filmov

tv

The Most Important Chart for Market Breadth July 2022

Показать описание

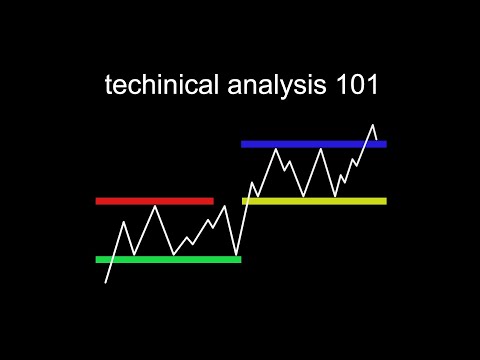

My morning coffee routine involves a number of charts covering market breadth. If the major averages are in a bull/bear trend, what about all the individual stocks that make up those indexes? Today I'll share what I feel is the most important chart to watch as the S&P 500 index breaks above 4000 en route to potentially 4200 and beyond.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Dave helps active investors and financial advisors make more informed investment decisions, inject more discipline into their investment process, and enrich relationships with their clients. Feel better about making better decisions!

He's also President and Chief Strategist at Sierra Alpha Research LLC, a boutique investment research and consulting firm focused on managing risk through market awareness. He combines the strengths of technical analysis, behavioral finance, and data visualization to identify investment opportunities and enrich relationships between advisors and clients.

Dave was previously a Managing Director of Research for Fidelity Investments in Boston, a Past President of the Chartered Market Technician (CMT) Association, and started in the financial industry just after the March 2000 market top at Bloomberg in New York.

✔ W E B S I T E

✔ T W I T T E R

✔ L I N K E D I N

✔ F A C E B O O K

#MarketMisbehavior

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Dave helps active investors and financial advisors make more informed investment decisions, inject more discipline into their investment process, and enrich relationships with their clients. Feel better about making better decisions!

He's also President and Chief Strategist at Sierra Alpha Research LLC, a boutique investment research and consulting firm focused on managing risk through market awareness. He combines the strengths of technical analysis, behavioral finance, and data visualization to identify investment opportunities and enrich relationships between advisors and clients.

Dave was previously a Managing Director of Research for Fidelity Investments in Boston, a Past President of the Chartered Market Technician (CMT) Association, and started in the financial industry just after the March 2000 market top at Bloomberg in New York.

✔ W E B S I T E

✔ T W I T T E R

✔ L I N K E D I N

✔ F A C E B O O K

#MarketMisbehavior

Комментарии

0:16:47

0:16:47

0:00:54

0:00:54

0:09:40

0:09:40

0:10:51

0:10:51

0:38:15

0:38:15

0:27:57

0:27:57

0:10:41

0:10:41

0:05:12

0:05:12

0:21:35

0:21:35

0:30:02

0:30:02

1:17:35

1:17:35

0:11:45

0:11:45

0:07:26

0:07:26

0:10:40

0:10:40

0:25:22

0:25:22

0:14:49

0:14:49

0:03:38

0:03:38

0:29:36

0:29:36

0:04:59

0:04:59

0:17:09

0:17:09

0:11:45

0:11:45

0:01:06

0:01:06

0:17:24

0:17:24

0:06:42

0:06:42