filmov

tv

Return On Assets (ROA) Explained_Profitability ratios_Ch.2 Fin. Statement Analysis_Unit 7_Module 2

Показать описание

Return on Assets (ROA): Is a crucial profitability ratio that measures how effectively a company is utilizing its assets to generate earnings. It provides insights into the efficiency of asset management in relation to the company's net income.

Meaning: ROA indicates the percentage of profit a company earns for every Naira (₦) of assets. It reflects how efficiently management is using its assets to produce profit, showcasing the company’s overall operational efficiency.

Formula

ROA = Net Income × 100

Total Assets

Where:

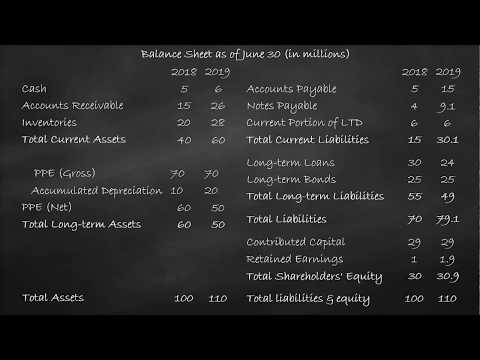

Net Income: The profit after all expenses, taxes, and costs have been deducted.

Total Assets: The sum of all current and non-current assets owned by the company.

Implications

A higher ROA suggests that a company is effective in generating profit from its assets. It indicates strong operational performance and efficient management. A lower ROA may indicate that the company is not effectively using its assets, which could lead to lower profitability and potential financial challenges.

A declining ROA may prompt management to assess their asset management strategies, operational efficiencies, and potential need for asset disposals or improvements in productivity.

Cause & Effect

Causes: Effective utilization of assets, such as efficient production processes or optimized inventory management. Strong sales performance relative to asset base, indicating good market demand and effective marketing strategies. Low operational costs and overheads that enhance profit margins.

Effects:

A consistently high ROE can attract investors and lead to a higher stock price, as it indicates strong financial performance and efficient capital utilization.

A declining ROE may prompt management to review operational strategies, cost structures, or consider restructuring to improve profitability.

Conclusion

ROA is an essential metric for evaluating a company’s operational efficiency and its ability to convert assets into profits. It helps investors and management assess how well the company is utilizing its resources and informs decisions related to investments, asset management, and overall business strategy. Regular monitoring of ROA can help companies maintain efficiency and profitability in their operations.

#instituteofcharteredaccountantsofnigeria

#icancasestudy

#ICANProfessionalExam

#ICANExamPreparation

#ICANPathfinder

#CharteredAccountants

#AccountingStudents

#ExamTips

#ICANDebrief

#ProfessionalAccountancy

#JosiahGabriel

Kindly download the ICAN Case study material here for your studies:

Meaning: ROA indicates the percentage of profit a company earns for every Naira (₦) of assets. It reflects how efficiently management is using its assets to produce profit, showcasing the company’s overall operational efficiency.

Formula

ROA = Net Income × 100

Total Assets

Where:

Net Income: The profit after all expenses, taxes, and costs have been deducted.

Total Assets: The sum of all current and non-current assets owned by the company.

Implications

A higher ROA suggests that a company is effective in generating profit from its assets. It indicates strong operational performance and efficient management. A lower ROA may indicate that the company is not effectively using its assets, which could lead to lower profitability and potential financial challenges.

A declining ROA may prompt management to assess their asset management strategies, operational efficiencies, and potential need for asset disposals or improvements in productivity.

Cause & Effect

Causes: Effective utilization of assets, such as efficient production processes or optimized inventory management. Strong sales performance relative to asset base, indicating good market demand and effective marketing strategies. Low operational costs and overheads that enhance profit margins.

Effects:

A consistently high ROE can attract investors and lead to a higher stock price, as it indicates strong financial performance and efficient capital utilization.

A declining ROE may prompt management to review operational strategies, cost structures, or consider restructuring to improve profitability.

Conclusion

ROA is an essential metric for evaluating a company’s operational efficiency and its ability to convert assets into profits. It helps investors and management assess how well the company is utilizing its resources and informs decisions related to investments, asset management, and overall business strategy. Regular monitoring of ROA can help companies maintain efficiency and profitability in their operations.

#instituteofcharteredaccountantsofnigeria

#icancasestudy

#ICANProfessionalExam

#ICANExamPreparation

#ICANPathfinder

#CharteredAccountants

#AccountingStudents

#ExamTips

#ICANDebrief

#ProfessionalAccountancy

#JosiahGabriel

Kindly download the ICAN Case study material here for your studies:

0:03:07

0:03:07

0:07:08

0:07:08

0:02:54

0:02:54

0:11:27

0:11:27

0:07:07

0:07:07

0:01:40

0:01:40

0:09:45

0:09:45

0:04:26

0:04:26

0:01:27

0:01:27

0:11:59

0:11:59

0:00:46

0:00:46

0:12:50

0:12:50

0:16:40

0:16:40

0:02:27

0:02:27

0:05:15

0:05:15

0:02:11

0:02:11

0:01:00

0:01:00

0:02:21

0:02:21

0:00:53

0:00:53

0:02:06

0:02:06

0:10:14

0:10:14

0:02:36

0:02:36

0:23:57

0:23:57

0:09:24

0:09:24