filmov

tv

Car Loan or Cash Which is Better? | EMI vs Full Payment

Показать описание

Should you buy car on cash or with a car loan? The incentives that come with car loans or EMIs come with the drawback of a significantly higher price tag. So, is the convenience of equated monthly installments worth it over the higher price you pay, or should you invest all of your money and buy a car with a full down payment? Learn it all in this video.

More informative videos for you:

00:00 Introduction

01:00 Full down payment

02:20 Upgrading/selling early

03:12 No extra cost

04:00 Cons: Limited choices

04:35 Lumpsum transaction

05:18 Finance pros: Choices

06:30 Doesn’t affect savings

07:05 Cons: Interest

07:58 Security

#sahigaadi #emi #carloans

More informative videos for you:

00:00 Introduction

01:00 Full down payment

02:20 Upgrading/selling early

03:12 No extra cost

04:00 Cons: Limited choices

04:35 Lumpsum transaction

05:18 Finance pros: Choices

06:30 Doesn’t affect savings

07:05 Cons: Interest

07:58 Security

#sahigaadi #emi #carloans

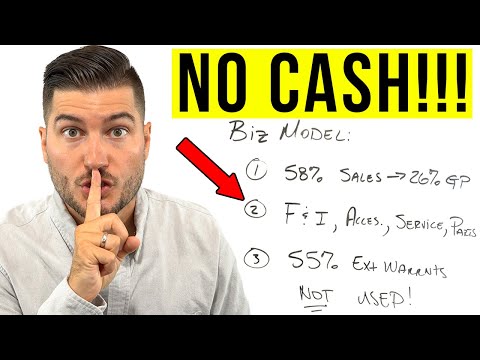

Why You Should Finance Your Car (And Not Pay Cash)

Car Loan or Cash Which is Better? | EMI vs Full Payment

Why Getting a Car Loan Is a Bad Idea

ACCOUNTANT EXPLAINS Should You Buy, Finance or Lease a New Car

Buying New Car ? Loan Or Cash payment ? Which is best ? Dont invest Hard Earn money Without Think

Buying a car? Why taking loan is not a smart option

DON'T PAY CASH AT CAR DEALERSHIPS! (Here's Why) - Car Dealer Reacts - Marko - WhiteBoard F...

ACCOUNTANT EXPLAINS: Should You Buy, Lease or Finance a New Car

What to do with Cash When Interest Rates Plummet

DON'T BE CONNED BUYING A CAR - PCP VS LEASE VS HP VS CASH EXPLAINED.

How to Get a Car Loan (The Right Way)

AUTO LOAN Bank vs Car Dealer | Alin ang mas Maganda

How To Make A Smart Car Purchase

Leasing Vs Buying A Car - Dave Ramsey

NEVER take a CAR LOAN #shorts

Which method is best to buy a car? (Tamil) | Cash vs Loan | Advantages & disadvantages

How to get a 0% car 🚘 loan

Buying A New Car in India? - Make Right Budget First | Financial Planning

DON'T PAY CASH AT CAR DEALERSHIPS! (Here's Why)

Your Car Loan Is Killing Your Wealth - Dave Ramsey Rant

Do I Buy, Finance, Lease or Rent My Cars and What Should You Do?

Monthly expenses of CAR? Loan or CASH? Canada vlog

The #1 Wealth Killer No One Talks About...

Say THIS to a 🚗 dealer and you’ll save $1,000s

Комментарии

0:16:54

0:16:54

0:09:38

0:09:38

0:02:51

0:02:51

0:14:24

0:14:24

0:08:52

0:08:52

0:04:42

0:04:42

0:18:25

0:18:25

0:09:27

0:09:27

0:11:19

0:11:19

0:08:23

0:08:23

0:07:46

0:07:46

0:15:59

0:15:59

0:04:50

0:04:50

0:05:51

0:05:51

0:00:52

0:00:52

0:07:45

0:07:45

0:00:59

0:00:59

0:10:34

0:10:34

0:12:27

0:12:27

0:05:24

0:05:24

0:17:30

0:17:30

0:11:19

0:11:19

0:14:18

0:14:18

0:01:00

0:01:00