filmov

tv

How To Calculate Taxes on Your Social Security Benefits

Показать описание

================================

Follow me censorship-free!

My course "Can I Retire" will help reduce your stress when it comes to retirement planning.

Get it here:

and don't forget there IS a 30 day money back guarantee if you're not satisfied!

Get my books on Audible here:

Want to support what I'm doing for $10 a month?

Join my SubscribeStar page!

My Amazon Product page:

Anything you buy there Amazon pays me a commission. Much appreciated!

GET MY BOOKS:

ALL are FREE to Kindle Unlimited Subscribers!

You Can RETIRE on SOCIAL SECURITY:

The Tax Bomb In Your Retirement Accounts: How The Roth IRA Can Help You Avoid It:

Strategic Money Planning: 8 Easy Ways To Put Your House In Order

GET ALL MY LATEST BLOGPOSTS:

How to Calculate Sales Tax | Math with Mr. J

How To Calculate Sales Tax On Calculator Easy Way

How to calculate tax

How To Calculate Federal Income Taxes - Social Security & Medicare Included

How to Calculate Sales Tax without a Calculator | Calculating Sales Tax by Hand | Math with Mr. J

Financial Education: How To Calculate Your Taxes in 2021?

How to Calculate your Income Tax? Step-by-Step Guide for Income Tax Calculation

How to Calculate Sales Tax in Excel - Tutorial

Cut Your Tax Bill with Itemized Deductions

How to calculate Excise Tax and determine Who Bears the Burden of the Tax

How to Calculate Your Taxes Under the U.S. Tax System

HOW TO CALCULATE INCOME TAX 🤔

Income Tax Calculation 2024-25 | How To Calculate Income Tax FY 2024-25 | New Income Tax Slab Rates

How To Calculate Sales Tax Using Math

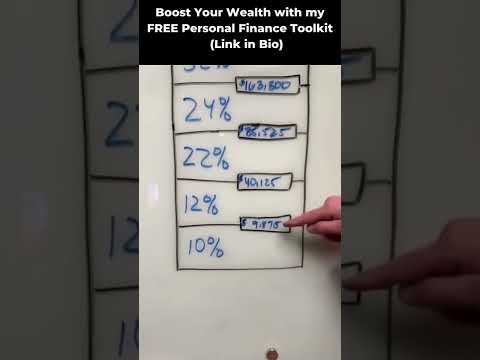

Using tax brackets to calculate tax

How To Calculate Tax On 1099-MISC Income?

Income Tax Calculation on Salary Payslip | How to Calculate Income Tax [Calculator]

How to Calculate Your Federal Income Tax Liability | Personal Finance Series

Using ATO Income Tax Brackets To Calculate Tax Payable

Budget 2024 | Income Tax Calculation | How To Calculate Income Tax | New Income Tax Slab Rates

How To Calculate Sales Tax-Math Lesson

HOW TO CALCULATE INCOME TAX(Example 1)

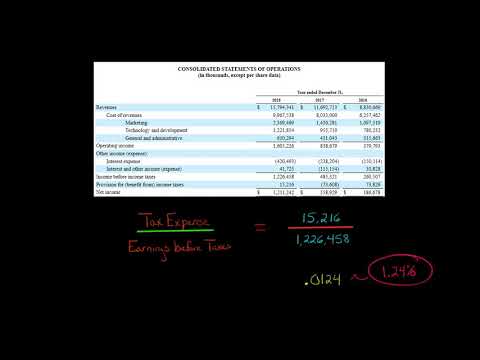

How to Calculate the Effective Tax Rate

How to Calculate Sales Tax

Комментарии

0:07:21

0:07:21

0:03:15

0:03:15

0:13:07

0:13:07

0:25:05

0:25:05

0:07:24

0:07:24

0:03:14

0:03:14

0:07:37

0:07:37

0:02:40

0:02:40

0:07:37

0:07:37

0:06:25

0:06:25

0:00:59

0:00:59

0:00:58

0:00:58

0:11:36

0:11:36

0:11:18

0:11:18

0:02:08

0:02:08

0:03:06

0:03:06

0:21:33

0:21:33

0:08:23

0:08:23

0:10:15

0:10:15

0:05:58

0:05:58

0:04:14

0:04:14

0:10:20

0:10:20

0:03:04

0:03:04

0:05:01

0:05:01