filmov

tv

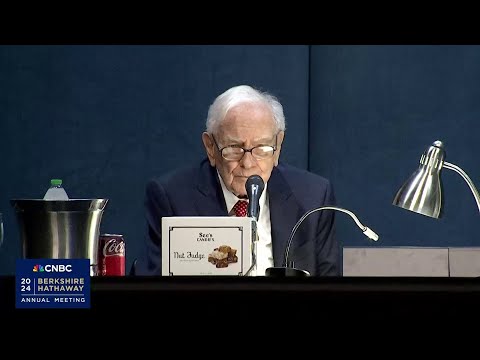

Warren Buffett WARNING : ✋ STOP 6 Things That Are Keeping You Poor ASAP ✋

Показать описание

#1. Zero Balance

Let's say you have fifty dollars in your bank account. Normally, when you think you have fifty dollars in your bank account, you assume you also have fifty dollars to spend, right? Well, this mindset may backfire big time.

As Buffet says here, don't buy what you can't afford. Just because you have fifty dollars doesn't mean you can afford to spend fifty dollars. This is exactly what zero balance thinking is about. Zero balance thinking is the killer of wealth. It's also the reason why income isn't what determines whether you are broke or rich.

#2 : Payment Traps

A lot of people who look rich really aren't rich; they just look rich. They have very expensive things, and it makes you wonder how on Earth they can afford that when you can't. Well, Warren Buffett has this to say about those who look rich: "Only when the tide goes out do you discover who's been swimming naked." In other words, only when you look carefully, you see who's actually rich and who’s simply pretending to be rich. So, don't get caught in payment traps designed to keep you broke.

#3 : Compounding

Once you've overcome payment traps and the zero balance mindset, you can focus on compounding your money. Compounding is the magical effect that takes money and grows it at an exponential rate.

However, if you want your money to grow using this magical effect, you'll need to understand the difference between two words that Warren Buffett knows better than anyone.

What are these 2 words? Assets and liabilities. Assets are things you own that put money in your pocket, and liabilities are things you buy that take money out of your pocket.

#4 : Flashy Lifestyle

The sad reality is that social media hypes things up a lot. They show tons of people who look rich but are really not rich at all. In fact, there have been several stories of people who have incurred thousands of dollars of debt just to look good on Instagram. It's a simple fix, but avoid the flashy lifestyle.

Take a look at Warren Buffett. No one ever sees a brand on his suits, he eats cheap, and he lives in the very first home he bought.

Yet, look how rich he is.

#5 : 1 Income Source

Unless you have millions of dollars invested, you’re probably still relying on your job to pay the bills. And if you lose your job, you either go into debt, or sell your investments at a loss. That’s why it’s so important to have multiple streams of income. In case one of them goes bust, you can sleep peacefully knowing that your other income sources will still cover your living expenses.

That’s why I recently started a passive income side hustle to earn an extra few thousand dollars per month. It’s beginner friendly and only requires a phone and an internet connection to start.

#6 : Step Ahead

While we can sit here and make excuses, saying that businesses are evil because they all want your money, the truth is, we're all trying to survive and earn a living. That’s how things have always been, and will always be.

The key idea here is that we all are able to make a simple choice : to buy or not to buy.

Most people just don't have a filter; they buy things they don't need just because they want them. When you can develop a filter and not buy things you don’t need just to satisfy your impulse, you'll notice how much quicker your bank balance grows.

📜 Disclaimer 📜

The information contained herein is for informational purposes only. Nothing herein shall be construed to be financial, legal or tax advice. Some of the links are affiliate links, and I will receive a small commission for referring viewers to the service at no cost to you.

#money #finance #budget #warrenbuffet

0:15:20

0:15:20

0:10:18

0:10:18

0:24:44

0:24:44

0:19:13

0:19:13

0:20:08

0:20:08

0:08:07

0:08:07

0:04:02

0:04:02

0:09:21

0:09:21

0:12:11

0:12:11

0:04:23

0:04:23

0:15:32

0:15:32

0:02:05

0:02:05

0:15:08

0:15:08

0:15:27

0:15:27

0:12:51

0:12:51

0:05:20

0:05:20

0:15:40

0:15:40

0:09:22

0:09:22

0:13:48

0:13:48

0:04:49

0:04:49

0:15:26

0:15:26

0:05:19

0:05:19

0:09:36

0:09:36

0:15:05

0:15:05