filmov

tv

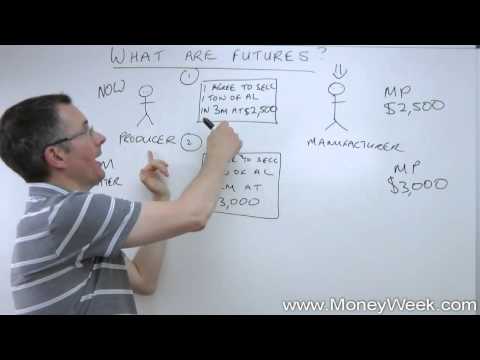

What Are Futures? (How To Trade Futures)

Показать описание

What Are Futures? (How To Trade Futures)

Used code: OPTIONS for 50% off!

👇🏻The Books I Recommend

👇🏻The Gear I Use For The Channel And Podcast

👇🏻Cool Things I Have Round The House

👉🏻💥CONNECT WITH ME:

🍺BEER MONEY DONATIONS🍺

The futures trading market has exploded over the past few month. I have made videos about trading futures in the past, but get many comments about how intimidating it can be to learn a new thing and the pros and cons of trading futures contracts as opposed to options contracts.

This is a follow up to a video I made talking about how I stopped day trading options and how I now only trade futures.

In this video I will tell you the futures that I trade, how to trade futures using a futures exchange like Tradovate, how I use my Bookmap Level 2, as well as place futures trade. You will understand the pros and cons of futures as well as the difference between Micro and Mini futures contracts.

Futures contracts are financial instruments that obligate the buyer to purchase an asset, or the seller to sell an asset, at a predetermined price and time in the future. Futures contracts are used to hedge against price fluctuations or to speculate on the direction of prices. They are standardized, exchange-traded contracts that are settled at the end of each trading day and can be bought or sold on a futures exchange.

Futures contracts are typically used in commodities markets, where they are used to hedge against price fluctuations in raw materials such as oil, corn, or gold. They are also used in financial markets, where they can be used to hedge against changes in interest rates or currency exchange rates.

In a futures contract, the buyer and seller agree to the terms of the contract, including the quantity, quality, and delivery date of the underlying asset. The price of the contract is determined at the time the contract is entered into, but the actual exchange of the asset and payment of the purchase price takes place at a later date. The futures price is based on the spot price of the underlying asset at the time the contract is entered into, plus a margin to cover the cost of financing the transaction and to compensate the seller for the risk of price fluctuations.

The buyer of a futures contract has the obligation to take delivery of the underlying asset at the agreed-upon price and date. The seller of a futures contract has the obligation to deliver the underlying asset at the agreed-upon price and date. If the price of the underlying asset changes before the delivery date, the buyer or seller may incur a profit or loss.

Futures contracts can be used to hedge against price fluctuations by locking in a fixed price for an asset. This can be useful for businesses that need to purchase raw materials or sell finished products at a fixed price in the future. Speculators, on the other hand, may use futures contracts to bet on the direction of prices, hoping to profit from price movements.

Futures contracts are complex financial instruments and involve a high degree of risk. They are not suitable for all investors, and it is important to carefully consider the potential risks and rewards before entering into a futures contract.

--------------------------------------------------------------------------------------------------------

DISCLAIMER: The content discussed in these videos are solely my opinion and should never be used as financial advice. This channel is for entertainment purposes only. Make sure to consult with a professional before making money decisions. This video and description contain affiliate links, which means that if you click on one of the product links, I’ll receive a small commission; all of which helps grow the channel! Thank you for your support!

#futures

Used code: OPTIONS for 50% off!

👇🏻The Books I Recommend

👇🏻The Gear I Use For The Channel And Podcast

👇🏻Cool Things I Have Round The House

👉🏻💥CONNECT WITH ME:

🍺BEER MONEY DONATIONS🍺

The futures trading market has exploded over the past few month. I have made videos about trading futures in the past, but get many comments about how intimidating it can be to learn a new thing and the pros and cons of trading futures contracts as opposed to options contracts.

This is a follow up to a video I made talking about how I stopped day trading options and how I now only trade futures.

In this video I will tell you the futures that I trade, how to trade futures using a futures exchange like Tradovate, how I use my Bookmap Level 2, as well as place futures trade. You will understand the pros and cons of futures as well as the difference between Micro and Mini futures contracts.

Futures contracts are financial instruments that obligate the buyer to purchase an asset, or the seller to sell an asset, at a predetermined price and time in the future. Futures contracts are used to hedge against price fluctuations or to speculate on the direction of prices. They are standardized, exchange-traded contracts that are settled at the end of each trading day and can be bought or sold on a futures exchange.

Futures contracts are typically used in commodities markets, where they are used to hedge against price fluctuations in raw materials such as oil, corn, or gold. They are also used in financial markets, where they can be used to hedge against changes in interest rates or currency exchange rates.

In a futures contract, the buyer and seller agree to the terms of the contract, including the quantity, quality, and delivery date of the underlying asset. The price of the contract is determined at the time the contract is entered into, but the actual exchange of the asset and payment of the purchase price takes place at a later date. The futures price is based on the spot price of the underlying asset at the time the contract is entered into, plus a margin to cover the cost of financing the transaction and to compensate the seller for the risk of price fluctuations.

The buyer of a futures contract has the obligation to take delivery of the underlying asset at the agreed-upon price and date. The seller of a futures contract has the obligation to deliver the underlying asset at the agreed-upon price and date. If the price of the underlying asset changes before the delivery date, the buyer or seller may incur a profit or loss.

Futures contracts can be used to hedge against price fluctuations by locking in a fixed price for an asset. This can be useful for businesses that need to purchase raw materials or sell finished products at a fixed price in the future. Speculators, on the other hand, may use futures contracts to bet on the direction of prices, hoping to profit from price movements.

Futures contracts are complex financial instruments and involve a high degree of risk. They are not suitable for all investors, and it is important to carefully consider the potential risks and rewards before entering into a futures contract.

--------------------------------------------------------------------------------------------------------

DISCLAIMER: The content discussed in these videos are solely my opinion and should never be used as financial advice. This channel is for entertainment purposes only. Make sure to consult with a professional before making money decisions. This video and description contain affiliate links, which means that if you click on one of the product links, I’ll receive a small commission; all of which helps grow the channel! Thank you for your support!

#futures

Комментарии

0:10:38

0:10:38

0:23:10

0:23:10

0:04:27

0:04:27

0:07:04

0:07:04

0:20:30

0:20:30

0:04:20

0:04:20

0:19:57

0:19:57

0:26:41

0:26:41

0:21:18

0:21:18

0:09:41

0:09:41

0:03:39

0:03:39

0:50:14

0:50:14

0:16:14

0:16:14

0:11:11

0:11:11

0:26:15

0:26:15

0:02:29

0:02:29

0:17:33

0:17:33

0:00:55

0:00:55

0:17:34

0:17:34

0:04:49

0:04:49

0:00:33

0:00:33

0:00:22

0:00:22

0:12:53

0:12:53

0:11:50

0:11:50