filmov

tv

Shareholders of an S Corporation [CPA Prep]

Показать описание

Unlock a holistic learning experience tailored to help you pass the CPA exams. Gain access to interactive quizzes, practice exams, and task-based simulations that mirror the real exam experience. Our AI-driven platform adapts to your learning style, providing personalized pathways to master each section of the CPA exam.

🎓 Lesson Overview:

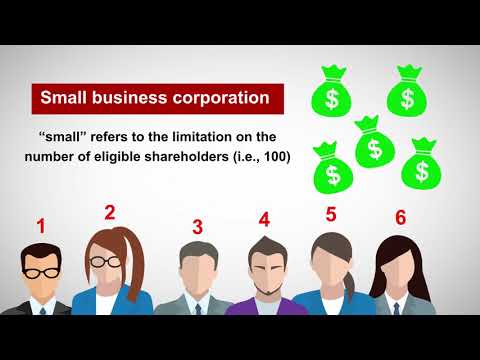

In this lesson, Nick Palazzolo, CPA, breaks down the specific shareholder eligibility requirements for S-Corporations, emphasizing the need to maintain S-Corp status for federal tax purposes. He delves into the rules surrounding the maximum number of shareholders an S-Corp can have, including how family members and estates may be counted. Furthermore, Nick discusses the types of shareholders that are allowed – highlighting U.S. citizens, resident aliens, and certain trusts – while also outlining who and what entities are ineligible, such as non-resident aliens, other corporations, and partnerships. He thoroughly explains the real-world implications of these eligibility criteria, including how improper transfers of shares can result in an S-Corp reverting to a C-Corp, and stresses the importance of internal bylaws and checks to prevent unauthorized transactions.

🔍 Key Topics Covered:

- S Corporations

- Shareholder Eligibility

- S-Corp Election

- S-Corp Requirements

💡 Learn More and Elevate Your CPA Exam Preparation:

Our comprehensive course offers a unique blend of AI-driven personalized learning experiences, expert insights, and practical exercises designed to ensure you're fully prepared to conquer the CPA exams.

👉 Begin your journey to becoming a Certified Public Accountant today!

#CPAExam #Accounting #ExamPrepAI

0:01:02

0:01:02

0:09:05

0:09:05

0:03:58

0:03:58

0:03:39

0:03:39

0:07:53

0:07:53

0:14:02

0:14:02

0:11:21

0:11:21

0:06:18

0:06:18

0:45:07

0:45:07

0:24:21

0:24:21

0:12:43

0:12:43

0:00:56

0:00:56

0:02:47

0:02:47

0:06:30

0:06:30

0:00:30

0:00:30

0:16:35

0:16:35

0:08:02

0:08:02

0:12:32

0:12:32

0:10:29

0:10:29

0:00:50

0:00:50

0:01:53

0:01:53

0:08:51

0:08:51

0:01:13

0:01:13

0:03:05

0:03:05