filmov

tv

Accounting Equation and Debits & Credits: Accounting Basic Foundations

Показать описание

Get more in-depth lessons via Axel's Accofina books:

Accounting Equation and Debits & Credits: Accounting Basic Foundations.

Time Markers:

The Accounting Equation 0:44

Double-Entry Accounting 2:06

What the Accounting Equation Measures 3:56

Assets 5:03

Liabilities 6:50

Equity 8:02

Debits and Credits 12:55

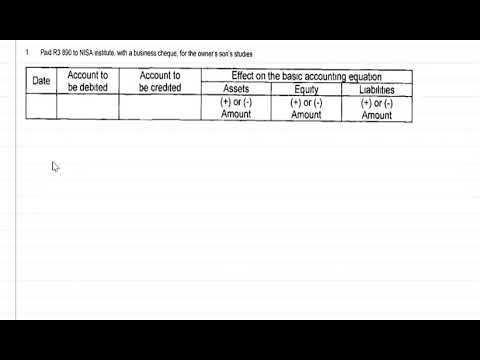

A Few Example Transactions 19:56

THE ACCOUNTING EQUATION

The Equation: A = L + E.

Accounting is about Measurement.

Assets = Liabilities + Equity.

The Equation MUST always balance ...and this is linked to double-entry accounting.

DOUBLE-ENTRY ACCOUNTING

It’s history dates back to the 15th century.

Accounting is about measurement …and double-entry accounting is a system to record/measure transactions.

Every transaction will impact the accounting equation at least TWICE (hence the term ‘double-entry’).

Plus the accounting equation must always remained balanced.

They impact the accounting equation (Asset = Liabilities + Equity) via Debits (Dr.) and Credits (Cr.) ...and we will look at this specifically later.

WHAT THE EQUATION MEASURES

Accounting is about Measurement (Asset = Liabilities + Equity)

The Equation Measures: Resources controlled by the entity & Claims on those resources.

The left hand side (Assets) are the resources.

The right hand side (Liabilities & Equity) are the claims on the resources.

Liabilities are External claims Equity are Internal claims.

ASSETS: THE LEFT HAND SIDE

Resources:

1) Controlled

2) Past Event

3) Value Reliably Measured

4) Lead to an Inflow of Economic Resources

…Simply: Things the entity ‘owns’.

They are often the income generating side of the business.

Examples: Cash, Accounts Receivable, Building

LIABILITIES: THE RIGHT HAND SIDE

Obligations:

1) Past Event

2) Value Reliably Measured

3) Lead to an Outflow of Economic Resources

…Simply: Things the entity ‘owes’.

They external claims on the assets, i.e. obligations to outsiders (creditors) paid from assets.

Examples: Accounts Payable, Bank Loan

EQUITY: THE RIGHT HAND SIDE

What’s left over for the owners.

Residual interest in Assets once all Liabilities paid off.

Rearranging the Accounting Equation: Assets - Liabilities = Equity

Internal/insider claims on the assets.

The complexity of equity accounts is often dependent on entity size.

Examples: Owners Equity/Share Capital, Retained Earnings, Reserves

Note: Revenue & Expenses are Equity Accounts.

Revenue is a Credit to Equity Expenses are Debits to Equity.

A BIT OF ACCOUNTING LOGIC...

All assets are funded via liabilities or equity (hence their respective claims).

Assets then generate income which itself boosts assets levels.

These higher level of assets are then returned to the claimants.

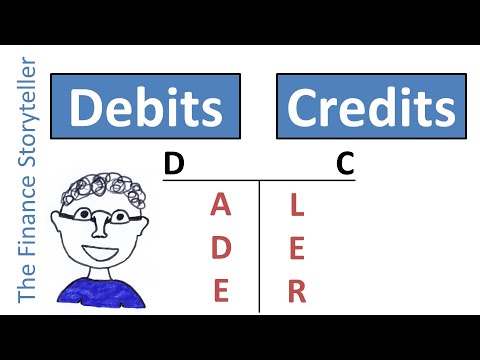

DEBITS & CREDITS

Remembering that A = L + E must always balance…

And remembering that we use double-entry accounting to record all transaction... and these transactions impact the equation…

How then do we record transactions within the accounting equation?

The answer:

Debits (Dr.) & Credits (Cr.)

DEBITS & CREDITS EVERY transaction:

Broken down & categorised into a set of Debits & Credits.

And the debits value must ALWAYS equal the credits value.

DEBITS

A debit (or Dr.) represents:

An INCREASE in Assets or

A DECREASE in Liabilities or Equity

Note: There is an opposite effect either side of the equation

CREDITS

A credit (or Cr.) represents:

A DECREASE in Assets or

An INCREASE in Liabilities or Equity

Note: There is an opposite effect either side of the equation Note: The impact is the reflection/opposite of a debit

THUS

When in business and a transaction occurs:

Look underneath and try and find the (at least) 2 impacts on the accounting equation.

Does an asset change? Does a liability change? Does equity change?

THEN: Record the entry as follows

Debits are recorded first (write ‘Dr.’ then the account and finally the financial value).

Credits are recorded at the bottom (with same formatting but the credit line(s) are Tab indented).

Dr. ‘account’ $xxx

Cr. ‘account’ $xxx

This video was brought to you by AccoFina...

