filmov

tv

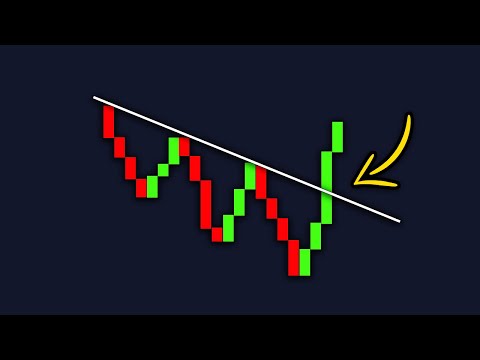

How I Use Line Charts to Spot Real Market Structure (Most Traders Overlook This)

Показать описание

In this video, I show you how to identify real market structure using the line chart — a simple but often overlooked method that can make your entries way more accurate.

I explain the key terms (higher highs, lower lows, etc.), what to look for in a structure shift, and how the line chart exposes clean trend changes without the noise of candlestick wicks. Plus, I share my tip on using structure two timeframes above your trading chart for confluence.

Timestamps:

00:00 – Intro: What is Market Structure?

00:48 – How to Identify Uptrends vs Downtrends

01:32 – Structure Break = Momentum Shift

02:24 – Switching to Line Chart on Gold (XAUUSD)

03:29 – Confirming Structure Changes with Clean Closes

05:20 – When to Switch Back to Buying Opportunities

06:19 – Pro Tip: Identify Structure 2 Timeframes Above

07:16 – Why Line Charts Reveal Clearer Trade Zones

#MarketStructure #TradingStrategy #ForexTrading #GoldTrading #PriceAction #TechnicalAnalysis

I explain the key terms (higher highs, lower lows, etc.), what to look for in a structure shift, and how the line chart exposes clean trend changes without the noise of candlestick wicks. Plus, I share my tip on using structure two timeframes above your trading chart for confluence.

Timestamps:

00:00 – Intro: What is Market Structure?

00:48 – How to Identify Uptrends vs Downtrends

01:32 – Structure Break = Momentum Shift

02:24 – Switching to Line Chart on Gold (XAUUSD)

03:29 – Confirming Structure Changes with Clean Closes

05:20 – When to Switch Back to Buying Opportunities

06:19 – Pro Tip: Identify Structure 2 Timeframes Above

07:16 – Why Line Charts Reveal Clearer Trade Zones

#MarketStructure #TradingStrategy #ForexTrading #GoldTrading #PriceAction #TechnicalAnalysis

Trading Price Action Using Line Charts (Old School Forex & Stock Trading Strategies)

The POWER of Line Charts Ignored By Most Traders!

How To Draw The Perfect Trend Line #shorts

How to build Line charts in Tableau | Tableau Charts

Price Action Trading: The Power Of Line Charts Ignored By Most Traders

Line chart in excel

Visualise FORECASTS in your Line Charts using this SIMPLE TRICK! // Beginners Guide to Power BI 2022

How to create an s-curve combo chart in #excel #exceltips #exceltricks

Sierra Chart Complete Beginner Crash Course - Everything You Need To Know To Get Started

#pocketoption - 2 Minute Line Chart Strategy

The ultimate guide to Notion Charts (9 examples)

Why You NEED To Be Using Volume When Trading

The Common MISTAKE Traders Make With Doji Candles #Shorts

How to Draw Trend Lines the RIGHT Way on CANDLESTICK Charts

How to create Line Chart to compare Sales of Multiple Years in PowerBI | MI Tutorials

How To Scalp Higher Timeframes With A Line Chart | Forex Scalping Strategy

How to Draw and Use Trendlines

The Only Line Chart Trading Strategy You’ll Ever Need!

How to Read Candlestick Charts (with ZERO experience)

5.1 How to create Line Chart in Power BI | Power BI Tutorials for Beginners | By Pavan Lalwani

How To Make a Line Graph In Excel।।Line Chart kaise use kre Excel Me।।Line Chart In Excel।। #excel...

How to pick the 'perfect' chart for your situation in Power BI?

The Secret To Using The Volume Profile Indicator #shorts

These chart patterns will make you RICH!🤑

Комментарии

0:10:10

0:10:10

0:11:18

0:11:18

0:00:43

0:00:43

0:03:05

0:03:05

0:18:01

0:18:01

0:00:48

0:00:48

0:09:01

0:09:01

0:00:23

0:00:23

1:47:38

1:47:38

0:07:33

0:07:33

0:49:46

0:49:46

0:00:30

0:00:30

0:00:47

0:00:47

0:39:20

0:39:20

0:02:49

0:02:49

0:13:26

0:13:26

0:00:26

0:00:26

0:12:47

0:12:47

0:55:18

0:55:18

0:03:55

0:03:55

0:00:47

0:00:47

0:11:43

0:11:43

0:00:56

0:00:56

0:00:41

0:00:41