real Example)

Private Equity Bidding Strategy

Private Equity Sourcing Funnel

Favorite LOI Negotiation Story

The Working Capital Adjustment Explained

The Stock Purchase Agreement

Purchase Price in Private Equity

Комментарии

0:06:55

0:06:55

0:06:59

0:06:59

0:04:25

0:04:25

0:02:26

0:02:26

0:03:44

0:03:44

0:04:42

0:04:42

0:14:07

0:14:07

0:03:27

0:03:27

0:12:08

0:12:08

0:01:26

0:01:26

0:03:20

0:03:20

0:05:40

0:05:40

0:03:09

0:03:09

0:00:51

0:00:51

0:04:06

0:04:06

0:14:02

0:14:02

0:16:23

0:16:23

0:04:13

0:04:13

0:01:15

0:01:15

0:01:57

0:01:57

0:02:50

0:02:50

0:13:55

0:13:55

0:10:26

0:10:26

0:02:04

0:02:04