filmov

tv

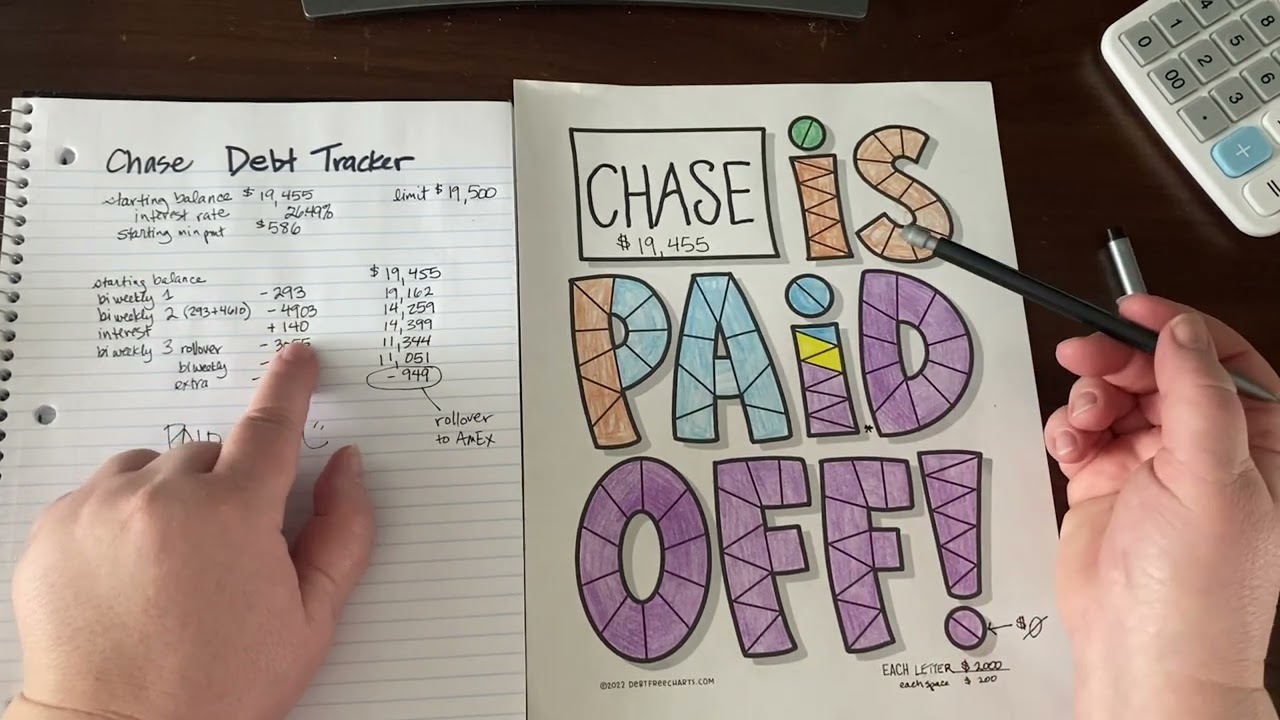

New Debt Trackers & Charts

Показать описание

I finally figured out how I want to track my progress, on each debt and on my total overall. I have both the simple/boring trackers -- plus some fun charts so I can better see visually the progress as I go along. And being able to easily see the progress is sooooooo motivating!

Do you have a chart that you love??? Please share below.

#debtfree #debtfreejourney #debtpayoff #debtpayoffplan #creditcarddebt #budget #budgeting #financialgoals #debtsnowball #zerobasedbudget

Do you have a chart that you love??? Please share below.

#debtfree #debtfreejourney #debtpayoff #debtpayoffplan #creditcarddebt #budget #budgeting #financialgoals #debtsnowball #zerobasedbudget

New Debt Trackers & Charts

Update my #debt tracker with me! #shorts #budget #money

Pay Debt With Me & NEW DEBT TRACKER CHART! | Debt Snowball

30% Debt Utilization Chart Tutorial| Credit card debt tracker

HOW CREATING FLOW CHARTS HELPS PAYOFF DEBT | debt free journey 2021

Finishing off another chart - Debt Trackers & Charts

UPDATE!!! Debt Tracker & Chart Update

NEW Debt Update & Giveaway Details

Holiday Trading Volume Crashes! Are Markets in Trouble?

Coloring My Debt Free Chart | Tracking Debt Payments

Debt Payoff Tracker | Amortization Schedule + Payoff Strategies

Debt Free Chart Examples | Track Debt Payoff Progress!

Debt Tracking Charts | Keeping Track of where it all goes | Debt Payoff

Master Your Finances: Create a Simple Debt Tracker on with Me + Template

2023 Debt-Free Journey: Start with the Perfect Debt Repayment Tracker! #debtpayoff #debtfree

Notion is so much better on your phone once you do this

Our Debt Free Charts- Tracking Our Debt Payoff Progress!

Debt and Savings Trackers I Use To Stay Motivated | Debt Free Charts

Notion Tour | Personal Finance Tracker (budget, Notion charts, expenses, debt, aesthetic template)

How to Make a Debt Snowball Spreadsheet in Excel and Google Sheets

Fun & Creative Debt Chart | Debt Progress

Excel Debt Tracker Dashboard

7 Ways to Track Debt Payoff Progress

How to Setup Debt Trackers 2020

Комментарии

0:38:11

0:38:11

0:00:42

0:00:42

0:05:04

0:05:04

0:00:16

0:00:16

0:07:59

0:07:59

0:16:08

0:16:08

0:30:59

0:30:59

0:32:16

0:32:16

1:02:45

1:02:45

0:03:30

0:03:30

0:12:53

0:12:53

0:05:08

0:05:08

0:04:00

0:04:00

0:09:27

0:09:27

0:00:13

0:00:13

0:00:37

0:00:37

0:07:37

0:07:37

0:14:31

0:14:31

0:08:21

0:08:21

0:10:06

0:10:06

0:12:41

0:12:41

0:00:51

0:00:51

0:07:37

0:07:37

0:12:23

0:12:23