filmov

tv

Saved $1,000? Do THIS Right Away!

Показать описание

Your first $1,000 can pave the way to your financial success. In this video, I'll walk you through my 3-step process not just to save more money, but also to start growing your savings immediately.

THIS VIDEO IS BROUGHT TO YOU BY

LINKS MENTIONED IN THIS VIDEO

Ramit Sethi is the host of Netflix’s “How To Get Rich” and New York Times bestselling author of “I Will Teach You To Be Rich”

THIS VIDEO IS BROUGHT TO YOU BY

LINKS MENTIONED IN THIS VIDEO

Ramit Sethi is the host of Netflix’s “How To Get Rich” and New York Times bestselling author of “I Will Teach You To Be Rich”

Saved $1,000? Do THIS Right Away!

This Learning Technique Saves me 10+ Hours A Week

I Destroyed Secret FINAL BOSS and Got 0.1% MEGA DOMINUS Pet in Arm Wrestling Simulator! (Roblox)

I Collected 1000 Armadillos in 1.21 Minecraft Hardcore!

I saved my son from a family church that had controversial practices | Tuko TV

save 1000 dollars right now #savings #finance #motivation #shorts #businesds #money

Why Do People Pay Me to Save Their Old Tech?

I found a FREE SKINS GLITCH in Fortnite...

Do it right the first time! Save future headaches and boost your property's value #RealEstateWi...

This Right Arm Downswing Move Will Save Your Game...

CORRECT Answers SAVE YOU!

I Turned My House into a 5 STAR HOTEL

The correct way to save a million dollars within 12 months

'This Is Not Right!' | Saving Private Ryan (1998) #shorts #savingprivateryan #movie #movie...

The correct parking method can save your life at a critical moment #car #driving #tips #shortsvideo

The *LUCKIEST* People Alive..

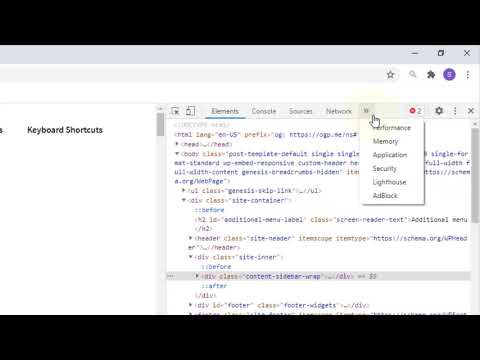

How to Save Images in Right Click Disabled websites In Chrome

1,000 Booster Packs of Shrouded Fable! Did I Lose Money?

Trump opens up about his faith following assassination attempt: 'It gives you some hope'

Man Hits Cop While Fleeing, Finds the Entire Police Department at His Door

Diane, you're gonna save me, right? (BoJack x Need 2 by Pinegrove Slowed)

Build a Car With LEGO, Win $1,000!

Why is the stock market freaking out today?

The system attached to the wrong person, and now I can summon gamers to my world

Комментарии

0:12:45

0:12:45

0:08:01

0:08:01

0:19:06

0:19:06

0:30:37

0:30:37

1:18:41

1:18:41

0:00:26

0:00:26

0:08:05

0:08:05

0:12:16

0:12:16

0:01:00

0:01:00

0:12:48

0:12:48

0:19:50

0:19:50

0:28:54

0:28:54

0:00:58

0:00:58

0:01:00

0:01:00

0:00:07

0:00:07

0:13:01

0:13:01

0:00:40

0:00:40

0:19:18

0:19:18

0:04:43

0:04:43

0:26:34

0:26:34

0:04:00

0:04:00

0:32:57

0:32:57

0:09:55

0:09:55

11:53:27

11:53:27