filmov

tv

How is Your Social Security Taxed?

Показать описание

Social Security payments are taxed if your overall annual income (including earnings from wages, investments, benefits and pensions) exceeds $25,000 for an individual or $32,000 for a married couple filing jointly.

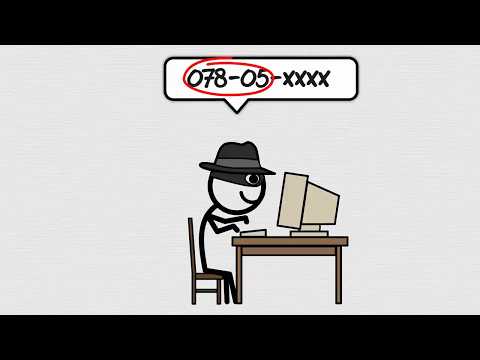

Your Social Security Card is Insecure

Social Security Explained | How to Maximize Your Social Security Benefit

How Social Security benefits are calculated on a $50,000 salary

Steps to take to maximize your social security benefits

my Social Security: What to Know Before You Sign Up

How to Apply for Social Security: Step-by-Step Guide

Here’s How Much Money You’ll Get From Social Security

4 Simple Ways to Increase Your Social Security Benefit

How vulnerable are your personal information and social security number in today’s digital age?

Social Security Explained | How Yours Are Calculated

8 Ways You Can LOSE Your Social Security Payment

Your Social Security Number & Card: What You Need to Know

Here's how different salaries can drastically raise or lower your Social Security benefits

How much your Social Security benefits will be if you make $30,000, $35,000 or $40,000

Social Security Timing: Age 62 vs. 70

How to Create Your -- My Social Security -- Account

Trying to retire on our Social Security only. September 2024 update.

Social Security Divorce Benefits MADE EASY

How To Calculate Social Security Benefits [3 Easy Steps]

How do Social Security Numbers work?

Today: Social Security CONFIRMS INCREASED SSI Benefits

Here’s Exactly How Social Security Gets Taxed

Former SSA Insider EXPLAINS: How YOUR Social Security benefits are CALCULATED

Social Security Spousal Benefits - MADE EASY to Understand

Комментарии

0:07:49

0:07:49

0:18:35

0:18:35

0:02:56

0:02:56

0:04:56

0:04:56

0:02:17

0:02:17

0:01:30

0:01:30

0:03:02

0:03:02

0:11:50

0:11:50

0:00:23

0:00:23

0:10:05

0:10:05

0:07:08

0:07:08

0:03:47

0:03:47

0:03:02

0:03:02

0:02:31

0:02:31

0:11:49

0:11:49

0:10:49

0:10:49

0:21:18

0:21:18

0:09:30

0:09:30

0:13:56

0:13:56

0:02:26

0:02:26

0:22:20

0:22:20

0:12:04

0:12:04

0:08:59

0:08:59

0:07:23

0:07:23