filmov

tv

A Day in the Life of a Hedge Fund Analyst

Показать описание

In this video I go over the daily routine of a hedge fund analyst, from calm days to the chaos of earnings season.

🧑🏫Wharton & Wall Street Prep Applied Value Investing Certificate Program🧑🏫

► Use code RARELIQUID for up to $500 OFF

🚀FREE Career Resources🚀

🍎My Courses🍎

🧑🎓Recruiting Resources👩🎓

🎥Related Videos🎥

⏱Timestamps⏱

0:00 - Introduction

0:40 - A Good Day

4:54 - A Bad Day

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

📱Interact With Me📱

🔎Disclaimer🔎

Some of the links above are affiliate links, meaning that at no additional cost to you, I may earn a commission if you click through and make a purchase.

🧑🏫Wharton & Wall Street Prep Applied Value Investing Certificate Program🧑🏫

► Use code RARELIQUID for up to $500 OFF

🚀FREE Career Resources🚀

🍎My Courses🍎

🧑🎓Recruiting Resources👩🎓

🎥Related Videos🎥

⏱Timestamps⏱

0:00 - Introduction

0:40 - A Good Day

4:54 - A Bad Day

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

📱Interact With Me📱

🔎Disclaimer🔎

Some of the links above are affiliate links, meaning that at no additional cost to you, I may earn a commission if you click through and make a purchase.

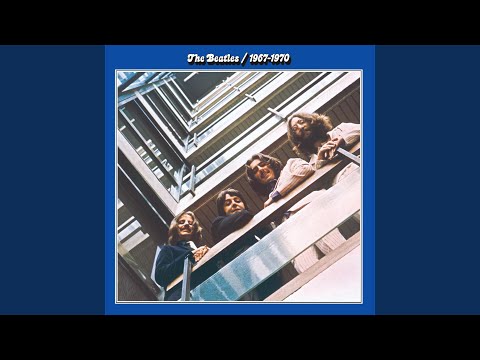

A Day In The Life (Remastered 2009)

A Day In The Life (Remastered 2017)

A Day In The Life (Remastered 2010)

A Day In The Life

A Day In The Life

A Day In The Life (2017 Remix)

Central Cee - Day In The Life [Music Video] | GRM Daily

A Day in the Life

“A Day in the Life of a White Rabbit & Baby Duck 🐰🦆 #babyducks #rabbit #shortvideo #shorts...

Day in the life of a rich lonely housewife #shorts

Day in the life of a throuple #shorts

The Beatles - A Day In The Life ( lyrics )

A Day In The Life with orchestra - The Beatles (arr. Sam Haug)

Day in the life of an octuple #shorts

Paul McCartney 'A Day In The Life Give Peace A Chance Let It Be

When our parents were young #shorts

[04] Jeff Beck Band - 'A Day in the Life' HD

Day in the life of a toddler #shorts

A Day In The Life

Day in the life of platonic friends (part 2) #friends

Where did the “Day in my life in tech” videos go?

A Day in the Life of an Art Major

The Beatles - A Day In The Life (Legendado)

A Day in the Life of a Biology Major

Комментарии

0:05:38

0:05:38

0:05:31

0:05:31

0:05:08

0:05:08

0:05:24

0:05:24

0:05:09

0:05:09

0:05:08

0:05:08

0:03:09

0:03:09

0:04:55

0:04:55

0:00:57

0:00:57

0:00:59

0:00:59

0:00:58

0:00:58

0:04:02

0:04:02

0:04:59

0:04:59

0:00:45

0:00:45

0:10:11

0:10:11

0:01:00

0:01:00

![[04] Jeff Beck](https://i.ytimg.com/vi/yUWvKDf3g5Y/hqdefault.jpg) 0:04:41

0:04:41

0:00:59

0:00:59

0:05:50

0:05:50

0:00:56

0:00:56

0:01:01

0:01:01

0:00:28

0:00:28

0:05:38

0:05:38

0:00:29

0:00:29