filmov

tv

🔴 Activity Based Costing Example in 6 Easy Steps - Managerial Accounting with ABC Costing

Показать описание

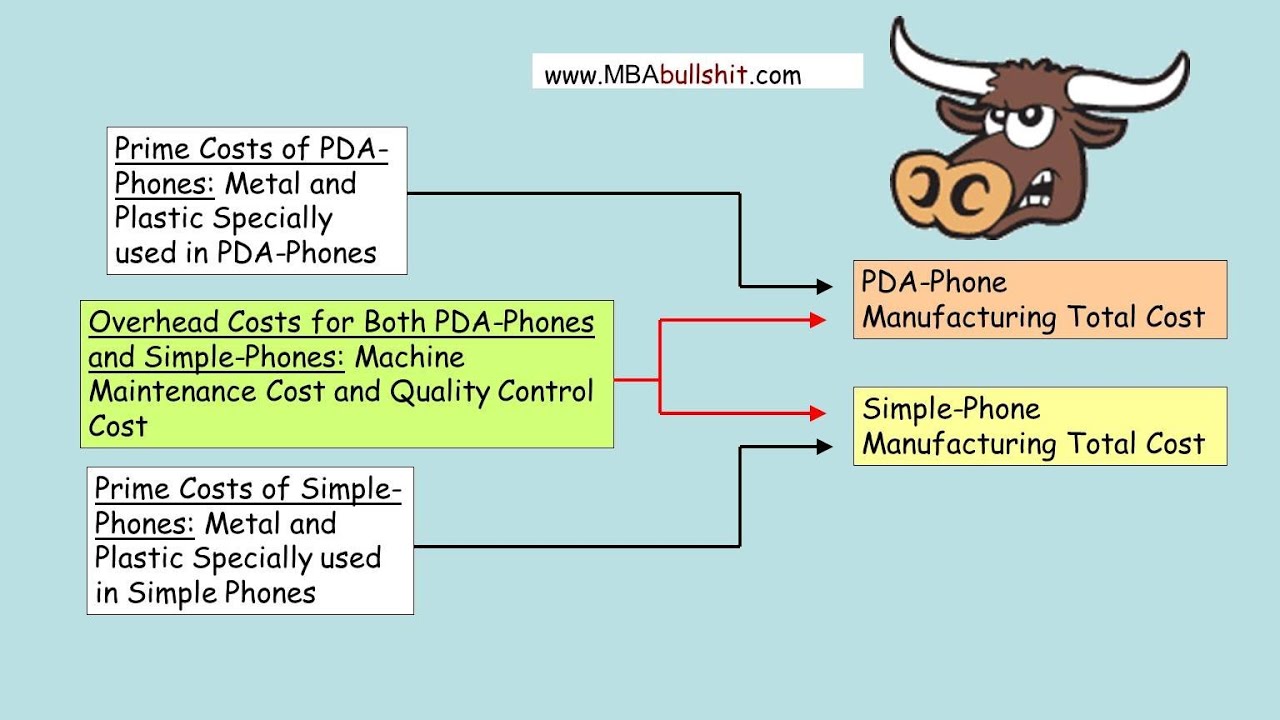

Imagine your brand makes two types of mobile phone devices. They are each produced working with one machine. The maintenance cost of the apparatus is $100 a month. What percentage should each style of telephone share under the maintenance cost? In order to be "just", some will suggest that the cost must be divided 50%-50%.

However, what if Phone A consumes 90 hours of the machinery, and Phone B uses only 10 hours of the apparatus? Should the cost remain to be split 50%-50%? As part of classic "allocated" costing, the cost should probably still be split 50%-50%.

However applying the principle of Activity Based Costing, it needs to most likely be cut up 90%-10% for the reason that one phone type is based on 90 hours of the apparatus monthly while the other cell phone form typically only consumes 10 hours of the identical device. The foregoing technique makes use of "amount of activity" for being a function of costing, and not just "allocation" where accountants simplistically allot the costs by the same token.Needless to say, for any product or service, there are a lot more activities to consider, and not only the employment of a particular device. These varying activities which generally encounter a mark on cost are classified as "cost drivers".

Cost drivers may appear in numerous varieties for instance machine hours consumed, number of inspections, hours spent on inspections, number of production runs, quantity of hours used up throughout production, quantity of setups, together with multiple others.In the case above, we simply used machine hours consumed. Inside a less forgiving example, we may additionally need to consider the number of inspections.

Suppose Phone A solicited added inspections by enterprise engineers than Phone B? It goes without saying, a great deal more of the compensation of institution engineers really needs to be allocated to Phone A. Whereas, what if Phone B solicited a great deal more production runs than Phone A? Again, we would struggle to conveniently partition broad production costs among the two mobile phone types. To further complicate the problem, what if Phone A, irrespective of using far less production runs, solicited more production setups than Phone B?

activity based costing, abc costing, what is activity based costing, what is abc

Комментарии

0:02:51

0:02:51

0:06:33

0:06:33

0:18:52

0:18:52

0:08:55

0:08:55

0:06:04

0:06:04

0:07:26

0:07:26

0:20:36

0:20:36

0:26:37

0:26:37

2:52:21

2:52:21

0:11:28

0:11:28

0:09:48

0:09:48

0:10:08

0:10:08

0:05:11

0:05:11

0:06:53

0:06:53

0:21:36

0:21:36

0:16:19

0:16:19

0:10:19

0:10:19

0:02:45

0:02:45

0:20:00

0:20:00

0:12:12

0:12:12

0:04:21

0:04:21

0:41:31

0:41:31

0:21:39

0:21:39

0:12:14

0:12:14