filmov

tv

Binomial Trees (FRM Part 1 2025 – Book 4 – Chapter 14)

Показать описание

*AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams*

After completing this reading, you should be able to:

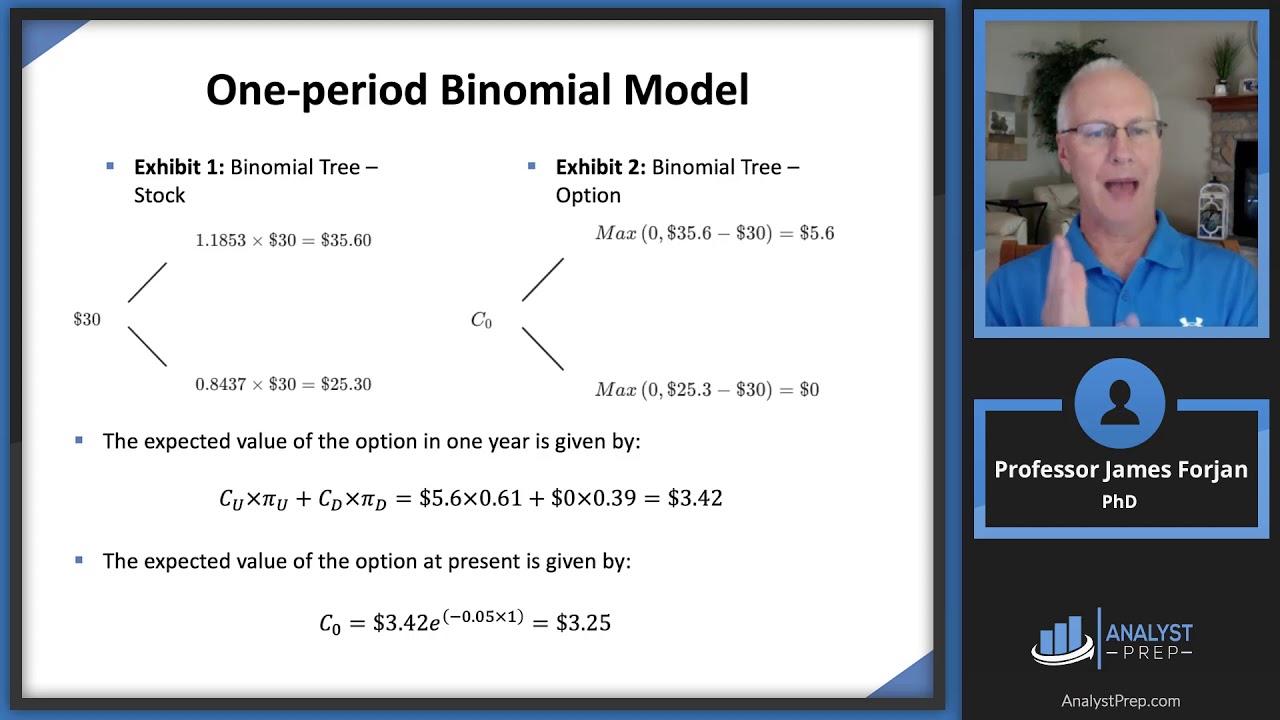

- Calculate the value of an American and a European call or put option using a one-step and two-step binomial model.

- Describe how volatility is captured in the binomial model.

- Describe how the value calculated using a binomial model converges as time periods are added.

- Explain how the binomial model can be altered to price options on: stocks with dividends, stock indices, currencies, and futures.

- Define and calculate delta of a stock option.

Комментарии