filmov

tv

How to Build a PAPER LBO Model in 3 Steps! (FREE Excel Included)

Показать описание

In this video, I show you step by step how to build a paper Leveraged Buyout (LBO) model.

🧑🏫Wharton / Wall Street Prep PE Certificate Program🧑🏫

► Learn from real investors (including the founder of Carlyle) about the private equity industry

► Use code RARELIQUID for up to $500 OFF for ANY cohort

⬇️Download the Excel for FREE⬇️

🍎Sign up for my courses🍎

▶️Playlists▶️

🎥Related Videos🎥

🧑🎓Career Resources👩🎓

⏱Timestamps⏱

0:00 - Introduction

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

📱Interact With Me📱

🔎Disclaimer🔎

All content in this video is for entertainment purposes only. I am not a professional financial advisor and my statements are not to be taken as instructions or directions. In addition, some of the links above are affiliate links, meaning that at no additional cost to you, I may earn a commission if you click through and make a purchase.

🧑🏫Wharton / Wall Street Prep PE Certificate Program🧑🏫

► Learn from real investors (including the founder of Carlyle) about the private equity industry

► Use code RARELIQUID for up to $500 OFF for ANY cohort

⬇️Download the Excel for FREE⬇️

🍎Sign up for my courses🍎

▶️Playlists▶️

🎥Related Videos🎥

🧑🎓Career Resources👩🎓

⏱Timestamps⏱

0:00 - Introduction

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

📱Interact With Me📱

🔎Disclaimer🔎

All content in this video is for entertainment purposes only. I am not a professional financial advisor and my statements are not to be taken as instructions or directions. In addition, some of the links above are affiliate links, meaning that at no additional cost to you, I may earn a commission if you click through and make a purchase.

How to Make an Easy Paper Airplane in 1 Minute! (60 Seconds) Competition Winner — Flies 100+ Feet!

How To Make Paper Airplane Easy that Fly Far

How to Make Paper Airplane That Flies Far Easy,How to Make Paper Airplane

How To Fold A Paper Airplane That Flies Far. (Full HD)

How to Fold an Easy Paper Airplane in 1 Minute (60 seconds)! — Flies Extremely Well!

How to Make a PAPER AIRPLANE!! - (Easy for Kids!)

WHISTLE ORIGAMI EASY CRAFT TUTORIAL | HOW TO WHISTLE | DIY WHISTLE ORIGAMI PAPER FOLDING INSTRUCTION

How To Make a Paper Boat That Floats - Origami Boat

How To Make The WORLD RECORD PAPER AIRPLANE

How to fit your whole body thru a sheet of paper *CHALLENGE REVEALED* 😱 #shorts

Cute DIY Paper Computer ☺️🌸 by #art #papercraft #diy

How To Make a Paper Fortune Teller - EASY Origami

How to Make an EASY Jet Paper Airplane that Flies REALLY Fast — Concorde Tutorial

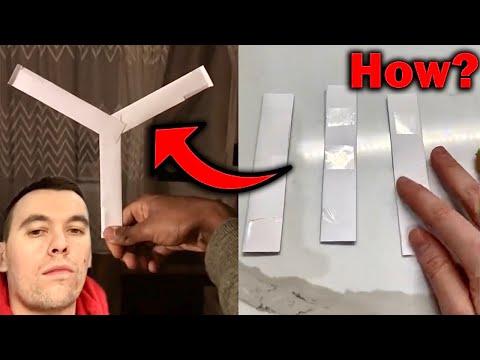

Easy Origami Boomerang (Paper Toys)

EASY PAPER CLAWS ORIGAMI TUTORIAL | HOW TO MAKE PAPER CLAWS ORIGAMI | EASY TOP ORIGAMI WOLF CLAWS

Paper Claws 💅

How To Make A SECRET Paper Boomerang Step By Step Tutorial..🥷

PAPER SHOTGUN ORIGAMI CRAFT TUTORIAL | HOW TO MAKE PAPER GUN ORIGAMI STEP BY STEP | DIY PAPER GUN

ORIGAMI KNIFE BUTTERFLY STEP BY STEP PAPER CRAFT WEAPON | DIY ORIGAMI KNIFE BUTTERFLY EASY TUTORIAL

Making a Paper Airplane

How to Make a Paper Boat that Floats - Paper Speed Boat

day 2 of making a paper gun. #paper #shorts #youtubeshorts comment what i should make next

FIFA WORLD CUP ORIGAMI PAPER CRAFT TUTORIAL | DIY WORLD CUP TROPHY EASY ORIGAMI WORLD ART FOLDING

Evolution 😮💨 (Tutorial on this channel)

Комментарии

0:01:51

0:01:51

0:02:23

0:02:23

0:02:04

0:02:04

0:03:15

0:03:15

0:01:30

0:01:30

0:02:51

0:02:51

0:00:11

0:00:11

0:03:37

0:03:37

0:06:16

0:06:16

0:01:00

0:01:00

0:00:13

0:00:13

0:06:31

0:06:31

0:06:09

0:06:09

0:08:47

0:08:47

0:02:24

0:02:24

0:00:22

0:00:22

0:00:24

0:00:24

0:00:33

0:00:33

0:00:21

0:00:21

0:01:58

0:01:58

0:08:03

0:08:03

0:00:10

0:00:10

0:00:29

0:00:29

0:00:18

0:00:18