filmov

tv

Session 18: Get in on the ground floor - The IPO story

Показать описание

In this session, we look at the process by which private businesses enter the public market place and whether investors can exploit frictions in that process to generate higher returns. We begin by describing the sequence of an initial public offering, from the investment banking underwriting agreement to the final offering date. We then examine the behavior of IPOs on the offering date, where, at least on average, the stock price jumps about 10-15% from the offering price. Trying to capture this “under pricing “ is difficult for investors to do for three reasons: a selection bias, where you tend to be over invested in over priced IPOs and under invested in under priced ones, a “hot and cold” markets problem, where you find almost nothing to invest in during cold IPO periods and too many choices in hot periods and a post-issue timing quandary, where you can lose most of your profits if you hold an IPO too long. We conclude on an optimistic note, by looking at ways you can modify the strategy to counter all three problems.

CONTENDING FOR THE FAITH (FULFILLING THE MANDATE) ACTS 26:18 WITH APOSTLE JOSHUA SELMAN 20||09||2024

Let's Pray Together Session 18 -Kevin & Kathi Zadai

How To FIX Lunar Client/Badlion Invalid Session Error | Microsoft Acc Under 18 Error FIX | Minecraft

Apprendre le PHP : Chapitre 18, La session

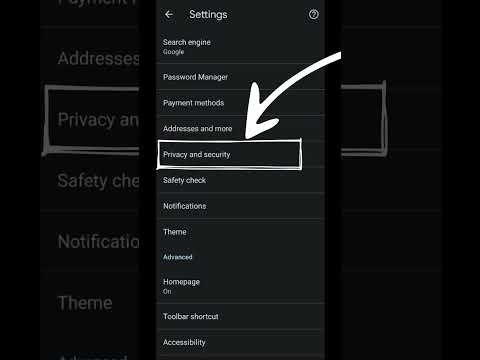

Easily Lock your Chrome Incognito session on Android

G Herbo - Sessions (Official Video)

Building The Attack | FA Learning Coaching Session From David Powderly

German B1 Session 18 Wortzschatz (Group Session on German Vocabulary Learning)

Creator 3-in-1 Main Street (31141) — Lego Building Session

B’z “HOME” session

Bubba Ray Dudley details iconic WrestleMania X-Seven match: Broken Skull Sessions sneak peek

130_Public Q & A Session & Meeting of SUNDAY with Engineer Muhammad Ali Mirza Bhai (21-Jan-2...

Get Physical Sessions Episode 18 with Jonas Woehl

Learn German with Kedar Jadhav : Session 18 : Past Tense

'Vinyl Sessions Vol.18' (A Soulful House Mix) by DJ Spivey

Nasty Pasty Sprint Session | 17 Mins HIIT Cycling Workout

Original 16 Brewery Sessions - Colter Wall - 'Kate McCannon'

SunoikisisDC Spring 2017: Session 18

Session 18: Optimal Financing Mix II- The cost of capital approach

Pa Salieu - Allergy (Live Session)

Spinnin’ Sessions Radio – Episode #593 | Joe Stone

Why you need multiple sessions to see permanent laser hair removal results

Jack couldn’t make it to our last session because of throat mucus. 😭

Dance And House Session 18 by Andreas Ericson - [House Music]

Комментарии

5:24:38

5:24:38

0:52:32

0:52:32

0:03:25

0:03:25

0:07:55

0:07:55

0:00:15

0:00:15

0:03:14

0:03:14

0:04:42

0:04:42

0:29:46

0:29:46

3:06:25

3:06:25

0:02:47

0:02:47

0:03:38

0:03:38

3:05:34

3:05:34

0:55:53

0:55:53

0:53:51

0:53:51

2:00:47

2:00:47

0:17:12

0:17:12

0:04:23

0:04:23

1:17:45

1:17:45

0:19:11

0:19:11

0:02:46

0:02:46

0:56:07

0:56:07

0:00:22

0:00:22

0:01:01

0:01:01

0:02:25

0:02:25