filmov

tv

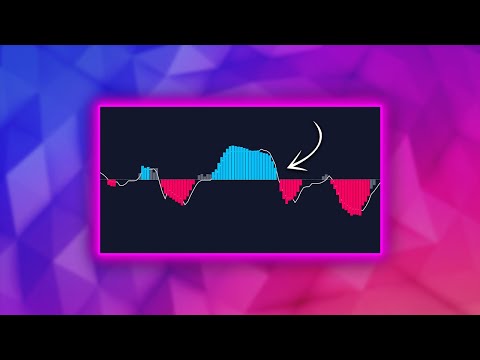

Day Trading Strategy: How to Trade Oil Stocks

Показать описание

Learn how to trade oil stocks--a valuable day trading strategy that you can use--in today's video!

(Recorded June 14, 2022)

#daytradingstrategies #oil #trading

Connect with us:

Join the community of like-minded investors:

_____________________________________________________

**BOOKS WE RECOMMEND FOR INVESTING **

You can find all these books on Amazon

The Psychology of Money - Morgan Housel

Richer, Wiser, Happier - William Green

The Intelligent Investor - Benjamin Graham

One Up On Wall Street - Peter Lynch

Beating The Street - Peter Lynch

The Little Book That Beats the Market - Joel Greenblatt

The Complete TurtleTrader: Michael Covel

--------------------

🚨⚠️ All content on the channels for discussion, entertainment, and illustrative purposes only and should not be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated on the Channel. There are risks associated with investing in securities. Loss of principal is possible. Some high-risk investments may use leverage, which could accentuate losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. Past performance is not a predictor of future investment performance. Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor. You agree to verify all information yourself before investing.

(Recorded June 14, 2022)

#daytradingstrategies #oil #trading

Connect with us:

Join the community of like-minded investors:

_____________________________________________________

**BOOKS WE RECOMMEND FOR INVESTING **

You can find all these books on Amazon

The Psychology of Money - Morgan Housel

Richer, Wiser, Happier - William Green

The Intelligent Investor - Benjamin Graham

One Up On Wall Street - Peter Lynch

Beating The Street - Peter Lynch

The Little Book That Beats the Market - Joel Greenblatt

The Complete TurtleTrader: Michael Covel

--------------------

🚨⚠️ All content on the channels for discussion, entertainment, and illustrative purposes only and should not be construed as professional financial advice, solicitation, or recommendation to buy or sell any securities, notwithstanding anything stated on the Channel. There are risks associated with investing in securities. Loss of principal is possible. Some high-risk investments may use leverage, which could accentuate losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. Past performance is not a predictor of future investment performance. Should you need such advice, consult a licensed financial advisor, legal advisor, or tax advisor. You agree to verify all information yourself before investing.

Комментарии

0:18:26

0:18:26

0:20:02

0:20:02

0:07:06

0:07:06

0:12:58

0:12:58

0:45:00

0:45:00

0:07:22

0:07:22

0:04:35

0:04:35

0:15:24

0:15:24

0:09:09

0:09:09

0:01:00

0:01:00

0:01:00

0:01:00

0:09:49

0:09:49

0:43:14

0:43:14

0:00:54

0:00:54

0:00:43

0:00:43

0:09:08

0:09:08

0:19:21

0:19:21

0:08:46

0:08:46

0:01:00

0:01:00

0:15:14

0:15:14

0:15:10

0:15:10

0:00:22

0:00:22

0:09:25

0:09:25

0:00:39

0:00:39