filmov

tv

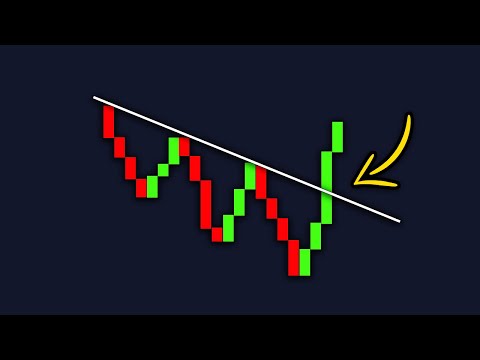

How to Recognize Perfect Trend Continuation Entry Points with Stochastic Confirmation

Показать описание

HOW TO RECOGNIZE PERFECT TREND CONTINUATION ENTRY POINTS WITH STOCHASTIC CONFIRMATION

================================================================================

Winning in Binary Options trading is quite easy if you know the market language. Like in real life contests, if you take time to study your opponent, it becomes easy for you to predict their moves.

Success in relationships is like that too. Spending quality time with your partner and taking time to study them help foster understanding of their behaviors and to easily predict them.

To win trades easily, you will need to practice a lot to have accurate knowledge of market structure and how to interpret signals given by indicators.

The indicators used in this video are:

Stochastic (13, 3, 3) - default;

EMA (5); Color (Yellow)

EMA (25); Color (Green)

EMA (34); Color (White)

EMA (144); Color (Red)

Trend continuation means that the current price trend is likely to remain in play. To follow the continuing trend, you simply open trades in the direction price is going.

The strategy used in this video makes use of moving averages and Stochastic Oscillator in predicting whether next candle will close bullish or bearish in continuation of the current trend and then find high probability entry points looking at the behaviour of the Stochastic Oscillator lines for confirmation.

WHEN TO TRADE LOWER (PUT/SELL)

==============================

Using this strategy, to open a PUT (SELL/LOWER) option, you must ensure the following:

** the candles are below the moving averages;

** the EMA (144) is farthest away from the candles, followed by the EMA (34), followed by EMA (25) and lastly EMA (5) which must be closest to or touching the candles;

** the moving averages are mostly pointing (sliding) down;

** Stochastic Oscillator lines are pointing down with gap between them and the blue line is not bending yet, or the stochastic lines are in the oversold region and stuck together with no gap between them;

After ensuring that all the conditions above have been met, you may open a LOWER (PUT/SELL) option with an expiration time of at least one (1) minute by entering at the opening of a new candle when the Purchase Time countdown hits 30. Better still, you may wait a bit longer before the Purchase Time countdown hits 3 to enable the candle to make a pullback above the candle's Open to give a better margin of safety.

WHEN TO TRADE HIGHER (CALL/BUY)

===============================

Using this strategy, to open a HIGHER (CALL/BUY) option, you must ensure the following:

** the candles are above the moving averages;

** the EMA (144) is farthest away from the candles, followed by the EMA (34), followed by EMA (25) and lastly EMA (5) which must be closest to or touching the candles;

** the moving averages are mostly pointing (sliding) up;

** Stochastic Oscillator lines are pointing up with gap between them and the blue line is not bending yet, or the stochastic lines are in the overbought region and stuck together with no gap between them;

** MACD is popping green bars and the lines are pointing up or attempting to do so.

After ensuring that all the conditions above have been met, you may open a HIGHER (CALL/BUY) option with an expiration time of at least one (1) minute by entering at the opening of a new candle when the Purchase Time countdown hits 30. Better still, you may wait a bit longer before the Purchase Time countdown hits 3 to enable the candle to make a pullback below the candle's Open to give a better margin of safety.

ADDITIONAL TIPS FOR SUCCESS

===========================

++ If Stochastic lines crossed but no gap between its lines and still hugging the extreme band, don’t trade reversal yet. Instead, trade trend continuation for 1 minute at a time after a nice pullback.

++ If price makes a momentous move after Stochastic lines have crossed with little or no gap between them, you may pause trading trend continuation as a temporary reversal or pullback may occur.

++ Your chance to trade reversal comes after price has consolidated for a while after an extended rally/decline and Stochastic lines finally cross with gap between them. You may take 1- or 2-minutes trade after a nice pullback and the formation of a double top/double bottom and reversal candlesticks such as doji or hammer/shooting star.

++ As you trade, be careful. Always wait and watch when Stochastic lines approach the 50 level or extreme bands, especially when there is volatility. Market tends to reverse/pullback at that point.

