filmov

tv

Derivative Securities -Introduction to Interest Rate Swaps

Показать описание

This video introduces the viewer to the interest rate swap.

In particular it gives details of the first swap contract in 1981 and details of the current US dollar interest rate swap market based on compounded SOFR (secured overnight funding rate).

In particular it gives details of the first swap contract in 1981 and details of the current US dollar interest rate swap market based on compounded SOFR (secured overnight funding rate).

Derivatives Explained in One Minute

Financial Derivatives Explained

Derivatives Market For Beginners | Edelweiss Wealth Management

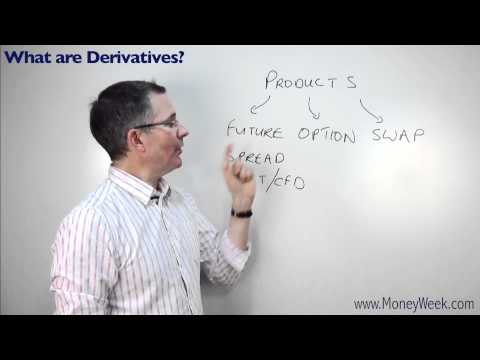

What are derivatives? - MoneyWeek Investment Tutorials

Derivative Securities Introduction to Interest Rate Swaps

Interest rate swap 1 | Finance & Capital Markets | Khan Academy

Derivative Instrument and Derivative Market Features (2024/25 LI CFA® Exam – Derivatives Module 1)...

Derivative securities: Overview

Factors to Consider Before Investing - NISM x IndiaBonds

Types of Derivatives | Forwards, Futures, Options & Swaps

Derivative securities: Overview - Global Financial Markets and Instruments

What are Securities?

Introduction to the 2021 ISDA Interest Rate Derivatives Definitions

Derivative Securities 1915

Derivatives in Stock Market?

Unlock the Power of Financial Derivatives in 60 Seconds: Futures, Options, and Swaps Explained!

Forward contract introduction | Finance & Capital Markets | Khan Academy

Financial Derivatives - An Introduction

Interest Rate Derivatives Part 1

There Are 4 TYPES of Derivatives!

What Is Futures And Options Trading? F&O Explained By CA Rachana Ranade

Derivatives SWAP

Introduction to the Black-Scholes formula | Finance & Capital Markets | Khan Academy

DERIVATIVES MCOM/BCOM FINANCIAL DERIVATIVES

Комментарии

0:01:30

0:01:30

0:06:47

0:06:47

0:06:01

0:06:01

0:09:51

0:09:51

0:19:23

0:19:23

0:03:51

0:03:51

0:26:21

0:26:21

0:07:30

0:07:30

0:59:51

0:59:51

0:06:19

0:06:19

0:05:05

0:05:05

0:03:30

0:03:30

0:01:29

0:01:29

0:05:43

0:05:43

0:00:51

0:00:51

0:00:59

0:00:59

0:03:11

0:03:11

0:07:02

0:07:02

0:28:00

0:28:00

0:00:21

0:00:21

0:11:50

0:11:50

0:06:31

0:06:31

0:10:24

0:10:24

0:14:27

0:14:27