filmov

tv

Given uncertainties and risks, we need to remain agile and flexible in our policy response.

Показать описание

Given uncertainties and risks, we need to remain agile and flexible in our policy response. The Eurogroup will work closely with the Commission in the coming weeks and months to do this. We reiterated our agreement to maintain a supportive fiscal stance for this year. Looking ahead, we concurred that the economic recovery will set the stage for a gradual evolution in fiscal policy, leading to a broadly neutral overall fiscal stance in 2023 for the euro area.

This comes with two important points. Firstly, we recognise the need for differentiation between member states. And secondly, we stand ready to adjust our policies if economic developments require us to do so. We will therefore be actively monitoring the evolving situation and continuing with our efforts to coordinate our plans.

The Eurogroup on Monday urged the most indebted countries of the common currency, including Spain, to make “adjustments” to reduce it “if conditions permit”, despite recognizing that the war in Ukraine has increased uncertainty about economic recovery. The Ministers of Economy and Finance of the Nineteen adopted a statement on the fiscal position to be taken by euro economies in the coming year at a meeting marked by the impact that Russia's invasion of Ukraine will have.

#Russia #Ukraine #Energy #inflation #sanctions #RussianElite

The text draws on the same conclusions that the European Commission presented last week and urges these countries - Spain, France, Italy, Greece and Belgium - to make a gradual adjustment within a “credible medium-term strategy that continues to boost the investments and reforms” needed for the green and digital transitions. “Based on the information we have available at the moment, we think it's the right choice. In whatever scenario we face, debt sustainability will be exceptionally important,” Eurogroup President Paschal Donohoe said in a press appearance.

The Irishman argued that “under the current circumstances” it is “feasible” for the most indebted countries to make “very gradual” changes in their fiscal policy to ensure that their GDP growth improves their “debt dynamics” by 2023. In a similar vein, Economy Commissioner Paolo Gentiloni stressed that debt reduction in these countries is “necessary”, although he added that it must be done in a “gradual and realistic way” so as not to “kill economic growth”.

GREATER UNCERTAINTY

This call comes at a time when uncertainty has “increased significantly” due to the war initiated by Russian President Vladimir Putin, although the impact of the aggression on European economies and its consequences on the supply chain, energy prices and inflation is “yet to be determined”, which will be elevated for longer than expected in any case.

In this regard, the Eurogroup emphasizes that its fiscal policies must remain “agile and flexible”, so ministers declared themselves “ready to adjust fiscal policy to changing circumstances if necessary”. In fact, the ministers themselves point out that the fiscal guidelines they have published this Monday are conditional on the very development of economic events and the European Commission has already opened the door for fiscal rules, instead of being activated in 2023, to be suspended for another year; something it will decide in spring when update your economic forecasts.

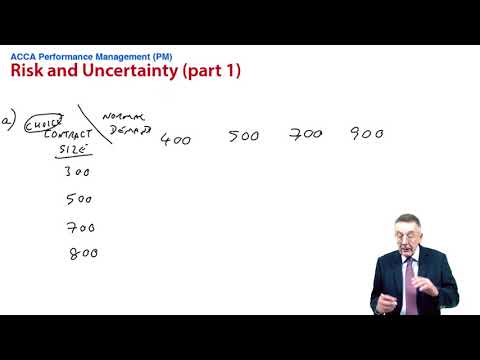

THE DEBATE ON FISCAL RULES

Precisely, the Belgian Finance Minister, Vincent van Peteghem, on his arrival at the meeting, advocated that the rules that limit public deficits and debt should also be frozen next year, taking into account the impact of the war. “I don't think we should have any taboo on this and we should discuss whether we could extend the clause for next year,” said in a line similar to that also shared with the media by his Portuguese colleague, Joao Leao, who called for assessing the possibility of not reactivating them.

On the other hand, according to German Minister Christian Lindner, it is “not the time” to have this debate yet because it is necessary to wait and see the consequences of the military aggression on Ukraine. “Let's look at economic developments, let's hope they won't get any worse, but it's not yet time to decide,” he said on behalf of a country that traditionally advocates strict application of fiscal rules. The debate on the return of fiscal rules also coincides with its own reform, which deeply divides the Nineteen between those who want little change (such as Germany, the Netherlands, Austria or the Nordic) and the countries of the south, which are committed to a major revision.

