filmov

tv

Total Income Questions in 1 shot | Inter | CA Amit Mahajan

Показать описание

Champs -

Welcome to the TAX-verse!

Let's kill the most challenging part of Direct Tax in 1 go!!

Let's make this as your final attempt.

Practice Batch Link -

Inter - Smart Rapider 2.0 links to purchase:

See you soon!

CA Amit Mahajan

For Queries - 82604 32090

super 50

super 50 direct tax

super 50 dt

Super 50 IDT

Sper 50 GST

direct tax amit mahajan

tax amit mahajan

Welcome to the TAX-verse!

Let's kill the most challenging part of Direct Tax in 1 go!!

Let's make this as your final attempt.

Practice Batch Link -

Inter - Smart Rapider 2.0 links to purchase:

See you soon!

CA Amit Mahajan

For Queries - 82604 32090

super 50

super 50 direct tax

super 50 dt

Super 50 IDT

Sper 50 GST

direct tax amit mahajan

tax amit mahajan

Total Income Question 1 | CA Intermediate May 2023 & Nov 2023 | Neeraj Arora

HOW TO CALCULATE INCOME TAX(Example 1)

Income tax computation (part 1) - ACCA Taxation (FA 2022) TX-UK lectures

Adjusted taxable income

IAS 12 - INCOME TAX (PART 1)

Maths Lit - Paper 1 Nov 2020 (Q2.3 - income, expenses & break even)

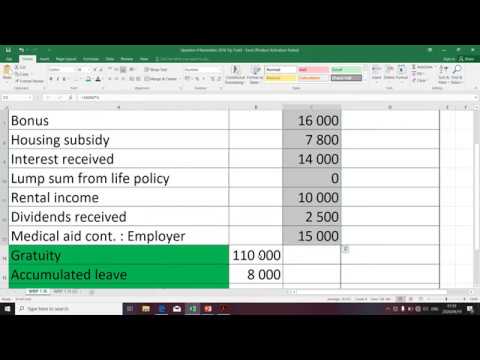

Computation of Gross Total Income in case of Residential Status-Problem No 1

How To Calculate Federal Income Taxes - Social Security & Medicare Included

Intermediate Paper-3A:ITL | Topic: Computation of total income and tax...| Session 2 | 21 Nov, 2024

Income statement

Income Tax N6 (Calculation of Tax Liability N.P - Gross Income - Part 1) - Mr. K. Modisane

Computation of Total Income & Tax Liability Questioner Discussion

Net vs. Gross (Income, Pay/Salary, etc.) in One Minute: Definition/Difference, Explanation, Examples

Income Tax Lecture-3 Computation Of total Income & Tax Liability | Income Tax Bcom /BBA 2022-23

The INCOME STATEMENT for BEGINNERS

Gross Total Income In Income Tax II Meaning Of Gross Total Income And Total Income

Income from salary assessment year 2019-20

Computation of Total Income and Tax Payable | Lecture 1 | CA Intermediate - May 2023 | Fast Track

How to estimate your personal income taxes

Incidence of Tax (Income Tax)in English with example for Bcom/IPCC/CS/CMA

Income Tax Basics Explained | Tax Rates | 5 Income Heads | Hindi

27. 'Proforma of Calculation of Income From Business' - From Income tax Subject

KCSE 2002 INCOME TAX

CA Inter computation of Total Income marathon | CA Inter May 2022/ Nov 2022 | CA Inter marathon

Комментарии

0:41:16

0:41:16

0:10:20

0:10:20

0:19:45

0:19:45

0:21:29

0:21:29

0:29:38

0:29:38

0:08:12

0:08:12

0:24:17

0:24:17

0:25:05

0:25:05

2:30:13

2:30:13

0:10:45

0:10:45

0:17:33

0:17:33

1:10:32

1:10:32

0:01:22

0:01:22

0:11:12

0:11:12

0:05:09

0:05:09

0:12:37

0:12:37

0:16:47

0:16:47

1:27:38

1:27:38

0:04:49

0:04:49

0:13:58

0:13:58

0:06:14

0:06:14

0:11:03

0:11:03

0:10:39

0:10:39

2:43:35

2:43:35