filmov

tv

How to Analyze Price Action with Data and GEX | Day Trading

Показать описание

How to analyze price action with data and GEX when day trading to improve your conviction. A Recap of Sept

Chapters:

00:00 Intro

02:36 Identifying Key Levels

04:14 GEX to Confirm Levels

08:44 Confirmation in SPX Trade Engine

11:09 Characteristics of Candlesticks

13:01 SPX Trade Engine Continued

16:40 Simplified GEX Chart

18:30 SPX Options Review

22:06 Additional Notes

#DayTrading #StockTrading #OptionsTrading

—————————————————————————————————————

Find me other places:

—————————————————————————————————————

DISCLAIMER: I am not a certified financial advisor and nothing in this video or text is an advertisement or recommendation to buy or sell any financial instrument. This video is for educational purposes only.

Chapters:

00:00 Intro

02:36 Identifying Key Levels

04:14 GEX to Confirm Levels

08:44 Confirmation in SPX Trade Engine

11:09 Characteristics of Candlesticks

13:01 SPX Trade Engine Continued

16:40 Simplified GEX Chart

18:30 SPX Options Review

22:06 Additional Notes

#DayTrading #StockTrading #OptionsTrading

—————————————————————————————————————

Find me other places:

—————————————————————————————————————

DISCLAIMER: I am not a certified financial advisor and nothing in this video or text is an advertisement or recommendation to buy or sell any financial instrument. This video is for educational purposes only.

Four Price Action Secrets (The Ultimate Guide To Price Action)

Price Action Trading Strategy Basics

Best Top Down Analysis Strategy - Smart Money & Price Action

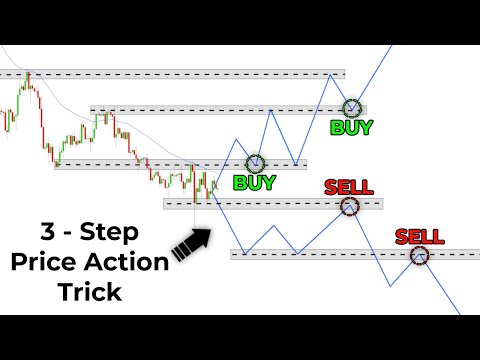

Price Action Trading Was Hard, Until I Discovered This Easy 3-Step Trick...

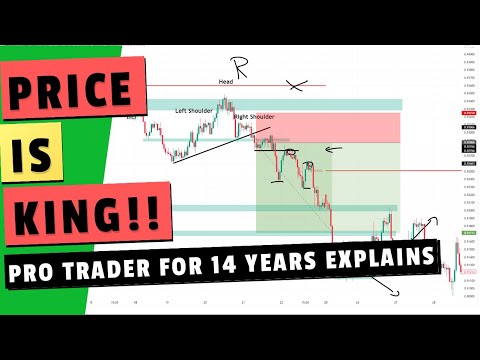

Price Action Trading like a Pro - I share my best tips after 14 years

The ONLY Candlestick Pattern Guide You'll EVER NEED

Price Action Analysis | Demand Supply Analysis | Price Volume Cheat Sheet | CA Rachana Ranade

TRADING PRICE ACTION (Validated by trading volume)

Open Interest and Price Action Analysis: How to use

5 Price Action Rules EVERY Trader NEEDS To Know

Best All-in-One Indicator For Accurate SMC / Price Action Concepts

Price Action Free Masterclass | Learn Stock Market Trading

Price Action Trading FULL Course - Trading Course went VIRAL 📈📈 🔥 🔥

The BEST Guide to CHART PATTERNS Price Action

The Only Technical Analysis Video You Will Ever Need... (Full Course: Beginner To Advanced)

Price action trading How To Read Chart

The Ultimate Price Action Trading Guide

Uncovering my Price Action Trading Strategy

Volume Trading Strategy EXPOSED (Volume Price Action Analysis)

Predict “The NEXT Candle” Using VSA | Price Action & Volume Spread Analysis Trading Course

My SIMPLE Technical Analysis Strategy - Price Action Entry & Exit Method

Price Action MASTERCLASS for beginners | Price Action Trading Strategies in Share Market | In Hindi

13 Trading Strategies using Price Action and Technical Analysis

Perfect entry ✅ pattern breakout price action trading #forex #crypto #analysis #shorts

Комментарии

0:08:11

0:08:11

0:05:10

0:05:10

0:14:53

0:14:53

0:23:08

0:23:08

0:32:40

0:32:40

0:11:45

0:11:45

0:15:33

0:15:33

0:11:18

0:11:18

0:14:50

0:14:50

0:31:16

0:31:16

0:09:50

0:09:50

0:30:54

0:30:54

0:57:18

0:57:18

0:09:09

0:09:09

1:17:35

1:17:35

0:07:02

0:07:02

0:12:01

0:12:01

0:10:49

0:10:49

0:15:02

0:15:02

0:16:49

0:16:49

0:29:06

0:29:06

0:19:18

0:19:18

0:12:02

0:12:02

0:00:19

0:00:19