filmov

tv

Will Markets See a Short Squeeze Before Expiry? | Weekly Outlook

Показать описание

Last week markets scaled new highs. With expiry of the September derivatives series around the corner, there is a possibility of a short squeeze. In this video I discuss whether bulls can force bears to cover their shorts and lead markets higher.

What are tail risk (Hacienda) hedges?-

How to make bigger trading profits per trade -

How to buy bullion at best prices -

How high can gold and silver rise? -

Follow me here for daily updates

===========================

00:00 About Vijay

00:05 Whats This Video About?

01:14 Weekly Market Round-up

02:48 Ratio Chart

04:15 Our In-house Indicators

06:13 Why a Short Squeeze Maybe Likely

09:35 Our In-house Indicators (Contd)

10:57 Bond Market Outlook

12:25 Bank Nifty Outlook

15:12 Nifty Outlook

17:36 Retail Risk Appetite

18:53 My Weekly Strategy

22:52 Contact Us

Stay ahead of the crowds with our videos

#alltimehigh #shortsqueeze #niftytradingstrategies #bankniftytradingstrategies

What are tail risk (Hacienda) hedges?-

How to make bigger trading profits per trade -

How to buy bullion at best prices -

How high can gold and silver rise? -

Follow me here for daily updates

===========================

00:00 About Vijay

00:05 Whats This Video About?

01:14 Weekly Market Round-up

02:48 Ratio Chart

04:15 Our In-house Indicators

06:13 Why a Short Squeeze Maybe Likely

09:35 Our In-house Indicators (Contd)

10:57 Bond Market Outlook

12:25 Bank Nifty Outlook

15:12 Nifty Outlook

17:36 Retail Risk Appetite

18:53 My Weekly Strategy

22:52 Contact Us

Stay ahead of the crowds with our videos

#alltimehigh #shortsqueeze #niftytradingstrategies #bankniftytradingstrategies

Emerging Markets Will See Short-Term Downward Pressure: Lo

What is Short Covering and Short Covering Rally in the Stock Market?

Market hit ALL TIME HIGH. How to invest AFTER Rate Cuts? | Akshat Shrivastava

The Big Short (2015) - Dr. Michael Burry Betting Against the Housing Market [HD 1080p]

FED Changed Everything | What 0.5% Rate Cut Will Do To The Market?!

What's the ruling on Short Selling in the Stock Market? - Assim al hakeem

INDIAN MARKET: Rest of 2024 Has a LOT in Store!

Any market pullback we see will be 'shallow and short', says BD8's Barbara Doran

How Bad The Stock Market Will Get #shorts

would you Buy or Sell here #tradingview | Stock | Market | crypto | Trading | #shorts

WHAT IS SHORT SELLING? | Stock Market Explained & More!

NEW TRADER PSYCHOLOGY #tradingview | Stock | Market | crypto | Trading | #shorts

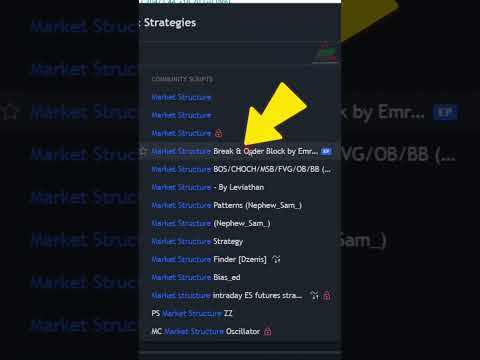

This indicator will help you predict market moves in Tradingview #shorts #forex #forextrading

What is a 'market melt-up' 🤔📊 #shorts

3 BOOKS to Master History of INDIAN STOCK MARKET📚📈 #shorts

#EarnMoney in Stock Market Crash | Short Selling & Option Trading Demo in #Upstox

Will Economy & Stock Markets Crash? #shorts

How TO IDENTIFY Breakout #ChartPatterns Candlestick | Stock | Market | Forex | crypto #Shorts

Wait for Confirmation #ChartPatterns Candlestick | Stock | Market | Forex | crypto | Trading #Shorts

Short Sellers - The Anti-heroes of Financial Market

Stock market could see 'short and shallow' pullback, says JPMorgan's Parker

Technical Analysis Breakdown #ChartPatterns | Stock | Market | Forex | crypto | Trading #Shorts

How Investing in the Stock Market Works🧠📈 #shorts

Billionaire Jeff Gundlach: What amateur investors don't understand about markets #shorts

Комментарии

0:05:14

0:05:14

0:05:22

0:05:22

0:13:15

0:13:15

0:04:30

0:04:30

0:17:39

0:17:39

0:01:54

0:01:54

0:10:06

0:10:06

0:04:02

0:04:02

0:00:51

0:00:51

0:00:54

0:00:54

0:05:17

0:05:17

0:00:39

0:00:39

0:00:25

0:00:25

0:00:37

0:00:37

0:00:57

0:00:57

0:23:15

0:23:15

0:00:21

0:00:21

0:00:16

0:00:16

0:00:30

0:00:30

0:22:08

0:22:08

0:03:43

0:03:43

0:00:22

0:00:22

0:00:20

0:00:20

0:00:50

0:00:50