filmov

tv

Macro 4.4B - Expansion of the Money Supply - How does the Money Multiplier Work?

Показать описание

This video covers the Money Multiplier in topic 4.4 of the AP Macroeconomics Course Exam Description (CED). It explains everything you need to know about the money multiplier.

or

Note: AP©, Advanced Placement Program©, and College Board© are registered trademarks of the College Board, which was not involved in the production of, and does not endorse, this material.

or

Note: AP©, Advanced Placement Program©, and College Board© are registered trademarks of the College Board, which was not involved in the production of, and does not endorse, this material.

Retightening My DIY Microlocs | 4 point rotation interlocks| #microlocs #diylocs #microlocsjourney

The duoquadragintuple 45-strafe - Most precise jump in Minecraft

My son asked for sonic braids pt. 2

fps comparison, can you notice the difference? #60fps #animation #attackontitan #shingekinokyojin

Girls Hostel Madness😂❤️ #shorts #short #girls #hostellife

HOW TO INSTALL MICROLOCS | Interlocking Method Step-by-Step

GACD e-Hub Advanced Programme - Lecture 4B Strategies for interventions at scale

Raspberry pi 5 inch HDMI Screen Installation | #Shorts

Mini braids for hair growth || mini braids on 4c natural hair WEEK 35

How To: Two Strand Twist on 4C Natural Hair

Raspberry Pi 5 Tutorial - 4x4 Matrix Keypad Input

I Got MICROLOCS! | Nia Hope

Singapore Adv Gold Workout - L180 draw w/ 4b analysis and preliminary run of a mandatory LD filter.

HOW TO RETAIN LENGTH IN A PROTECTIVE STYLE | CURLCODEBLACK #naturalhair

Mini Twist Bob | w/ Added Hair

4 Macro Trading Edges

microlocs with fine low density hair

QVR Brazilian Remy Hair Afro kinky Bulk Human Hair For Braiding Dreadlock Hair

Micro Loc Extensions on SHORT LOW DENSITY HAIR | QVR HAIR | Tutorial | QVR HAIR

PCG Interiors Pt 4B: Feature Enhancements - Tutorial UE5.3

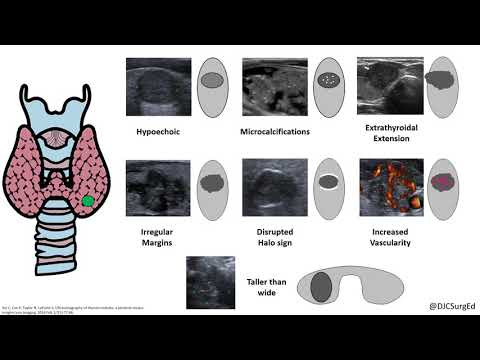

Thyroid Nodules

How to EARN MONEY FAST in Roblox Car Crushers 2 | (2024)

Unit 1 Lesson 4b Supply Shifters

IPMI and Remote Management for Any Motherboard! PiKVM

Комментарии

0:03:12

0:03:12

0:00:25

0:00:25

0:01:00

0:01:00

0:00:12

0:00:12

0:00:11

0:00:11

0:10:51

0:10:51

0:18:50

0:18:50

0:00:35

0:00:35

0:01:18

0:01:18

0:01:00

0:01:00

0:04:11

0:04:11

0:05:16

0:05:16

0:19:20

0:19:20

0:11:16

0:11:16

0:08:21

0:08:21

0:15:30

0:15:30

0:05:27

0:05:27

0:00:44

0:00:44

0:08:08

0:08:08

0:45:46

0:45:46

0:02:21

0:02:21

0:02:07

0:02:07

1:07:35

1:07:35

0:10:52

0:10:52