filmov

tv

Choosing the Best Time-Series AI Model for Your Data

Показать описание

Twitter: @mindsdb

What is Time Series Analysis?

Time Series Vs Non Time Series Problems- Why Time Series Forecasting Is Difficult?

What are Neural Network Time Series Models

Time Series Forecasting with Machine Learning

Time Series Forecasting with XGBoost - Use python and machine learning to predict energy consumption

Challenges in Time Series Forecasting

Forecast Your Products’ Demand with Machine Learning

Time Series Forecasting with XGBoost - Advanced Methods

Quant Radio: Time-Series Momentum Strategies

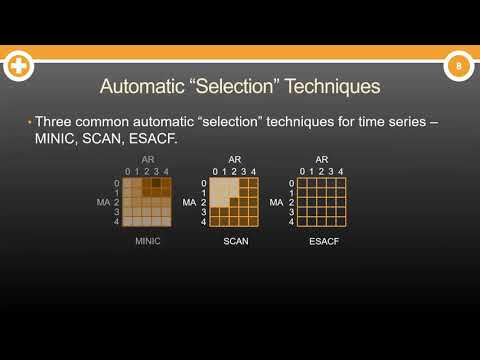

Time Series Model Selection (AIC & BIC) : Time Series Talk

Deep Learning for Time Series Data (O'Reilly Artificial Intelligence Conference)

Defining an LSTM Neural Network for Time Series Forecasting in PyTorch #shorts

AI Show: Time Series Forecasting with Automated Machine Learning

Preparing a Time Series Dataset for Supervised Learning Forecasting #shorts

Two Effective Algorithms for Time Series Forecasting

All Machine Learning Models Explained in 5 Minutes | Types of ML Models Basics

Feature Engineering for Time Series Forecasting - Kishan Manani

Forecasting Future Sales Using ARIMA and SARIMAX

How to Use ACF and PACF to Identify Time Series Analysis Models

Top AI courses that you can take for free

ARIMA Models for Stock Price Prediction ❌ How to Choose the p, d, q Terms to Build ARIMA Model (1/2)...

Introduction to Time Series Analysis: AR MA ARIMA Models, Stationarity, and Data Differencing

Time Series Prediction

What are ARIMA Models

Комментарии

0:07:29

0:07:29

0:11:09

0:11:09

0:04:47

0:04:47

0:13:52

0:13:52

0:23:09

0:23:09

0:44:25

0:44:25

0:18:29

0:18:29

0:22:02

0:22:02

0:18:20

0:18:20

0:09:42

0:09:42

0:42:29

0:42:29

0:00:42

0:00:42

0:13:08

0:13:08

0:00:35

0:00:35

0:14:20

0:14:20

0:05:01

0:05:01

1:02:14

1:02:14

0:24:23

0:24:23

0:10:35

0:10:35

0:00:08

0:00:08

0:16:23

0:16:23

0:10:25

0:10:25

0:11:02

0:11:02

0:05:07

0:05:07