filmov

tv

CASE STUDY: 10% Dividend Growth Rate EXPLODES Income!

Показать описание

In this video we are talking about the value of dividend stocks that grow their dividend by 7.5% or 10% compared to 5% or less and how this significantly impacts future dividend payments. We will also explore 6 dividend stocks that recently massively increased their dividend payments in 2024.

WANT ACCESS TO ALL OF MY SPREADSHEETS I USE ON THE CHANNEL ALONG WITH THE MONTHLY DIVIDEND STOCK SPREADSHEET AND INSTANT AWARENESS OF CHANGES TO MY PORTFOLIO? JOIN THE PATREON COMMUNITY!

Need a GREAT Dividend Tracker for your portfolio? Here is what I use and it is EXCELLENT:

This communication/content is for informational purposes only and is not intended as personalized investment advice, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon for purposes of transacting in securities or other investment vehicles.

#dividendstocks #dividends #investing

WANT ACCESS TO ALL OF MY SPREADSHEETS I USE ON THE CHANNEL ALONG WITH THE MONTHLY DIVIDEND STOCK SPREADSHEET AND INSTANT AWARENESS OF CHANGES TO MY PORTFOLIO? JOIN THE PATREON COMMUNITY!

Need a GREAT Dividend Tracker for your portfolio? Here is what I use and it is EXCELLENT:

This communication/content is for informational purposes only and is not intended as personalized investment advice, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. This communication should not be relied upon for purposes of transacting in securities or other investment vehicles.

#dividendstocks #dividends #investing

CASE STUDY: 10% Dividend Growth Rate EXPLODES Income!

The Power of Dividend Growth

The Power Of Dividend Growth

CASE STUDY: Dividend Stock Portfolio that Beats Dividend ETF's!

10 Buy and Hold FOREVER Dividend Stocks!

10 Blue-Chip Dividend Growth Stocks With 3% Yields And Safe Dividends | FAST Graphs

Dividend growth case study Ramsay Health Care

3 Dividend Mistakes and How To Avoid Them - Dividend Growth Investing

How To Build A Monster Dividend Portfolio | Ep. 325

The Truth About The Dividend Snowball - What They Don't Tell You

Top 10 Dividend Stocks for 2024!

The S&P 500 is Overvalued These 10 Dividend Growth Stocks Are Not: Part 3

The #1 Problem With Dividend Growth Investing! (No One Admits THIS)

Dividend Investing - The 3 Important Numbers

Dividend Growth Rate: Why It's One of the Most Important Metrics for Income Investors

10 Dividend Growth Stocks for Yield and Growth | FAST Graphs

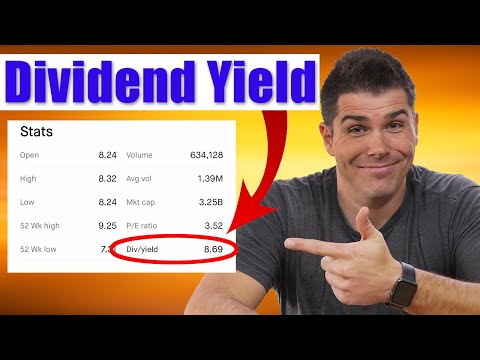

Dividend Yield Explained (For Beginners)

I'm Building a Massive Canadian Dividend Growth Investing Portfolio (WEEK 5)

What is Going On with Johnson & Johnson? (JNJ) - Dividend Growth Investing

The most unique dividend growth ETF (12% Dividend CAGR)

Dividend yield of large market cap companies

Buy and hold forever with 20% dividend growth

Raising Its Dividend! This Stock Has Been A Dividend Growth Monster

10 Attractively Valued Dividend Growth Stocks in Today’s Overvalued Market | FAST Graphs

Комментарии

0:09:23

0:09:23

0:09:14

0:09:14

0:08:38

0:08:38

0:09:20

0:09:20

0:24:56

0:24:56

0:25:46

0:25:46

0:06:30

0:06:30

0:46:08

0:46:08

0:43:04

0:43:04

0:12:56

0:12:56

0:28:12

0:28:12

0:18:05

0:18:05

0:09:18

0:09:18

0:17:38

0:17:38

0:08:21

0:08:21

0:26:31

0:26:31

0:04:42

0:04:42

0:10:35

0:10:35

0:08:50

0:08:50

0:33:16

0:33:16

0:03:35

0:03:35

0:35:30

0:35:30

0:16:13

0:16:13

0:22:14

0:22:14