filmov

tv

The 6% Trap | How Employers Control Your Savings (and Why It’s Costing You)

Показать описание

00:00 Intro

00:16 Saving 6% (plus employer match)

01:35 Is It Enough?

03:10 Let’s Talk 6% or 9%

03:49 Average Age To Start Investing

04:24 Running An Example

06:19 Annual Withdrawal

07:00 “Everyone agrees that’s too low.”

09:26 Bloopers

Disclaimer: Please note that this video is made for entertainment purposes only and not to be taken as financial advice. Always make sure to do your own research.

Thanks for watching, I appreciate you!

00:16 Saving 6% (plus employer match)

01:35 Is It Enough?

03:10 Let’s Talk 6% or 9%

03:49 Average Age To Start Investing

04:24 Running An Example

06:19 Annual Withdrawal

07:00 “Everyone agrees that’s too low.”

09:26 Bloopers

Disclaimer: Please note that this video is made for entertainment purposes only and not to be taken as financial advice. Always make sure to do your own research.

Thanks for watching, I appreciate you!

The 6 Best Trap Exercises (YOU’VE NEVER DONE!)

Easy figure 6 hog trap (in action)

Blade Brown x K Trap - 6 Figures [Music Video] | GRM Daily

Trap Workout (SORE IN 6 MINUTES!)

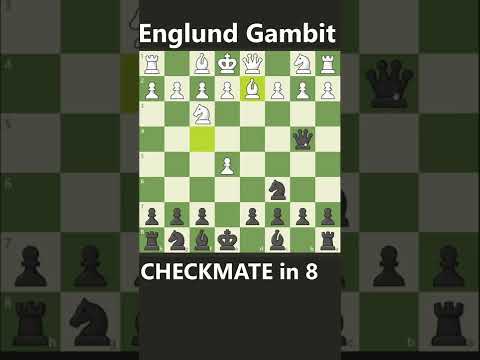

Mate in 6 moves! Budapest Trap #shorts #chess

#5. How to teach: Controlling › Touch & trap | Soccer skills in PE (grade K-6)

Wild Pigs: How To Build A Corral Trap

The Tip & Slip RAT Trap - 6 Rats caught in 1 night. A Great Rat Trap. Mousetrap Monday

How To Beat The 50 HOUR POOL TRAP In '12 Feet Deep'

MGK666 - El Dios Del Trap (Official Visualizer)(Prod. by Binti)

Free Tokens or Hidden Trap? The Pros and Cons of Retrodrops | Part 5 of 6 | MemeFi

The Scene Hip Hop Trap Mix - Lil Baby, Travis Scott, Drake, Roddy Ricch, DaBaby, Nicki Minaj, Future

300,000+ People Fell For This Trap

6 Minute Traps Workout - HASfit Traps Exercises to Work Traps - Trap Exercise - Trapezius Workouts

SAW FALLEN DIE MAN EASY ÜBERLEBT #saw #trap #falle #horror #horrormovie

Home Alone Flipbook: Every Booby Trap Compilation (surprise ending)

6-Year-Old Miles Creates a Trap Beat using a Toothbrush!

EASY Chess Trap!

6 MOVE CHECKMATE TRAP AGAINST THE DUTCH DEFENSE

Win Fast: Chess trap to checkmate in 7 moves! - chess tricks #chess #shorts

The Ultimate Bloon Trap Farming Guide In BTD6!

FREE TOKENS OR HIDDEN TRAP? THE PROS AND CONS OF RETRODROPS | PART 5 OF 6 | MEMEFI New Video Code

8 Move CHECKMATE and QUEEN TRAP

A Mind-blowing Trap | Chess Opening Tricks to WIN Fast #shorts

Комментарии

0:06:44

0:06:44

0:02:44

0:02:44

0:02:01

0:02:01

0:08:15

0:08:15

0:00:32

0:00:32

0:01:40

0:01:40

0:06:17

0:06:17

0:06:37

0:06:37

0:23:35

0:23:35

0:02:35

0:02:35

0:02:53

0:02:53

0:44:20

0:44:20

0:00:44

0:00:44

0:07:46

0:07:46

0:00:57

0:00:57

0:00:57

0:00:57

0:01:51

0:01:51

0:00:36

0:00:36

0:00:53

0:00:53

0:00:40

0:00:40

0:01:26

0:01:26

0:01:04

0:01:04

0:01:00

0:01:00

0:00:55

0:00:55