filmov

tv

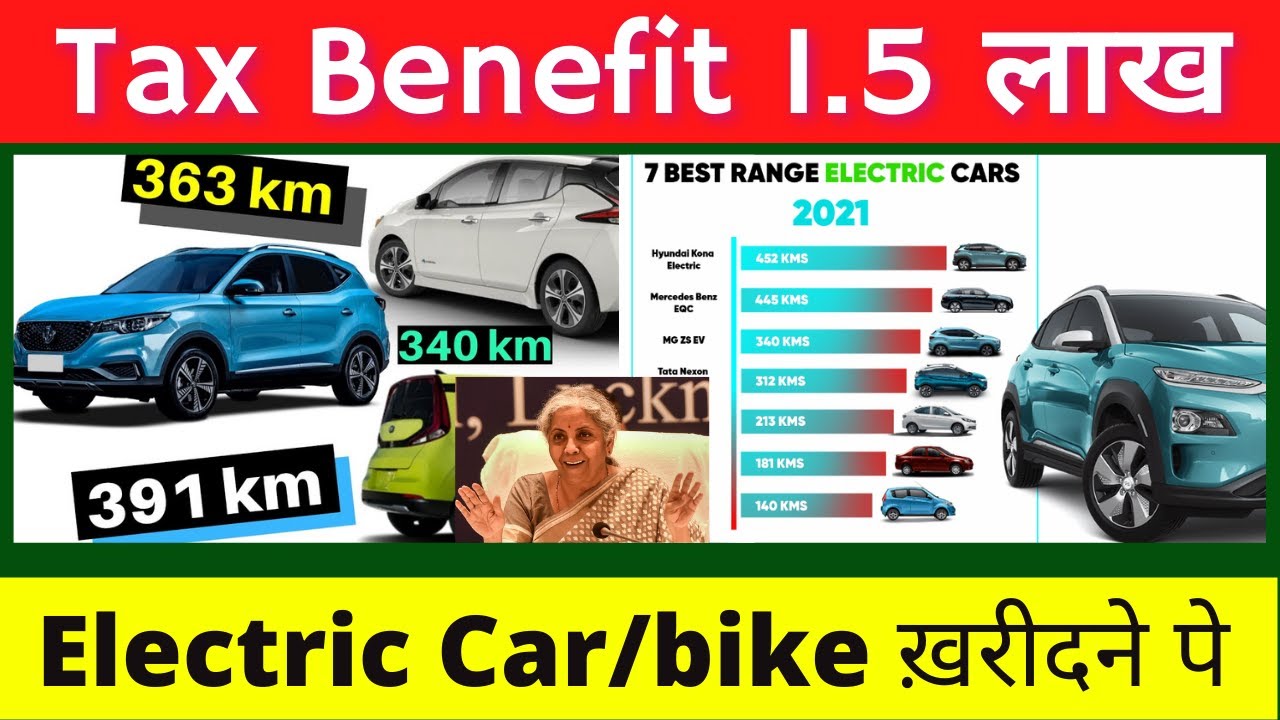

Tax Benefit on Electric Vehicle Purchase Upto 1.5 Lakh | Section 80EEB

Показать описание

Are you planning to a new Electric Vehcile Car or bike than you need to understand the tax benefit in it which is comes under 80EEB upto 1.5 lakh. lets understand who can take benefit and how you can avial this benefit for you.

--------------------------------

Open Your Free Demat Account On Angel and Invest in Share Market:

Open Your Demat Account On Zerodha in Rs. 300:

All chapter with time line on Electric Vehicle tax benefit

0:00 Introduction

0:40 Electric Vehicle vs Petrol Diesel Car

1:29 tax Benefit on EVs

#EV #tax #80EEB #ElectricCar #Bike

=========================

========================

Social media Links:

========================

thank you for watching keep loving and keep supporting 'Ravi Kant Yadav' channel.

--------------------------------

Open Your Free Demat Account On Angel and Invest in Share Market:

Open Your Demat Account On Zerodha in Rs. 300:

All chapter with time line on Electric Vehicle tax benefit

0:00 Introduction

0:40 Electric Vehicle vs Petrol Diesel Car

1:29 tax Benefit on EVs

#EV #tax #80EEB #ElectricCar #Bike

=========================

========================

Social media Links:

========================

thank you for watching keep loving and keep supporting 'Ravi Kant Yadav' channel.

Tax Benefits on Electric Car Bike Scooter Loan | How to Get Tax Benefits on Car Loan 80EEB Deduction

EV Tax Credits: Everything You Need to Know for 2024 | Eligibility, Incentive Amount & More

Tax Benefits on Electric vehicle loan 2024 | Step-by-Step Guide

TAX Benefits of buying EV | #LLAShorts 46

Deduction u/s 80 EEB | CA INTER | Income Tax | CA Rohan Gupta

ACCOUNTANT EXPLAINS: How to Buy a Tesla Half Price

Tax benefits on Electric Vehicles | Mayur Firodiya | Tax Thursday

Buy Electric Vehicle and save Tax. How much tax do electric cars save? #EV #itr

End Of Model Y: Elon Musk Announces Tesla Model Y Juniper 2025 Is Here! CHEAPEST VERSION

Electric Cars Help You Save Tax

What Are The Tax Benefits Of Buying An EV? | Mercedes Benz | CNBC TV18 Climate Clock Podcast | N18S

Ram Prasad - Tax Benefits on Electric Vehicles | TAX Benefits of buying EV | Cars buy in Loans #Cars

Recap: What is BiK (Benefit in Kind) Tax. EV Salary Sacrfice.

ELECTRIC CARS AND HMRC – ARE THEY TAX DEDUCTIBLE IN THE UK?

Section 80EEB | Tax Benefits on Electric Vehicles(EV) in India | Claim deduction on ClearTax

EV Tax Credits - Every 2024/2025 EV & PHEV That Qualifies & How It Works

EV Tax Credit: What It Is, How It Works, and Do You Qualify? | The Federal EV Tax Credit Explained

Electric vehicle (EV) Tax benefit | Section 80EEB - Electric vehicle | Deduction under Section 80EEB

The Federal EV Tax Credit | 2024 Edition

Save tax on your electric vehicle

Tax Benefits on Electric Car Bike Scooter Loan | How to Get Tax Benefits on Car Loan 80EEB Deduction

Benefit of electric vehicle loan sec 80EEB #shorts #sec80eeb #eletricvehicleloan

Get an electric car and SAVE TAX in the UK! ✅ #shorts

Electric Vehicle Novated Lease Model 3 Australia Case Study FBT exempt

Комментарии

0:04:15

0:04:15

0:06:20

0:06:20

0:04:20

0:04:20

0:00:41

0:00:41

0:02:27

0:02:27

0:08:01

0:08:01

0:06:20

0:06:20

0:06:42

0:06:42

0:08:47

0:08:47

0:00:52

0:00:52

0:00:53

0:00:53

0:06:35

0:06:35

0:10:39

0:10:39

0:08:46

0:08:46

0:01:57

0:01:57

0:17:54

0:17:54

0:07:35

0:07:35

0:02:37

0:02:37

0:03:30

0:03:30

0:00:06

0:00:06

0:02:37

0:02:37

0:00:45

0:00:45

0:01:00

0:01:00

0:15:18

0:15:18