filmov

tv

Take Your Stop Loss or Stop Trading!

Показать описание

#Stocks #Trading #Money

Don't let your ego trade for you...Be smart and use good money management, if not, just quit trading cause it's not for you!

$1, 14 Day Trial to the Live Traders Chat Room: Link Below:

Don't let your ego trade for you...Be smart and use good money management, if not, just quit trading cause it's not for you!

$1, 14 Day Trial to the Live Traders Chat Room: Link Below:

How To Know Where to Set Your Stop Loss

Where to Place your Stop Loss and Take Profit Tutorial

How To Place The PERFECT Stop loss #stoploss

Truths about Stop Losses That Nobody Tells You!

Stop Hunting in Trading Exists! But it is Just Not What You Expect it to Be

PRICE ACTION: Best Way To Set Your STOP LOSS

Stop Loss Strategy VS Buy & Hold? (11 year study)

11 Important Trading Rules You Can Use For Your Stop Loss

Stop Loss I Intraday Trading I Pro Level Concept

Where Your Stop Loss Should Day Trading Forex

Why You Shouldn't Move Your Stop Loss | Lets Take A Minute, Episode 1 | Urban Forex

The best stop loss techniques

The Best ATR Indicator for Setting Stoploss

How to set Stop-Loss and Take-Profit in MT4 || Forex for Beginners

How To Set A Correct Stop Loss And Avoid Stop Hunting (Video 9 Of 12)

Where Should You Place Your Stop Loss

How to Place a STOP LOSS and TAKE PROFIT when Trading Forex!

Stop Loss Orders And Limit Orders Explained - When And How To Use It - Trading Basics

I Decoded The Stop Loss Hunting Algorithm In Trading

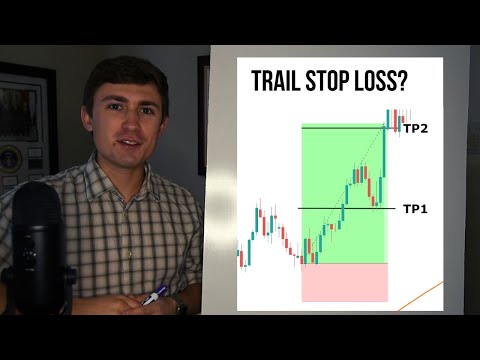

TRAILING STOP LOSS EXPLAINED | LIMIT YOUR LOSSES | HOW TO TAKE PROFITS

Stop Loss Strategy Secrets: The Truth About Stop Loss Nobody Tells You

Forex Trading Strategy: How to Trail your Stop Loss Effectively? 💭📈

Great Tips on Where To Place Your Stop Loss! 👍

Stock Market Order Types (Market Order, Limit Order, Stop Loss, Stop Limit)

Комментарии

0:07:26

0:07:26

0:03:22

0:03:22

0:00:51

0:00:51

0:04:38

0:04:38

0:04:36

0:04:36

0:06:03

0:06:03

0:09:56

0:09:56

0:15:58

0:15:58

0:29:27

0:29:27

0:12:09

0:12:09

0:03:21

0:03:21

0:12:54

0:12:54

0:07:51

0:07:51

0:06:32

0:06:32

0:12:10

0:12:10

0:11:47

0:11:47

0:12:43

0:12:43

0:08:57

0:08:57

0:15:04

0:15:04

0:11:21

0:11:21

0:21:56

0:21:56

0:08:39

0:08:39

0:08:56

0:08:56

0:09:05

0:09:05