Subscribe to the Channel:

Or just check out the Channel Page:

Most Popular YouTube Video:

Latest YouTube Upload:

1) Website

2) Amazon Author Page:

3) Udemy Instructor Page

4) Twitter

5) Google+

6) Instagram

7) Facebook Page

#Accounting #FinancialEducation #Accounting101

Accounting Equation and Debits & Credits: Accounting Basic Foundations.

Time Markers:

The Accounting Equation 0:44

Double-Entry Accounting 2:06

What the Accounting Equation Measures 3:56

Assets 5:03

Liabilities 6:50

Equity 8:02

Debits and Credits 12:55

A Few Example Transactions 19:56

THE ACCOUNTING EQUATION

The Equation: A = L + E.

Accounting is about Measurement.

Assets = Liabilities + Equity.

The Equation MUST always balance ...and this is linked to double-entry accounting.

DOUBLE-ENTRY ACCOUNTING

It’s history dates back to the 15th century.

Accounting is about measurement …and double-entry accounting is a system to record/measure transactions.

Every transaction will impact the accounting equation at least TWICE (hence the term ‘double-entry’).

Plus the accounting equation must always remained balanced.

They impact the accounting equation (Asset = Liabilities + Equity) via Debits (Dr.) and Credits (Cr.) ...and we will look at this specifically later.

WHAT THE EQUATION MEASURES

Accounting is about Measurement (Asset = Liabilities + Equity)

The Equation Measures: Resources controlled by the entity & Claims on those resources.

The left hand side (Assets) are the resources.

The right hand side (Liabilities & Equity) are the claims on the resources.

Liabilities are External claims Equity are Internal claims.

ASSETS: THE LEFT HAND SIDE

Resources:

1) Controlled

2) Past Event

3) Value Reliably Measured

4) Lead to an Inflow of Economic Resources

…Simply: Things the entity ‘owns’.

They are often the income generating side of the business.

Examples: Cash, Accounts Receivable, Building

LIABILITIES: THE RIGHT HAND SIDE

Obligations:

1) Past Event

2) Value Reliably Measured

3) Lead to an Outflow of Economic Resources

…Simply: Things the entity ‘owes’.

They external claims on the assets, i.e. obligations to outsiders (creditors) paid from assets.

Examples: Accounts Payable, Bank Loan

EQUITY: THE RIGHT HAND SIDE

What’s left over for the owners.

Residual interest in Assets once all Liabilities paid off.

Rearranging the Accounting Equation: Assets - Liabilities = Equity

Internal/insider claims on the assets.

The complexity of equity accounts is often dependent on entity size.

Examples: Owners Equity/Share Capital, Retained Earnings, Reserves

Note: Revenue & Expenses are Equity Accounts.

Revenue is a Credit to Equity Expenses are Debits to Equity.

A BIT OF ACCOUNTING LOGIC...

All assets are funded via liabilities or equity (hence their respective claims).

Assets then generate income which itself boosts assets levels.

These higher level of assets are then returned to the claimants.

DEBITS & CREDITS

Remembering that A = L + E must always balance…

And remembering that we use double-entry accounting to record all transaction... and these transactions impact the equation…

How then do we record transactions within the accounting equation?

The answer:

Debits (Dr.) & Credits (Cr.)

DEBITS & CREDITS EVERY transaction:

Broken down & categorised into a set of Debits & Credits.

And the debits value must ALWAYS equal the credits value.

DEBITS

A debit (or Dr.) represents:

An INCREASE in Assets or

A DECREASE in Liabilities or Equity

Note: There is an opposite effect either side of the equation

CREDITS

A credit (or Cr.) represents:

A DECREASE in Assets or

An INCREASE in Liabilities or Equity

Note: There is an opposite effect either side of the equation Note: The impact is the reflection/opposite of a debit

THUS

When in business and a transaction occurs:

Look underneath and try and find the (at least) 2 impacts on the accounting equation.

Does an asset change? Does a liability change? Does equity change?

THEN: Record the entry as follows

Debits are recorded first (write ‘Dr.’ then the account and finally the financial value).

Credits are recorded at the bottom (with same formatting but the credit line(s) are Tab indented).

Dr. ‘account’ $xxx

Cr. ‘account’ $xxx

This video was brought to you by AccoFina...

Subscribe to the Channel:

Or just check out the Channel Page:

Most Popular YouTube Video:

Latest YouTube Upload:

1) Website

2) Amazon Author Page:

3) Udemy Instructor Page

4) Twitter

5) Google+

6) Instagram

7) Facebook Page

#Accounting #FinancialEducation #Accounting101

Комментарии

0:05:44

0:05:44

0:04:58

0:04:58

0:22:16

0:22:16

0:04:44

0:04:44

0:06:00

0:06:00

0:28:16

0:28:16

0:14:13

0:14:13

0:04:29

0:04:29

0:09:45

0:09:45

0:27:15

0:27:15

0:10:50

0:10:50

0:06:55

0:06:55

0:16:40

0:16:40

0:09:26

0:09:26

0:04:21

0:04:21

0:14:31

0:14:31

0:12:35

0:12:35

0:17:46

0:17:46

0:04:39

0:04:39

0:02:32

0:02:32

0:15:55

0:15:55

0:20:16

0:20:16

0:08:41

0:08:41

0:24:14

0:24:14