filmov

tv

Changes to the Child Tax Credit Under Kamala Harris | 2024 Update

Показать описание

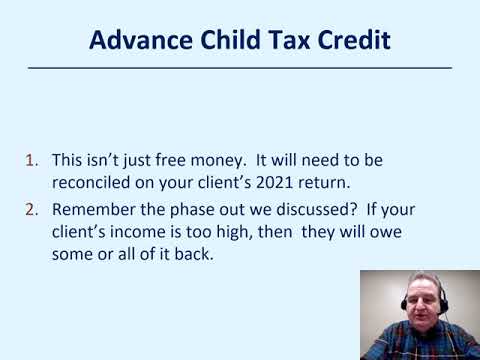

Learn about the Child Tax Credit (CTC) and Kamala Harris's potential IRS tax payment policies that could impact your family's finances. Discover how these policies provide financial relief, reduce child poverty, and support middle-class families.

In today's update, learn about the Child Tax Credit and Kamala Harris's and the Democratic Administration's potential tax policies that could impact your family's finances in 2024 and 2025 and beyond. Understand how the Child Tax Credit provides financial relief through possible stimulus checks, reduces child poverty, and supports middle-class families. Discover Harris's proposals like the LIFT the Middle Class Act, the importance of Biden’s pledge not to raise taxes on those earning under $400,000, and what expiring Trump-era tax cuts mean for you. Find out how these policies can help cover childcare, education, and everyday expenses, and why staying informed and engaged with community and representatives is crucial for shaping beneficial policies. Learn practical tips to maximize these benefits and secure a more stable financial future for your family.

*SUBSCRIBE TO OUR YOUTUBE CHANNEL:*

*WATCH NEXT*

Child Tax Credit Explained: Guide to IRS Eligibility, Benefits & Payments

Is There a New $300 Child Tax Credit in July 2024?

Will the Child Tax Credit Get a Senate Vote? Will it Pass? Political Battle 2024 Update

Child Tax Credit Update: Anything New? What Families Must Understand

Will There Be a 4th Stimulus Check? Here’s What You Need to Know

The Truth about Stimulus Checks | Adapting Without Government Aid

Money Instructor has been a leading resource in financial education for over two decades, empowering educators, financial advisors, students, parents, and individuals with essential topics in financial literacy. Our extensive coverage spans personal finance, money management, saving money, budgeting, investing, business fundamentals, taxes and taxation, Social Security, retirement planning, tax credits and refunds, economic stimulus checks and payments, as well as debt management—including credit card debt and interest rates. Additionally, we explore monetary policy, inflation, housing market trends, government legislation, political news, stock market dynamics, economic trends, improving credit scores, career development, housing and rent issues, and strategies for wealth building. By providing educational resources and tools, we help ensure you are well-informed and updated with the latest news and developments in these areas.

------------------------------------------------------------------------------

#childtaxcredit

#CTC

#TaxCredit2024

#KamalaHarris

#FinancialPlanning

#moneyinstructor

#financialeducation

#financialliteracy

Money Instructor does not provide tax, legal or accounting advice. This material has been prepared for educational and informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors regarding your own situation. Although the information has been researched and vetted beforehand, it may not be current at the time of viewing.

In today's update, learn about the Child Tax Credit and Kamala Harris's and the Democratic Administration's potential tax policies that could impact your family's finances in 2024 and 2025 and beyond. Understand how the Child Tax Credit provides financial relief through possible stimulus checks, reduces child poverty, and supports middle-class families. Discover Harris's proposals like the LIFT the Middle Class Act, the importance of Biden’s pledge not to raise taxes on those earning under $400,000, and what expiring Trump-era tax cuts mean for you. Find out how these policies can help cover childcare, education, and everyday expenses, and why staying informed and engaged with community and representatives is crucial for shaping beneficial policies. Learn practical tips to maximize these benefits and secure a more stable financial future for your family.

*SUBSCRIBE TO OUR YOUTUBE CHANNEL:*

*WATCH NEXT*

Child Tax Credit Explained: Guide to IRS Eligibility, Benefits & Payments

Is There a New $300 Child Tax Credit in July 2024?

Will the Child Tax Credit Get a Senate Vote? Will it Pass? Political Battle 2024 Update

Child Tax Credit Update: Anything New? What Families Must Understand

Will There Be a 4th Stimulus Check? Here’s What You Need to Know

The Truth about Stimulus Checks | Adapting Without Government Aid

Money Instructor has been a leading resource in financial education for over two decades, empowering educators, financial advisors, students, parents, and individuals with essential topics in financial literacy. Our extensive coverage spans personal finance, money management, saving money, budgeting, investing, business fundamentals, taxes and taxation, Social Security, retirement planning, tax credits and refunds, economic stimulus checks and payments, as well as debt management—including credit card debt and interest rates. Additionally, we explore monetary policy, inflation, housing market trends, government legislation, political news, stock market dynamics, economic trends, improving credit scores, career development, housing and rent issues, and strategies for wealth building. By providing educational resources and tools, we help ensure you are well-informed and updated with the latest news and developments in these areas.

------------------------------------------------------------------------------

#childtaxcredit

#CTC

#TaxCredit2024

#KamalaHarris

#FinancialPlanning

#moneyinstructor

#financialeducation

#financialliteracy

Money Instructor does not provide tax, legal or accounting advice. This material has been prepared for educational and informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors regarding your own situation. Although the information has been researched and vetted beforehand, it may not be current at the time of viewing.

Комментарии

0:02:18

0:02:18

0:04:34

0:04:34

0:02:47

0:02:47

0:05:24

0:05:24

0:10:01

0:10:01

0:02:03

0:02:03

0:01:17

0:01:17

0:01:56

0:01:56

0:06:06

0:06:06

0:10:01

0:10:01

0:02:17

0:02:17

0:02:08

0:02:08

0:04:24

0:04:24

0:01:39

0:01:39

0:01:19

0:01:19

0:03:14

0:03:14

0:00:57

0:00:57

0:02:15

0:02:15

0:01:59

0:01:59

0:02:09

0:02:09

0:05:58

0:05:58

0:02:24

0:02:24

0:09:01

0:09:01

0:15:04

0:15:04