filmov

tv

What To Do If Your Tax Return Is Rejected By the IRS - TurboTax Tax Tip Video

Показать описание

What to do if Your Baby is Choking - First Aid Training - St John Ambulance

What to do if Your Child is Choking

What to Do if Your Self-Test Result is Positive

What You Should Do If You feel Sick - For Students

DO THIS If You’re Young and Broke

What to Do if Your Spouse Has Depression

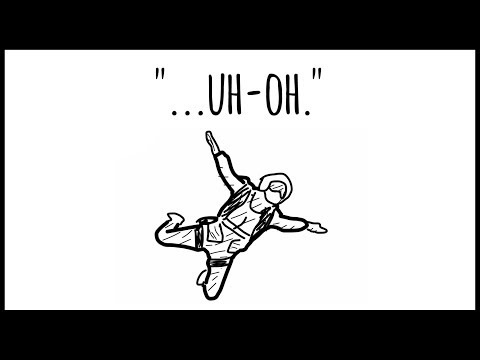

What To Do If Your Parachute Fails

Mayo Clinic Minute: What to do if your child has an upset stomach

What To Do If Your Layover Is Too Short? 🤔

What To Do If You’re BORED 🥴

What to do if you don't like your life

How do you know if your shoulder is dislocated?

What to do if your Baby has a Serious Fall - First Aid Training - St John Ambulance

Mayo Clinic Minute: 3 tips on what to do if your child is addicted to gaming

Mayo Clinic Minute: What to do if your child has a fever

What to do if your child is choking

What to do if Your Baby has Fever - First Aid Training - St John Ambulance

What To Do If Someone Has A Seizure - First Aid Training - St John Ambulance

What to do if your baby spits up while sleeping on their back

What to do if your Baby has a Head Injury - First Aid Training - St John Ambulance

What should you do if you test positive for COVID | ACP

What to do if you feel tightness in your chest

What to do if you're alone and choking

How Do You Know If You Have Depression?

Комментарии

0:01:47

0:01:47

0:01:19

0:01:19

0:02:31

0:02:31

0:00:37

0:00:37

0:13:05

0:13:05

0:07:33

0:07:33

0:04:09

0:04:09

0:01:00

0:01:00

0:03:02

0:03:02

0:00:06

0:00:06

0:08:41

0:08:41

0:00:43

0:00:43

0:04:19

0:04:19

0:01:01

0:01:01

0:00:57

0:00:57

0:03:53

0:03:53

0:02:10

0:02:10

0:02:59

0:02:59

0:00:33

0:00:33

0:02:50

0:02:50

0:03:32

0:03:32

0:02:31

0:02:31

0:00:29

0:00:29

0:03:34

0:03:34