filmov

tv

What Is The Best Strategy For Investing In Real Estate?

Показать описание

What Is The Best Strategy For Investing In Real Estate?

Listen to how ordinary people built extraordinary wealth—and how you can too. You’ll learn how millionaires live on less than they make, avoid debt, invest, are disciplined and responsible! Featuring hosts from the Ramsey Network: Dave Ramsey, Ken Coleman, Christy Wright, Rachel Cruze, Anthony ONeal and John Delony.

Listen to how ordinary people built extraordinary wealth—and how you can too. You’ll learn how millionaires live on less than they make, avoid debt, invest, are disciplined and responsible! Featuring hosts from the Ramsey Network: Dave Ramsey, Ken Coleman, Christy Wright, Rachel Cruze, Anthony ONeal and John Delony.

BEST Scalping Trading Strategy For Beginners (How To Scalp Forex, Stocks, and Crypto)

BEST MACD Trading Strategy [86% Win Rate]

TOP 4 Trading Strategies to Make $500/Day For Beginners

From 50$ to 20,000$+ NO-RISK method | Pocket Option Trading Strategy | Binary options trading

After 8 Years Trading This Is My Favorite Strategy - Best Way To Trade Consistently And Profitably

The ONLY FOREX Trading Strategy You Will EVER Need

This FREE TradingView Indicator for 2024: BEST Buy/Sell Signals! Crazy Scalping Strategy

Transform Your Trading with This Proven Order Block Strategy

I Tested This Trading Strategy & It Made 310%

Best SIMPLE Profitable Trading Strategy On TradingView

BEST Trend Lines Strategy for Daytrading Forex & Stocks (Simple Technique)

BEST Moving Average Strategy for Daytrading Forex (Easy Crossover Strategy)

I Found A Trading Strategy With a 225% Profit Rate #shorts

Very PROFITABLE Trading Strategy with Only 1 Indicator! #shorts

What's the best 2024 campaign strategy?

Bollinger Band + RSI Trading Strategy That Actually Works

The Heikin Ashi Trading Strategy (Simple & Effective)

5 Minute Scalping Strategy **HIGHEST WIN RATE**

BEST Guess Who Strategy- 96% WIN record using MATH

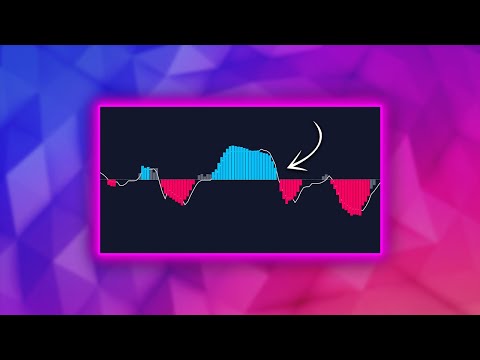

Most Effective MACD Strategy for Daytrading Crypto, Forex & Stocks (High Winrate Strategy)

Best Scalping Strategy Period

35 Vital Chess Principles | Opening, Middlegame, and Endgame Principles - Chess Strategy and Ideas

The Best Marketing Strategy For A New Business Or Product

The Best Trading Strategy that won the US Championship (Mark Minervini)

Комментарии

0:07:22

0:07:22

0:07:06

0:07:06

0:13:15

0:13:15

0:07:32

0:07:32

0:12:50

0:12:50

0:14:47

0:14:47

0:08:48

0:08:48

0:14:55

0:14:55

0:01:00

0:01:00

0:08:11

0:08:11

0:09:25

0:09:25

0:09:08

0:09:08

0:01:00

0:01:00

0:00:39

0:00:39

0:07:35

0:07:35

0:06:41

0:06:41

0:06:05

0:06:05

0:15:10

0:15:10

0:12:25

0:12:25

0:09:49

0:09:49

0:11:54

0:11:54

0:18:51

0:18:51

0:09:30

0:09:30

0:09:12

0:09:12