filmov

tv

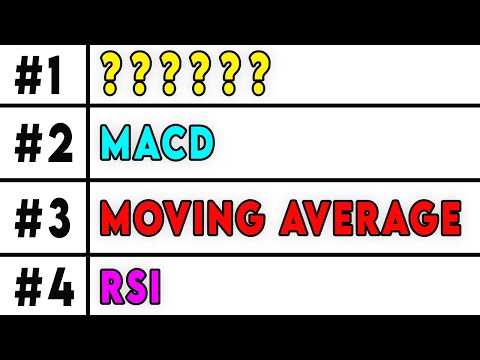

The Perfect Indicator For Trading Reversals - Heiken Ashi RSI

Показать описание

Discover the power of Heiken Ashi RSI, the ultimate indicator for trading reversals. In this video, we delve into the features and benefits of this powerful tool, unveiling its effectiveness in identifying trend reversals with precision. Learn how to interpret the signals provided by Heiken Ashi RSI and incorporate them into your trading strategy.

✅30 Days Risk-Free (with the link)

✅30% Off With Code: ST30 (with the link)

What is Switch Stats?

Switch stats is the best channel for learning profitable 1 minute, 3 minute, 5 minute. 15 minute and 30 minute scalping strategies! We always try to keep the video as short as possible and enjoy sharing the best trading and scalping strategies for free.

DISCLAIMER:

The information presented in this video is for educational and entertainment purposes only and is not financial advice.

This SECRET TradingView Indicators to Use in 2025! The Most Accurate BUY & SELL Indicator

This Indicator Predicts The Future

This Indicator is Over Powered!

🔴 Trading Indicators - Discover the Best Indicators for Day Trading and Swing Strategies

This Indicator Finds PERFECT Entries

THE BEST SCALPING INDICATOR ON TRADINGVIEW | STRATEGY | SCALPING | 1MINUTE | #forex

Simple Indicator Earn Daily 20 to 50k #optiontrading #intradaytradingtips #tradingstrategy #shorts

Best trading indicator 📈

Best Trading Indicators : SmartCharts Tips for Smarter Trades with Greg Secker!

Crazy RSI Indicator Tricks

1 Indicator, 3 Uses! Most Powerful Trading Tool Ever Created

🔴 Best TradingView Indicator for Nasdaq100! Day Trading #forex #daytrading #forextrading

The Secret To Using The Volume Profile Indicator #shorts

The Only Indicator You’ll Ever Need

Trading indicator - THE BEST BINARY OPTIONS INDICATORS! Best trading indicator

Very PROFITABLE Trading Strategy with Only 1 Indicator! #shorts

SECRET TradingView BEST Indicators! The Most Accurate BUY & SELL Indicator Of 2024

100% High Probability REVERSAL Indicator on TradingView Gives Perfect Signals

The #1 Trading Indicator on TradingView

Best Indicator For Mobile Trading!! #Forex #shorts

Best trading indicator 📈 #stocks #crypto #forex #tradingview

The BEST SMC indicator on TradingView!📈 #smartmoneyconcepts

The TradingView Indicators to Use in 2025! Best Scalping Indicator on Tradingview

PERFECT BUY & SELL SIGNAL INDICATOR ON #TRADINGVIEW

Комментарии

0:08:38

0:08:38

0:05:24

0:05:24

0:00:33

0:00:33

0:13:25

0:13:25

0:00:40

0:00:40

0:00:17

0:00:17

0:01:00

0:01:00

0:00:27

0:00:27

0:04:25

0:04:25

0:00:46

0:00:46

0:12:42

0:12:42

0:00:21

0:00:21

0:00:56

0:00:56

0:08:48

0:08:48

0:07:32

0:07:32

0:00:39

0:00:39

0:09:06

0:09:06

0:07:52

0:07:52

0:09:01

0:09:01

0:00:27

0:00:27

0:00:10

0:00:10

0:00:34

0:00:34

0:08:24

0:08:24

0:00:48

0:00:48