filmov

tv

Can you afford a ₹2 CRORE house? 3-20-33 Rule #shorts #personalfinance | Udayan Adhye

Показать описание

How Much Home You Can ACTUALLY Afford (By Salary)

How Much Car Can You Really Afford? (By Salary)

We Make $1.7 Million A Year, Can We Afford A 2nd Home?

How Much Car Can You Afford: $30K vs $75K vs $265K Supercar

How Much Car You Can ACTUALLY Afford (By Salary)

Can you afford a 2 BHK in BOMBAY?! | Ankur Warikoo #shorts

Can We Really Afford a SECOND Village in Kettlewick? (Cities Skylines 2)

More than you can afford pal, Ferrari.

What does this idiom mean?

How Do You Afford Your Car in High School?

Can I Afford A $1,000,000 House?

How Much Housing Can You ACTUALLY Afford? (By Salary)

How Much Home You Can ACTUALLY Afford in 2024 (By Salary)

What Cars Can You Afford with a $75,000 Salary

How To Know How Much House You Can Afford

Can Jigsaw Afford Saw 2? | Foot the Bill - Saw 2 (2005)

How Much Rent Can You REALLY Afford to Pay? (By Income Level)

Tata Punch - Can you AFFORD it with these 2 RULES? | Ankur Warikoo #shorts

How Much House Can You Actually Afford? (By Salary)

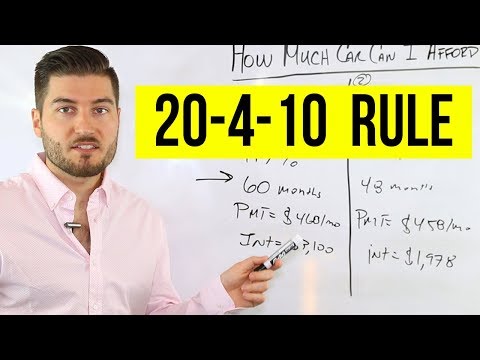

How Much Car Can I Afford (20/4/10 Rule)

How Much Car You Can REALISTICALLY Afford! (By Income Level)

🏡 Never put a downpayment on your house #realestate #money #downpayment #personalfinance #mortgage...

Can You Afford a Tesla in 2024? | How Much I Pay Per Month

Can you afford it? MERCEDES AMG! | Ankur Warikoo #shorts

Комментарии

0:13:48

0:13:48

0:12:39

0:12:39

0:07:00

0:07:00

0:19:21

0:19:21

0:14:10

0:14:10

0:00:34

0:00:34

0:54:30

0:54:30

0:01:17

0:01:17

0:00:56

0:00:56

0:00:30

0:00:30

0:07:30

0:07:30

0:13:52

0:13:52

0:18:13

0:18:13

0:00:20

0:00:20

0:05:36

0:05:36

0:37:08

0:37:08

0:11:39

0:11:39

0:00:38

0:00:38

0:18:25

0:18:25

0:07:38

0:07:38

0:12:24

0:12:24

0:01:01

0:01:01

0:13:17

0:13:17

0:00:35

0:00:35