filmov

tv

ISDA Webinar: The Path Forward for LIBOR

Показать описание

Earlier this week, ICE Benchmark Administration (IBA), the administrator of LIBOR, announced that it will consult on its intention to cease publication of one-week and two-month US dollar LIBOR at end-December 2021, and stop the remaining US dollar LIBOR settings immediately after publication on June 30, 2023. This followed an announcement on November 18 that IBA will consult on its plan to cease publication of all sterling, euro, Swiss franc, and yen LIBOR settings at end-December 2021.

Alongside the November 30 release from IBA, the Federal Reserve Board published a statement welcoming the development and encouraging banks to cease using US dollar LIBOR as soon as practicable, and in any event no later than the end of 2021. This was matched by a similar release from the UK Financial Conduct Authority (FCA), which set out some information about its proposed powers under the Financial Services Bill.

Since then, there’s been a lot of talk among market participants about how this will play out and what it means. Given more than 1,500 entities have now adhered to the ISDA IBOR Fallbacks Protocol, there have also understandably been questions about the implications under the fallback calculation methodology.

In this video, we’ll try and answer some of those questions.

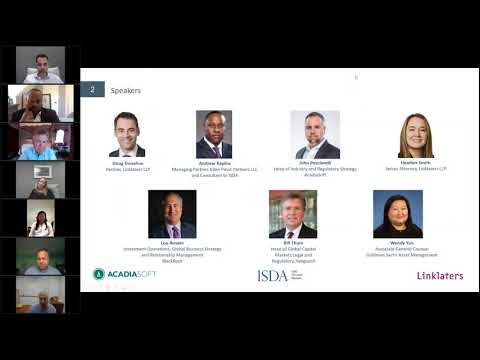

I’m delighted to be joined by:

David Bowman, Senior Associate Director at the Federal Reserve Board

Edwin Schooling Latter, Director, Markets and Wholesale Policy, at the FCA

Deepak Sitlani, Partner at Linklaters

Tom Wipf, Vice Chairman of Institutional Securities, Morgan Stanley, Chairman of the Alternative Reference Rates Committee (ARRC), and ISDA Board Member

00:07 Introduction

02:01 Recap of Key Points

06:58 Interaction with Spread Calculation

12:26 Triggering the Spread Calculation

12:55 Maintaining a Representative USD LIBOR

13:44 Announcements from Fed / FDIC / OCC

16:14 Restrictions on USD LIBOR after 2021

17:10 1.5 Year Transition for US$

19:40 Proposed Extension to USD Tenors

21:01 FCA Calculation of the Spread

22:34 Next Steps for FCA Timeline

VISIT

FOLLOW US ON SOCIAL

Alongside the November 30 release from IBA, the Federal Reserve Board published a statement welcoming the development and encouraging banks to cease using US dollar LIBOR as soon as practicable, and in any event no later than the end of 2021. This was matched by a similar release from the UK Financial Conduct Authority (FCA), which set out some information about its proposed powers under the Financial Services Bill.

Since then, there’s been a lot of talk among market participants about how this will play out and what it means. Given more than 1,500 entities have now adhered to the ISDA IBOR Fallbacks Protocol, there have also understandably been questions about the implications under the fallback calculation methodology.

In this video, we’ll try and answer some of those questions.

I’m delighted to be joined by:

David Bowman, Senior Associate Director at the Federal Reserve Board

Edwin Schooling Latter, Director, Markets and Wholesale Policy, at the FCA

Deepak Sitlani, Partner at Linklaters

Tom Wipf, Vice Chairman of Institutional Securities, Morgan Stanley, Chairman of the Alternative Reference Rates Committee (ARRC), and ISDA Board Member

00:07 Introduction

02:01 Recap of Key Points

06:58 Interaction with Spread Calculation

12:26 Triggering the Spread Calculation

12:55 Maintaining a Representative USD LIBOR

13:44 Announcements from Fed / FDIC / OCC

16:14 Restrictions on USD LIBOR after 2021

17:10 1.5 Year Transition for US$

19:40 Proposed Extension to USD Tenors

21:01 FCA Calculation of the Spread

22:34 Next Steps for FCA Timeline

VISIT

FOLLOW US ON SOCIAL

0:25:24

0:25:24

0:01:56

0:01:56

1:01:38

1:01:38

0:46:17

0:46:17

1:02:42

1:02:42

1:00:27

1:00:27

0:56:39

0:56:39

0:59:22

0:59:22

0:48:23

0:48:23

0:52:15

0:52:15

1:23:29

1:23:29

0:17:56

0:17:56

0:01:33

0:01:33

0:21:33

0:21:33

0:58:06

0:58:06

0:14:58

0:14:58

0:52:49

0:52:49

1:02:30

1:02:30

0:57:12

0:57:12

1:04:51

1:04:51

0:05:39

0:05:39

0:04:58

0:04:58

0:07:48

0:07:48

0:04:55

0:04:55