*************************************************************************

*************************************************************************

================================================================================

Winning in Binary Options trading is quite easy if you know the market language. Like in real life contests, if you take time to study your opponent, it becomes easy for you to predict their moves.

Success in relationships is like that too. Spending quality time with your partner and taking time to study them help foster understanding of their behaviors and to easily predict them.

To win trades easily, you will need to practice a lot to have accurate knowledge of market structure and how to interpret signals given by indicators.

The indicators used in this video are:

Stochastic (13, 3, 3) - default;

EMA (5); Color (Yellow)

EMA (25); Color (Green)

EMA (34); Color (White)

EMA (144); Color (Red)

Trend continuation means that the current price trend is likely to remain in play. To follow the continuing trend, you simply open trades in the direction price is going.

The strategy used in this video makes use of moving averages and Stochastic Oscillator in predicting whether next candle will close bullish or bearish in continuation of the current trend and then find high probability entry points looking at the behaviour of the Stochastic Oscillator lines for confirmation.

WHEN TO TRADE LOWER (PUT/SELL)

==============================

Using this strategy, to open a PUT (SELL/LOWER) option, you must ensure the following:

** the candles are below the moving averages;

** the EMA (144) is farthest away from the candles, followed by the EMA (34), followed by EMA (25) and lastly EMA (5) which must be closest to or touching the candles;

** the moving averages are mostly pointing (sliding) down;

** Stochastic Oscillator lines are pointing down with gap between them and the blue line is not bending yet, or the stochastic lines are in the oversold region and stuck together with no gap between them;

After ensuring that all the conditions above have been met, you may open a LOWER (PUT/SELL) option with an expiration time of at least one (1) minute by entering at the opening of a new candle when the Purchase Time countdown hits 30. Better still, you may wait a bit longer before the Purchase Time countdown hits 3 to enable the candle to make a pullback above the candle's Open to give a better margin of safety.

WHEN TO TRADE HIGHER (CALL/BUY)

===============================

Using this strategy, to open a HIGHER (CALL/BUY) option, you must ensure the following:

** the candles are above the moving averages;

** the EMA (144) is farthest away from the candles, followed by the EMA (34), followed by EMA (25) and lastly EMA (5) which must be closest to or touching the candles;

** the moving averages are mostly pointing (sliding) up;

** Stochastic Oscillator lines are pointing up with gap between them and the blue line is not bending yet, or the stochastic lines are in the overbought region and stuck together with no gap between them;

** MACD is popping green bars and the lines are pointing up or attempting to do so.

After ensuring that all the conditions above have been met, you may open a HIGHER (CALL/BUY) option with an expiration time of at least one (1) minute by entering at the opening of a new candle when the Purchase Time countdown hits 30. Better still, you may wait a bit longer before the Purchase Time countdown hits 3 to enable the candle to make a pullback below the candle's Open to give a better margin of safety.

ADDITIONAL TIPS FOR SUCCESS

===========================

++ If Stochastic lines crossed but no gap between its lines and still hugging the extreme band, don’t trade reversal yet. Instead, trade trend continuation for 1 minute at a time after a nice pullback.

++ If price makes a momentous move after Stochastic lines have crossed with little or no gap between them, you may pause trading trend continuation as a temporary reversal or pullback may occur.

++ Your chance to trade reversal comes after price has consolidated for a while after an extended rally/decline and Stochastic lines finally cross with gap between them. You may take 1- or 2-minutes trade after a nice pullback and the formation of a double top/double bottom and reversal candlesticks such as doji or hammer/shooting star.

++ As you trade, be careful. Always wait and watch when Stochastic lines approach the 50 level or extreme bands, especially when there is volatility. Market tends to reverse/pullback at that point.

*************************************************************************

*************************************************************************

Комментарии

0:00:43

0:00:43

0:06:43

0:06:43

0:09:25

0:09:25

0:09:28

0:09:28

0:00:59

0:00:59

0:03:25

0:03:25

0:27:26

0:27:26

0:00:26

0:00:26

0:07:34

0:07:34

0:04:11

0:04:11

0:00:46

0:00:46

0:00:54

0:00:54

0:00:43

0:00:43

0:08:05

0:08:05

0:01:01

0:01:01

0:00:39

0:00:39

0:00:57

0:00:57

0:08:01

0:08:01

0:00:32

0:00:32

0:04:24

0:04:24

0:09:04

0:09:04

0:07:13

0:07:13

0:05:06

0:05:06

0:09:05

0:09:05