filmov

tv

How to solve Standard Deviation in Urdu

Показать описание

In this video you will learn how to solve standard deviation. First we will talj about is definition and detail.

What Is Standard Deviation?

The standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance. It is calculated as the square root of variance by determining the variation between each data point relative to the mean. If the data points are further from the mean, there is a higher deviation within the data set; thus, the more spread out the data, the higher the standard deviation.

Standard deviation is a statistical measurement in finance that, when applied to the annual rate of return of an investment, sheds light on the historical votality of that investment. The greater the standard deviation of securities, the greater the variance between each price and the mean, which shows a larger price range. For example, a volatile stock has a high standard deviation, while the deviation of a stable blue chip stock is usually rather low.

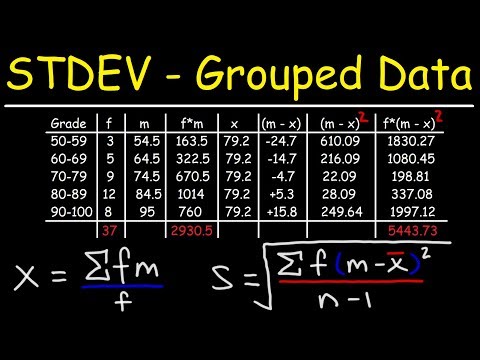

Calculate Standard Deviation

Standard deviation is calculated as:

The mean value is calculated by adding all the data points and dividing by the number of data points.

The variance for each data point is calculated, first by subtracting the value of the data point from the mean. Each of those resulting values is then squared and the results summed. The result is then divided by the number of data points less one.

The square root of the variance—result from no. 2—is then taken to find the standard deviation.

Using Standard Deviation

Standard deviation is an especially useful tool in investing and trading strategies as it helps measure market and security volatility—and predict performance trends. As it relates to investing, for example, one can expect an index fund to have a low standard deviation versus its benchmark index, as the fund's goal is to replicate the index.

On the other hand, one can expect aggressive growth funds to have a high standard deviation from relative stock indices, as their portfolio managers make aggressive bets to generate higher-than-average returns.

A lower standard deviation isn't necessarily preferable. It all depends on the investments one is making, and one's willingness to assume the risk. When dealing with the amount of deviation in their portfolios, investors should consider their personal tolerance for volatility and their overall investment objectives. More aggressive investors may be comfortable with an investment strategy that opts for vehicles with higher-than-average volatility, while more conservative investors may not.

Standard deviation is one of the key fundamenal riak measure that analysts, portfolio managers, advisors use. Investment firms report the standard deviation of their mutual funds and other products. A large dispersion shows how much the return on the fund is deviating from the expected normal returns. Because it is easy to understand, this statistic is regularly reported to the end clients and investors.

What Is Standard Deviation?

The standard deviation is a statistic that measures the dispersion of a dataset relative to its mean and is calculated as the square root of the variance. It is calculated as the square root of variance by determining the variation between each data point relative to the mean. If the data points are further from the mean, there is a higher deviation within the data set; thus, the more spread out the data, the higher the standard deviation.

Standard deviation is a statistical measurement in finance that, when applied to the annual rate of return of an investment, sheds light on the historical votality of that investment. The greater the standard deviation of securities, the greater the variance between each price and the mean, which shows a larger price range. For example, a volatile stock has a high standard deviation, while the deviation of a stable blue chip stock is usually rather low.

Calculate Standard Deviation

Standard deviation is calculated as:

The mean value is calculated by adding all the data points and dividing by the number of data points.

The variance for each data point is calculated, first by subtracting the value of the data point from the mean. Each of those resulting values is then squared and the results summed. The result is then divided by the number of data points less one.

The square root of the variance—result from no. 2—is then taken to find the standard deviation.

Using Standard Deviation

Standard deviation is an especially useful tool in investing and trading strategies as it helps measure market and security volatility—and predict performance trends. As it relates to investing, for example, one can expect an index fund to have a low standard deviation versus its benchmark index, as the fund's goal is to replicate the index.

On the other hand, one can expect aggressive growth funds to have a high standard deviation from relative stock indices, as their portfolio managers make aggressive bets to generate higher-than-average returns.

A lower standard deviation isn't necessarily preferable. It all depends on the investments one is making, and one's willingness to assume the risk. When dealing with the amount of deviation in their portfolios, investors should consider their personal tolerance for volatility and their overall investment objectives. More aggressive investors may be comfortable with an investment strategy that opts for vehicles with higher-than-average volatility, while more conservative investors may not.

Standard deviation is one of the key fundamenal riak measure that analysts, portfolio managers, advisors use. Investment firms report the standard deviation of their mutual funds and other products. A large dispersion shows how much the return on the fund is deviating from the expected normal returns. Because it is easy to understand, this statistic is regularly reported to the end clients and investors.

0:07:14

0:07:14

0:05:05

0:05:05

0:12:12

0:12:12

0:10:21

0:10:21

0:02:06

0:02:06

0:00:46

0:00:46

0:05:23

0:05:23

0:00:41

0:00:41

0:06:11

0:06:11

0:07:49

0:07:49

0:12:42

0:12:42

0:02:39

0:02:39

0:08:26

0:08:26

0:08:52

0:08:52

0:00:59

0:00:59

0:04:52

0:04:52

0:06:16

0:06:16

0:05:00

0:05:00

0:02:44

0:02:44

0:03:09

0:03:09

0:02:39

0:02:39

0:03:00

0:03:00

0:04:37

0:04:37

0:08:01

0:08:01