filmov

tv

Mathematics of Maximizing Profit in Gambling/Investing - Kelly Criterion

Показать описание

In this video, we introduce the Kelly criterion which is the formula that gives optimal risk that maximizes the long term profit, and we will proceed to derive the formula in a nonstandard way.

The necessary prerequisite materials like random variables, transformations of random variables, expected value, generalized mean are introduced in the video.

Links:

Proof that E(B) = np

Wiki page which has detailed information about the median and the mode of the binomial distribution

geometric mean is the limit of the power mean as the power goes to 0

Chapters:

00:00 Intro

03:18 Problem Statement

04:51 The Kelly Criterion

06:36 What is an Average?

11:53 First Step towards the Model

13:30 Random Variables

16:00 Expected Value

18:05 Transformation of Random Variables

20:20 Random Variable for the Problem

22:26 Median of Random Variables

29:15 Mode of Random Variables

31:18 Geometric Mean of Random Variables

Music🎵:

Corrections:

18:22 Y=1/X should be 1/X if X ≠ 0 and 0 if X = 0

21:59 E(R) = (1+r)^n, not (1+r)^20

The necessary prerequisite materials like random variables, transformations of random variables, expected value, generalized mean are introduced in the video.

Links:

Proof that E(B) = np

Wiki page which has detailed information about the median and the mode of the binomial distribution

geometric mean is the limit of the power mean as the power goes to 0

Chapters:

00:00 Intro

03:18 Problem Statement

04:51 The Kelly Criterion

06:36 What is an Average?

11:53 First Step towards the Model

13:30 Random Variables

16:00 Expected Value

18:05 Transformation of Random Variables

20:20 Random Variable for the Problem

22:26 Median of Random Variables

29:15 Mode of Random Variables

31:18 Geometric Mean of Random Variables

Music🎵:

Corrections:

18:22 Y=1/X should be 1/X if X ≠ 0 and 0 if X = 0

21:59 E(R) = (1+r)^n, not (1+r)^20

Mathematics of Maximizing Profit in Gambling/Investing - Kelly Criterion

Maximizing Profit Practice

Profit maximization | APⓇ Microeconomics | Khan Academy

What Ticket Price Maximizes Revenue? (Quadratic Word Problem Precalculus)

Optimization: profit | Applications of derivatives | AP Calculus AB | Khan Academy

profit maximising level of output and price from Revenue and Cost functions #EconMath

Determine Maximum Profit From Revenue and Cost Function

given demand & cost function find price function total revenue function & profit Maximizing ...

profit maximising price output and maximum profit from demand and cost function

Calculus: Maximizing Profit

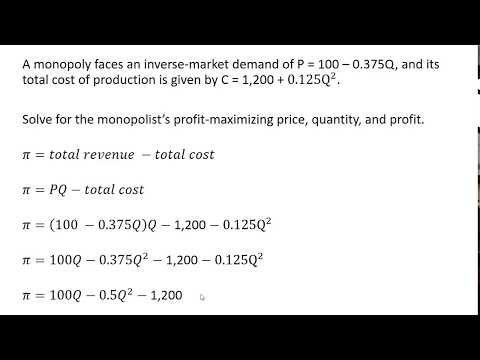

How to Find Monopoly Profit Maximizing Price, Quantity, and Profit

Optimization - Maximizing Profit

(M6E8) [Microeconomics] Profit Maximization

MCR3U - What Ticket Price Maximizes Revenue Quadratic Word Problem - Grade 11 Functions

Profit Maximization, Revenue Maximization and PED in Pure Monopoly

profit maximization condition for a perfectly competitive firm. #MR #MC

Profit maximization with calculus: the basics

Ex: Given the Cost and Demand Functions, Maximize Profit

Economic profit for a monopoly | Microeconomics | Khan Academy

Linear Programming (Optimization) 2 Examples Minimize & Maximize

Ex: Derivative Application - Maximize Profit

profit Maximization Second order condition . finding critical points where profit is maximum

How many widgets should be produced to maximize profit? (see the problem below)

Math for Economists Week 10-1: Profit Maximization

Комментарии

0:34:26

0:34:26

0:03:46

0:03:46

0:05:00

0:05:00

0:03:54

0:03:54

0:11:27

0:11:27

0:08:10

0:08:10

0:03:49

0:03:49

0:04:46

0:04:46

0:09:35

0:09:35

0:02:38

0:02:38

0:03:04

0:03:04

0:07:07

0:07:07

![(M6E8) [Microeconomics] Profit](https://i.ytimg.com/vi/mwoDOrz-4IY/hqdefault.jpg) 0:08:54

0:08:54

0:09:58

0:09:58

0:17:11

0:17:11

0:22:30

0:22:30

0:04:26

0:04:26

0:04:41

0:04:41

0:06:13

0:06:13

0:15:08

0:15:08

0:04:25

0:04:25

0:14:48

0:14:48

0:17:54

0:17:54

0:23:00

0:23:00