filmov

tv

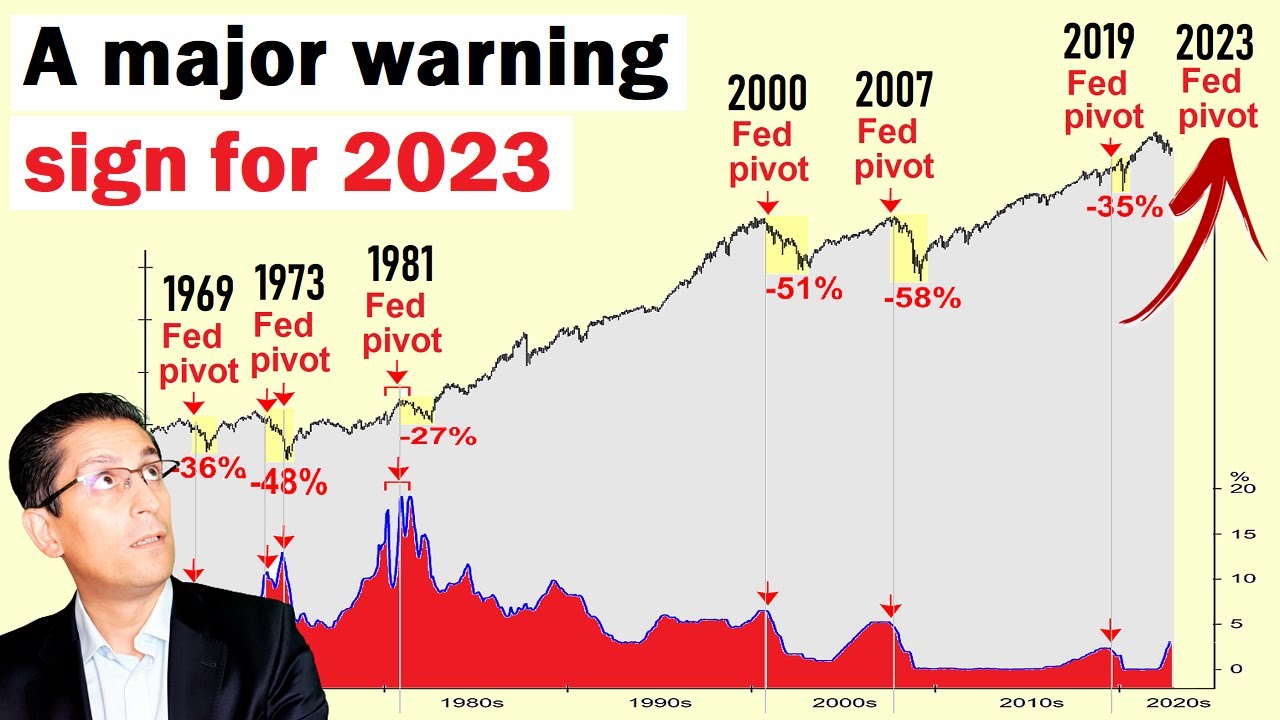

Why Everybody is WRONG about the Markets and the Fed Pivot (danger for 2023)

Показать описание

Why everybody is wrong about the markets and the Fed pivot (danger for 2023). Most analysts and economists are expecting a "fed pivot" either in December or next year in 2023. The "Fed pivot" is when the Federal Reserve decides to reverse its strategy of raising rates to bring inflation under control and instead to cut rates (hence the "pivot"). This event is expected to happen some time in 2023. The majority of analysts and economists are of the view that this pivot by the Fed will be a positive for the stock market - i.e. that it will make stock markets rally much higher. However, does history agree with this view? In this video I am going to show you why the majority opinion on the "Fed pivot" is mistaken. History shows something completely different to what the majority of analysts expect. In fact, it seems that the stock market usually rallies in expectation of a pivot by the Fed (when the Fed decides to cut rates) and after the pivot occurs, the market is ready to make a top and drop much further lower. We look at examples from previous major pivots in the years 2007, 2000 and 1973. #stockmarket #sp500 #alessiorastani

Follow Alessio Rastani:

Watch more Alessio Rastani:

DISCLAIMER and RISK WARNING:

Trading has large potential rewards and also large potential risks. You must be aware of the risks and be willing to accept them. Don't trade with money you can't afford to lose. We are neither an investment advisory service nor an investment advisor. Data and information provided are solely for educational purposes. Nothing in this channel, videos and the information provided in it should be construed as a recommendation to buy or sell stocks, ETFs, futures, indices, forex, cryptocurrencies, commodities or any market. The past performance of any trading system or methodology is not necessarily indicative of future results. Current analysis can change due to future market events. Investing in cryptocoins or tokens is highly speculative and the market is largely unregulated, therefore anyone considering it should be prepared to lose their entire investment.

Follow Alessio Rastani:

Watch more Alessio Rastani:

DISCLAIMER and RISK WARNING:

Trading has large potential rewards and also large potential risks. You must be aware of the risks and be willing to accept them. Don't trade with money you can't afford to lose. We are neither an investment advisory service nor an investment advisor. Data and information provided are solely for educational purposes. Nothing in this channel, videos and the information provided in it should be construed as a recommendation to buy or sell stocks, ETFs, futures, indices, forex, cryptocurrencies, commodities or any market. The past performance of any trading system or methodology is not necessarily indicative of future results. Current analysis can change due to future market events. Investing in cryptocoins or tokens is highly speculative and the market is largely unregulated, therefore anyone considering it should be prepared to lose their entire investment.

Комментарии

0:13:55

0:13:55

0:14:02

0:14:02

0:00:10

0:00:10

0:14:12

0:14:12

0:10:34

0:10:34

0:01:00

0:01:00

0:12:10

0:12:10

0:29:36

0:29:36

0:01:00

0:01:00

0:00:56

0:00:56

0:23:43

0:23:43

0:52:29

0:52:29

0:25:32

0:25:32

0:12:39

0:12:39

0:00:31

0:00:31

0:55:16

0:55:16

0:11:30

0:11:30

0:34:26

0:34:26

0:00:57

0:00:57

0:00:52

0:00:52

0:20:25

0:20:25

0:30:59

0:30:59

0:13:24

0:13:24

0:00:56

0:00:56