On this issue, Dutch Minister Sigrid Kaag pointed out that her government is not in favour of taking investments in defence or in the ecological transition out of the calculation because she would run the risk that countries would not “measure the same” when estimating their deficit and debt.

This comes with two important points. Firstly, we recognise the need for differentiation between member states. And secondly, we stand ready to adjust our policies if economic developments require us to do so. We will therefore be actively monitoring the evolving situation and continuing with our efforts to coordinate our plans.

The Eurogroup on Monday urged the most indebted countries of the common currency, including Spain, to make “adjustments” to reduce it “if conditions permit”, despite recognizing that the war in Ukraine has increased uncertainty about economic recovery. The Ministers of Economy and Finance of the Nineteen adopted a statement on the fiscal position to be taken by euro economies in the coming year at a meeting marked by the impact that Russia's invasion of Ukraine will have.

#Russia #Ukraine #Energy #inflation #sanctions #RussianElite

The text draws on the same conclusions that the European Commission presented last week and urges these countries - Spain, France, Italy, Greece and Belgium - to make a gradual adjustment within a “credible medium-term strategy that continues to boost the investments and reforms” needed for the green and digital transitions. “Based on the information we have available at the moment, we think it's the right choice. In whatever scenario we face, debt sustainability will be exceptionally important,” Eurogroup President Paschal Donohoe said in a press appearance.

The Irishman argued that “under the current circumstances” it is “feasible” for the most indebted countries to make “very gradual” changes in their fiscal policy to ensure that their GDP growth improves their “debt dynamics” by 2023. In a similar vein, Economy Commissioner Paolo Gentiloni stressed that debt reduction in these countries is “necessary”, although he added that it must be done in a “gradual and realistic way” so as not to “kill economic growth”.

GREATER UNCERTAINTY

This call comes at a time when uncertainty has “increased significantly” due to the war initiated by Russian President Vladimir Putin, although the impact of the aggression on European economies and its consequences on the supply chain, energy prices and inflation is “yet to be determined”, which will be elevated for longer than expected in any case.

In this regard, the Eurogroup emphasizes that its fiscal policies must remain “agile and flexible”, so ministers declared themselves “ready to adjust fiscal policy to changing circumstances if necessary”. In fact, the ministers themselves point out that the fiscal guidelines they have published this Monday are conditional on the very development of economic events and the European Commission has already opened the door for fiscal rules, instead of being activated in 2023, to be suspended for another year; something it will decide in spring when update your economic forecasts.

THE DEBATE ON FISCAL RULES

Precisely, the Belgian Finance Minister, Vincent van Peteghem, on his arrival at the meeting, advocated that the rules that limit public deficits and debt should also be frozen next year, taking into account the impact of the war. “I don't think we should have any taboo on this and we should discuss whether we could extend the clause for next year,” said in a line similar to that also shared with the media by his Portuguese colleague, Joao Leao, who called for assessing the possibility of not reactivating them.

On the other hand, according to German Minister Christian Lindner, it is “not the time” to have this debate yet because it is necessary to wait and see the consequences of the military aggression on Ukraine. “Let's look at economic developments, let's hope they won't get any worse, but it's not yet time to decide,” he said on behalf of a country that traditionally advocates strict application of fiscal rules. The debate on the return of fiscal rules also coincides with its own reform, which deeply divides the Nineteen between those who want little change (such as Germany, the Netherlands, Austria or the Nordic) and the countries of the south, which are committed to a major revision.

On this issue, Dutch Minister Sigrid Kaag pointed out that her government is not in favour of taking investments in defence or in the ecological transition out of the calculation because she would run the risk that countries would not “measure the same” when estimating their deficit and debt.

0:08:16

0:08:16

0:05:08

0:05:08

0:01:57

0:01:57

0:01:06

0:01:06

0:11:24

0:11:24

0:02:50

0:02:50

0:05:06

0:05:06

0:32:32

0:32:32

0:03:23

0:03:23

0:10:05

0:10:05

0:09:53

0:09:53

0:48:30

0:48:30

0:08:56

0:08:56

0:36:39

0:36:39

0:32:12

0:32:12

0:23:02

0:23:02

0:02:42

0:02:42

0:10:01

0:10:01

0:05:24

0:05:24

0:30:33

0:30:33

0:26:49

0:26:49

0:23:01

0:23:01

0:25:10

0:25:10

0:05:22

0:05:22