filmov

tv

Fiscal Policy vs Monetary Policy: Pros and Cons for the Economy

Показать описание

#monetarypolicy #fiscalpolicy #economicpolicy #macroeconomics #centralbank #government #economy #inflation #interestrates #stimulus #recession #investment #publicspending #taxes #budget #growth

In the world of economics, monetary and fiscal policy are two of the most important tools used by governments and central banks to stabilize the economy. While both policies aim to achieve economic stability and growth, they differ in their approaches and impact.

Monetary policy involves the actions taken by a central bank to manage the money supply and interest rates to achieve macroeconomic goals such as price stability, full employment, and economic growth. This policy is primarily implemented by adjusting interest rates, open market operations, and reserve requirements.

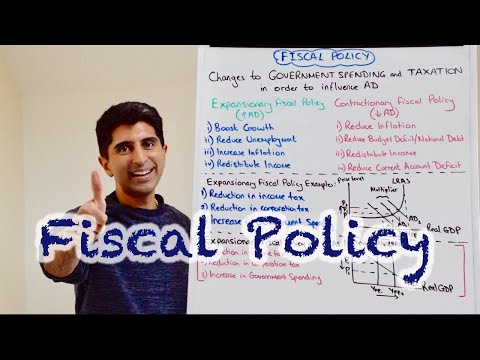

On the other hand, fiscal policy involves the government's decisions regarding public spending, taxation, and borrowing to achieve similar macroeconomic goals. Fiscal policy is typically implemented through the government budget, where it determines the allocation of resources to various sectors such as health care, education, and defense.

In this video, we'll discuss the key differences between monetary policy and fiscal policy, including their benefits and drawbacks. We'll explore how these policies impact inflation, interest rates, and economic growth, and their role in managing recessions and economic crises.

While monetary policy is often seen as a short-term solution to stabilize the economy, fiscal policy tends to be a long-term strategy that involves structural changes to the economy. We'll also discuss the challenges associated with each policy, including their impact on government debt, inflation, and the financial market.

Overall, the choice between monetary policy and fiscal policy depends on the specific economic situation and the policy objectives of the government. By understanding the differences between these policies, investors can make informed decisions about their investments and individuals can make better decisions about their personal finances.

In the world of economics, monetary and fiscal policy are two of the most important tools used by governments and central banks to stabilize the economy. While both policies aim to achieve economic stability and growth, they differ in their approaches and impact.

Monetary policy involves the actions taken by a central bank to manage the money supply and interest rates to achieve macroeconomic goals such as price stability, full employment, and economic growth. This policy is primarily implemented by adjusting interest rates, open market operations, and reserve requirements.

On the other hand, fiscal policy involves the government's decisions regarding public spending, taxation, and borrowing to achieve similar macroeconomic goals. Fiscal policy is typically implemented through the government budget, where it determines the allocation of resources to various sectors such as health care, education, and defense.

In this video, we'll discuss the key differences between monetary policy and fiscal policy, including their benefits and drawbacks. We'll explore how these policies impact inflation, interest rates, and economic growth, and their role in managing recessions and economic crises.

While monetary policy is often seen as a short-term solution to stabilize the economy, fiscal policy tends to be a long-term strategy that involves structural changes to the economy. We'll also discuss the challenges associated with each policy, including their impact on government debt, inflation, and the financial market.

Overall, the choice between monetary policy and fiscal policy depends on the specific economic situation and the policy objectives of the government. By understanding the differences between these policies, investors can make informed decisions about their investments and individuals can make better decisions about their personal finances.

0:07:47

0:07:47

0:02:42

0:02:42

0:03:59

0:03:59

0:09:19

0:09:19

0:08:54

0:08:54

0:03:40

0:03:40

0:02:51

0:02:51

0:01:14

0:01:14

2:56:12

2:56:12

0:05:28

0:05:28

0:06:37

0:06:37

0:08:15

0:08:15

0:04:16

0:04:16

0:00:49

0:00:49

0:11:27

0:11:27

0:35:41

0:35:41

0:25:02

0:25:02

0:02:41

0:02:41

0:03:27

0:03:27

0:05:04

0:05:04

0:00:31

0:00:31

0:08:42

0:08:42

0:09:25

0:09:25

0:11:54

0:11:54