filmov

tv

Why U.S. Banks Are At Risk Of Failing

Показать описание

Add me on Instagram and Snapchat: GPStephan

The YouTube Creator Academy:

My ENTIRE Camera and Recording Equipment:

UBS CEO Ermotti Sees a Lot of 'Over Capacity' in US Banking

Bank of America CEO Brian Moynihan on Australia, US Economy, Fed Policy

Two US Banks Just Failed - What Happened, and What Now?

Why Do U.S. Banks Keep Failing?

8 Safest Banks To Bank With In The US (banks to keep your money in during a financial crisis)

Why are So Many US Banks Collapsing?

U.S. banking crisis: ‘Banks are very fragile,’ professor says

The silver lining for Australia in the collapse of major US banks

The Banks Are in Bed With the Fed; the U.S. Bank Stress Test Cover-Up

China buys US bonds | Money, banking and central banks | Finance & Capital Markets | Khan Acade...

How do banks actually create money? We explain

Stress Testing the Big US Banks

What's the impact of two banks failing in the US? | Inside Story

Two U.S. banks cut overdraft fees

U.S. Banks Are Terrified of Chinese Payment Apps

Collapse of U.S. banks: There's a catharsis happening in bank deposits, says research firm

What the US government says after 2 banks failed

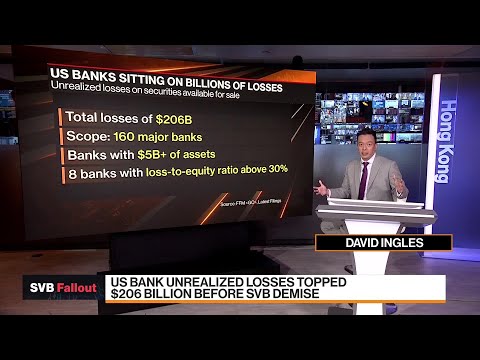

US Banks Sitting on Billions of Losses

For US banks, their China dreams turn sour | World Business Watch | WION

Is the safety of US banks in jeopardy?

Major US banks rescue troubled First Republic with $30bn

The Best US Banks for Global Citizens

US Banks’ $118 Billion Buffer Likely Wiped Out by New Rules

Global Banks Risk Breaching China Law by Complying With U.S.

Комментарии

0:08:28

0:08:28

0:17:26

0:17:26

0:15:52

0:15:52

0:12:32

0:12:32

0:17:19

0:17:19

0:08:02

0:08:02

0:06:32

0:06:32

0:02:47

0:02:47

0:23:16

0:23:16

0:02:51

0:02:51

0:01:00

0:01:00

0:11:14

0:11:14

0:27:26

0:27:26

0:00:20

0:00:20

0:02:13

0:02:13

0:02:51

0:02:51

0:02:16

0:02:16

0:02:06

0:02:06

0:01:34

0:01:34

0:02:24

0:02:24

0:01:27

0:01:27

0:10:53

0:10:53

0:03:03

0:03:03

0:02:10

0:02:10