filmov

tv

The Power of a High Yield Savings Account!

Показать описание

The Power of a High Yield Savings Account!

Bring confidence to your wealth building with simplified strategies from The Money Guy. Learn how to apply financial tactics that go beyond common sense and help you reach your money goals faster. Make your assets do the heavy lifting so you can quit worrying and start living a more fulfilled life.

Bring confidence to your wealth building with simplified strategies from The Money Guy. Learn how to apply financial tactics that go beyond common sense and help you reach your money goals faster. Make your assets do the heavy lifting so you can quit worrying and start living a more fulfilled life.

The Power of a High Heel

THE RAMPAGE - THE POWER (OST High & Low The Worst X Cross) | Lyrics

The POWER of Black Soprano Singers!!! - High Notes

Тест пускового устройства HIGH-POWER 29A 16800mAh.

Cane Hill - Power of the High -- Elijah Barnett Guitar Playthrough

High Power Jump Starter

The Last of Us Season 2 | The Last of Us Day Official Teaser | Max

High Vibrational Power WORDS Create Magic: Part 3: English: BK Shivani at Tenerife, Spain

Power Grid hits fresh record highs in September; will the rally continue?

HIGH POWER (NEW LIVE-ACT TRAILER)

Huey Lewis And The News: The Power Of Love (1985) (High Tone)

Power Princess Shining Bright Lyric Video | New Ever After High Original Song!

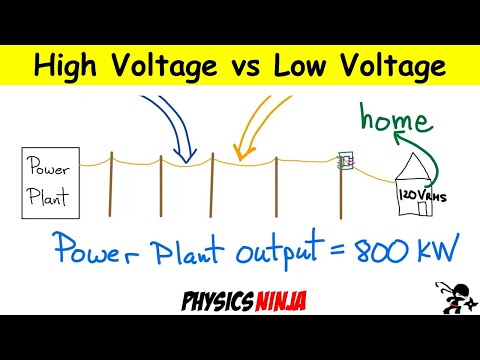

Why do Power Lines use High Voltage?

China Built Record-Breaking Ultra High Voltage Power Transmission Projects

High and Low The Worst x Cross / [ THE POWER ] ~THE RAMPAGE~ LIVE SHOW/22

Unstoppable Power [POWER: From On High] Dr. Cindy Trimm

Céline Dion- POWER OF LOVE (High Notes 1993-2018)

𝗢𝗹𝗮𝗱𝗶𝗽𝗼 (𝗟𝘆𝗿𝗶𝗰𝘀) - 𝗛𝗶𝗴𝗵 𝗣𝗼𝘄𝗲𝗿

Why HIGH VOLTAGE DC power Transmission

How to Become a High Value Person (The Power of Walking Away)

Question of the week - Should I buy near high voltage power lines?

Feel The Power of Ultra HIGH Frequencies, Theta State of Consciousness, Awakening the Higher Chakras

High Hang Power Clean

Peach Power | The God of High School

Комментарии

0:03:37

0:03:37

0:03:35

0:03:35

0:04:10

0:04:10

0:02:24

0:02:24

0:03:25

0:03:25

0:01:57

0:01:57

0:02:07

0:02:07

0:22:55

0:22:55

0:01:30

0:01:30

0:00:45

0:00:45

0:03:45

0:03:45

0:03:20

0:03:20

0:06:57

0:06:57

0:08:28

0:08:28

0:06:25

0:06:25

0:16:56

0:16:56

0:04:45

0:04:45

0:03:28

0:03:28

0:13:03

0:13:03

0:10:00

0:10:00

0:01:20

0:01:20

3:00:00

3:00:00

0:00:15

0:00:15

0:02:11

0:02:11