filmov

tv

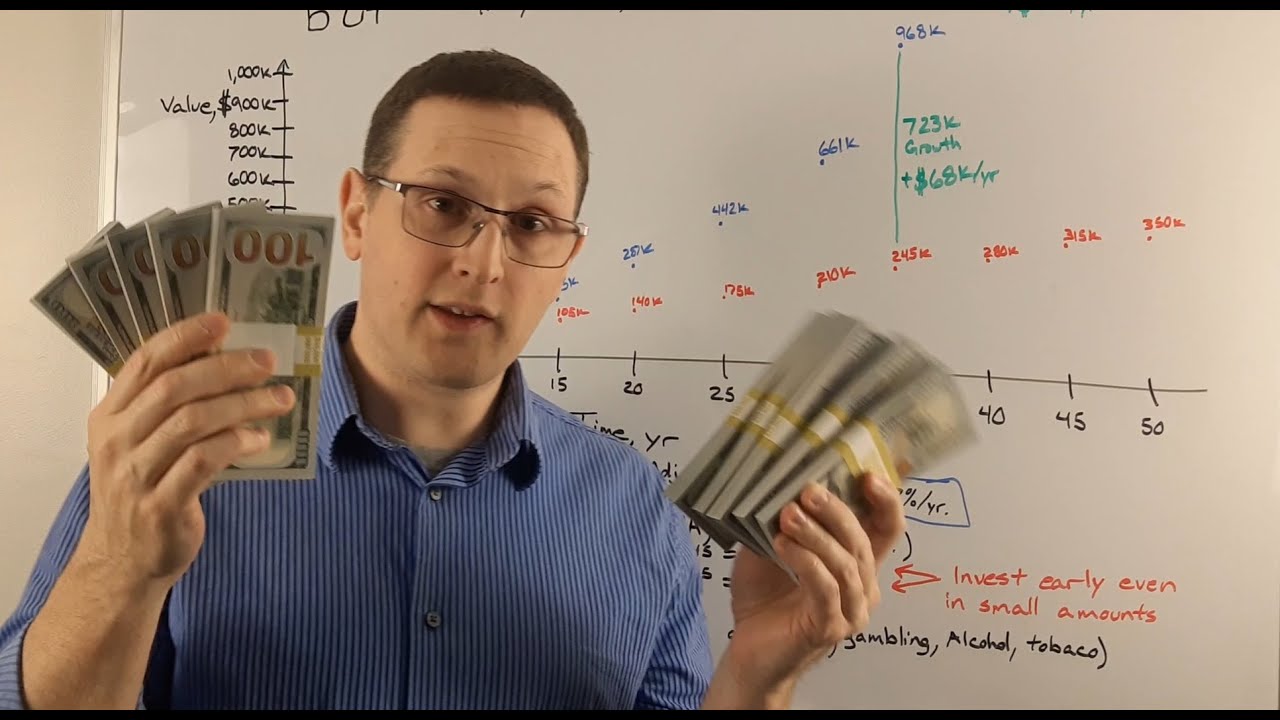

Why the first $100K is hard, but to get to a million dollars is easy after that

Показать описание

Getting to your first $100K is the hardest step in investing. Once you are at $100K compounding takes over and getting to a million is so much easier. How do you get your first $100,000? Crazy ways my family makes an extra $1,000 per month.

Charlie Munger: Your first $100k is the hardest.

Compound Interest Calculator:

Money spent on lottery, alcohol, tobacco, gambling:

The crazy ways some of my relatives have found ways to make $1,000 extra each month are what they have done after doing their own due diligence. I am not advising in anyway to do the same thing as they are just a few examples and I have no opinions on the matters regarding any pharmaceutical research or products.

Disclaimer and safe Harbor statement:

Topics discussed may include predictions, estimates or other information that might be considered forward-looking and results are not guaranteed. This is not individual investment, legal, or tax advice. Investments can lose money. Make sure to complete your own due diligence and work with licensed investment, tax, and accountant professionals when making financial decisions. Financial Freedom 101 is not responsible for any of the financial decisions that you make. Financial Freedom 101 typically has investments including, but not limited to positions in diversified ETFs and mutual funds such as SPY, VOO, SWPPX, FXAIX and others which may contain holdings in the companies discussed. The content of this video is for entertainment purposes only.

Charlie Munger: Your first $100k is the hardest.

Compound Interest Calculator:

Money spent on lottery, alcohol, tobacco, gambling:

The crazy ways some of my relatives have found ways to make $1,000 extra each month are what they have done after doing their own due diligence. I am not advising in anyway to do the same thing as they are just a few examples and I have no opinions on the matters regarding any pharmaceutical research or products.

Disclaimer and safe Harbor statement:

Topics discussed may include predictions, estimates or other information that might be considered forward-looking and results are not guaranteed. This is not individual investment, legal, or tax advice. Investments can lose money. Make sure to complete your own due diligence and work with licensed investment, tax, and accountant professionals when making financial decisions. Financial Freedom 101 is not responsible for any of the financial decisions that you make. Financial Freedom 101 typically has investments including, but not limited to positions in diversified ETFs and mutual funds such as SPY, VOO, SWPPX, FXAIX and others which may contain holdings in the companies discussed. The content of this video is for entertainment purposes only.

Комментарии

0:08:28

0:08:28

0:08:04

0:08:04

0:07:22

0:07:22

0:05:58

0:05:58

0:06:21

0:06:21

0:14:19

0:14:19

0:08:45

0:08:45

0:10:46

0:10:46

0:08:18

0:08:18

0:15:14

0:15:14

0:04:02

0:04:02

0:09:47

0:09:47

0:14:40

0:14:40

0:21:14

0:21:14

0:05:03

0:05:03

0:00:11

0:00:11

0:07:44

0:07:44

0:19:34

0:19:34

0:10:38

0:10:38

0:00:11

0:00:11

0:09:44

0:09:44

0:10:29

0:10:29

0:00:26

0:00:26

0:08:02

0:08:02