filmov

tv

Change in TDS rates in budget 2024

Показать описание

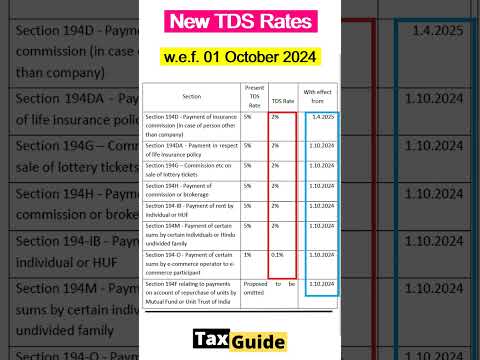

Change in TDS rates in budget 2024

there have been changes in TDS rates in budget 2024

1. Section 194D (Insurance Commission): 5% to 2% (Effective from 1 April 2025)

2. Section 194DA (Life Insurance Policy Payment): 5% to 2% (Effective from 1 October 2024)

3. Section 194G (Lottery Commission): 5% to 2% (Effective from 1 October 2024)

4. Section 194H (Commission or Brokerage): 5% to 2% (Effective from 1 October 2024)

5. Section 194-IB (Rent Payment): 5% to 2% (Effective from 1 October 2024)

6. Section 194M (Certain Payments by Individuals or HUFs): 5% to 2% (Effective from 1 October 2024)

7. Section 194-O (E-commerce Payments): 1% to 0.1% (Effective from 1 October 2024)

8. Section 194F (Repurchase of Units by Mutual Funds or UTI): Omitted (Effective from 1 October 2024)

Watch full video on our YouTube channel

(link in bio)

#taxsavingtips #incometax #itr #startup #employment #salary #losses #profit #budget2024 #share #equity

there have been changes in TDS rates in budget 2024

1. Section 194D (Insurance Commission): 5% to 2% (Effective from 1 April 2025)

2. Section 194DA (Life Insurance Policy Payment): 5% to 2% (Effective from 1 October 2024)

3. Section 194G (Lottery Commission): 5% to 2% (Effective from 1 October 2024)

4. Section 194H (Commission or Brokerage): 5% to 2% (Effective from 1 October 2024)

5. Section 194-IB (Rent Payment): 5% to 2% (Effective from 1 October 2024)

6. Section 194M (Certain Payments by Individuals or HUFs): 5% to 2% (Effective from 1 October 2024)

7. Section 194-O (E-commerce Payments): 1% to 0.1% (Effective from 1 October 2024)

8. Section 194F (Repurchase of Units by Mutual Funds or UTI): Omitted (Effective from 1 October 2024)

Watch full video on our YouTube channel

(link in bio)

#taxsavingtips #incometax #itr #startup #employment #salary #losses #profit #budget2024 #share #equity

0:14:38

0:14:38

0:06:23

0:06:23

0:02:23

0:02:23

0:00:38

0:00:38

0:12:14

0:12:14

0:03:42

0:03:42

0:05:45

0:05:45

0:09:43

0:09:43

0:07:43

0:07:43

0:10:01

0:10:01

0:00:32

0:00:32

0:05:33

0:05:33

0:00:52

0:00:52

0:08:08

0:08:08

0:01:42

0:01:42

0:06:25

0:06:25

0:00:11

0:00:11

0:00:34

0:00:34

0:06:31

0:06:31

0:06:56

0:06:56

0:00:36

0:00:36

0:00:44

0:00:44

0:01:00

0:01:00

0:14:30

0:14:30