filmov

tv

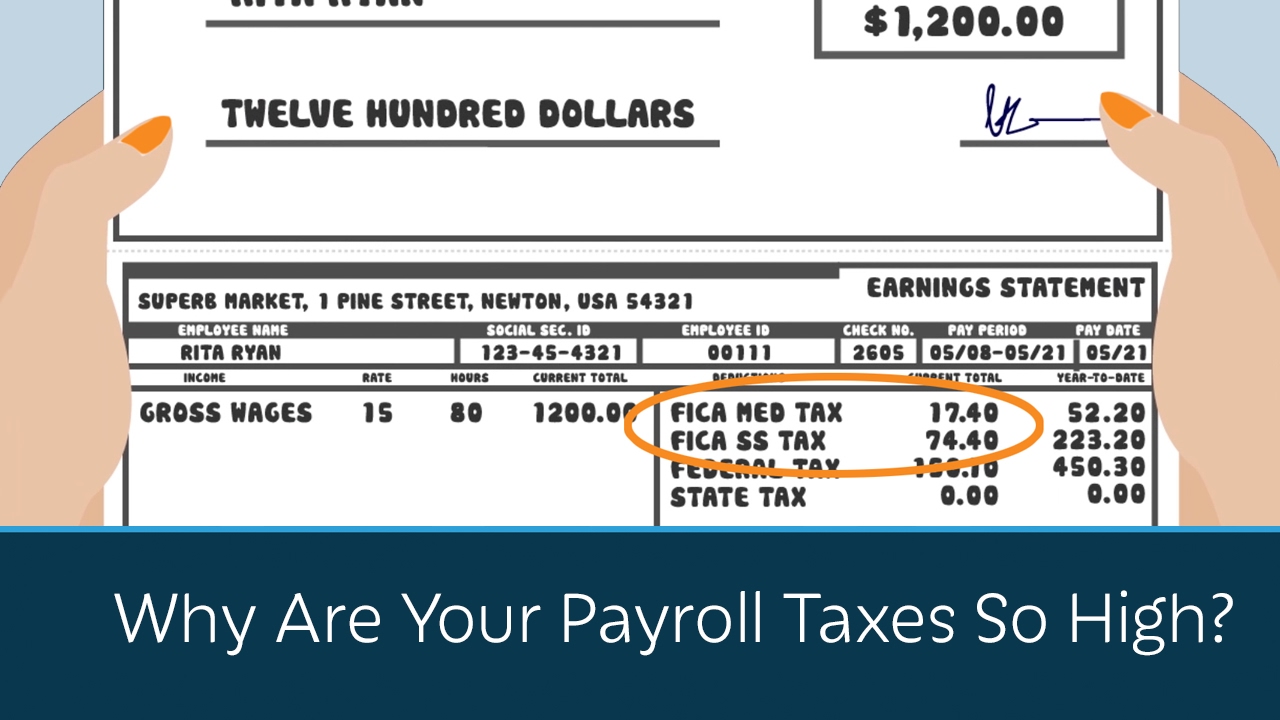

Why Are Your Payroll Taxes So High?

Показать описание

Did you know the government deducts money out of every paycheck you get? Do you know where that money goes? Watch this short video on payroll taxes to learn more.

Download Pragerpedia on your iPhone or Android! Thousands of sources and facts at your fingertips.

FOLLOW us!

PragerU is on Snapchat!

JOIN PragerFORCE!

Script:

If you have a job you might be wondering what all those deductions on your paycheck are.

When you’re just starting out in the workforce it’s important to learn the difference between gross pay and net pay. Gross pay is what you earned before deductions, like taxes. Net pay is what’s left in your check after all the deductions are taken out.

So who or what is FICA?

It is the Federal Insurance Contributions Act Tax, which is comprised of Social Security and Medicare taxes. It’s called a payroll tax because it takes money out of employees paychecks every pay cycle. FICA taxes are currently more than 7.5 percent of everyone’s paycheck until you reach a cap.

Employers pay an equal amount of FICA taxes for each employee. And even if you don’t pay any income taxes, you still pay FICA taxes.

Social Security taxes fund retirement benefits for retired workers, as well as benefits for the disabled and their dependents. The funds received for Medicare, on the other hand, are used to provide medical benefits for certain individuals when they reach age 65.

Workers, retired workers, and the spouses of workers and retired workers, are eligible to receive Medicare benefits once they reach retirement age.

So if you’re working, it’s your money that helps pay for those benefits. And it’s a lot of money too. In 2015, federal payroll taxes generated $1.07 trillion in revenue for the government, accounting for about one-third of all federal tax revenues.

Download Pragerpedia on your iPhone or Android! Thousands of sources and facts at your fingertips.

FOLLOW us!

PragerU is on Snapchat!

JOIN PragerFORCE!

Script:

If you have a job you might be wondering what all those deductions on your paycheck are.

When you’re just starting out in the workforce it’s important to learn the difference between gross pay and net pay. Gross pay is what you earned before deductions, like taxes. Net pay is what’s left in your check after all the deductions are taken out.

So who or what is FICA?

It is the Federal Insurance Contributions Act Tax, which is comprised of Social Security and Medicare taxes. It’s called a payroll tax because it takes money out of employees paychecks every pay cycle. FICA taxes are currently more than 7.5 percent of everyone’s paycheck until you reach a cap.

Employers pay an equal amount of FICA taxes for each employee. And even if you don’t pay any income taxes, you still pay FICA taxes.

Social Security taxes fund retirement benefits for retired workers, as well as benefits for the disabled and their dependents. The funds received for Medicare, on the other hand, are used to provide medical benefits for certain individuals when they reach age 65.

Workers, retired workers, and the spouses of workers and retired workers, are eligible to receive Medicare benefits once they reach retirement age.

So if you’re working, it’s your money that helps pay for those benefits. And it’s a lot of money too. In 2015, federal payroll taxes generated $1.07 trillion in revenue for the government, accounting for about one-third of all federal tax revenues.

Комментарии

0:01:46

0:01:46

0:07:45

0:07:45

0:05:10

0:05:10

0:11:06

0:11:06

0:03:19

0:03:19

0:01:01

0:01:01

0:02:17

0:02:17

0:08:12

0:08:12

0:00:41

0:00:41

0:00:50

0:00:50

0:07:22

0:07:22

0:07:39

0:07:39

0:12:34

0:12:34

0:12:31

0:12:31

0:03:08

0:03:08

0:10:11

0:10:11

0:01:00

0:01:00

0:00:41

0:00:41

0:04:12

0:04:12

0:03:41

0:03:41

0:06:46

0:06:46

0:02:59

0:02:59

0:00:50

0:00:50

0:08:35

0:08:35