filmov

tv

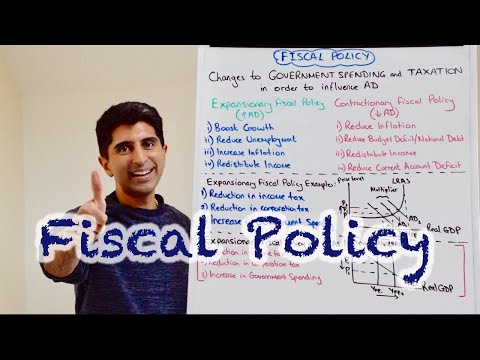

3.6 (Macro) Demand-side policies (contractionary fiscal): Monetarist & Keynesian; 3.3 Demand-pull

Показать описание

Video tutorial for IB Economics students illustrating how to draw and analyze the demand-side policy of contractionary fiscal policy using the monetarist / new classical and Keynesian models.

The demand-side policy applied leading to the decreased AD is contractionary fiscal policy, which is closing an inflationary gap.

Demand side fiscal policies includes changes in income taxes, corporate taxes, and/or wealth taxes, as well as changes in government spending on public goods and services by the central government as a means to influence aggregate demand.

Contractionary demand side fiscal policies would include the central government increasing income taxes, corporate taxes, and/or wealth taxes as well as decreasing government spending on public goods and services to encourage increased consumption and investment spending.

Note:

IB Econ Paper analysis of the economic model at time 8:01

----------------------

Analysis: Creation and elimination of an inflationary gap (demand-pull inflation) via contractionary fiscal policies

* Graph A: Monetarist model: Creating and eliminating an inflationary gap via contractionary fiscal policies

* Graph B: Keynesian model: Creating and eliminating an inflationary gap via contractionary fiscal policies

* X-axis measures real GDP

* Y-axis measures price level (PL)

------

* In references to Graph A (at time 8:32)

* Aggregate Demand 1 = AD1 = C+I+G+(X-M)

* AD is downward sloping as a result of the following: wealth effect, interest rate effect, and international trade effect

* Short Run Aggregate Supply 1 = SRAS1

* SRAS is upward sloping since as the PL rises with costs of production held constant in the short-run, the profit margin for firms increases thus increasing the incentive for firms to increase the quantity of output supplied

* Long Run Aggregate Supply 1 = LRAS1

* LRAS represents the long-run average level of output within a national economy when factors or production (inputs) are fully employed

------

* In reference to Graph B (at time 8:46)

3 sections of the Keynesian AS curve:

Section 1: illustrating recessionary gaps where unemployment is greater than the natural rate of unemployment (spare capacity), and real GDP is less than full potential GDP. There is a change in real GDP, but no change in PL.

Section 2: illustrating full employment equilibrium where unemployment = natural rate of unemployment, and real GDP at full potential GDP. There is a marginal change in real GDP, and a marginal change in PL.

Section 3: illustrating an inflationary gap where unemployment is less than the natural rate of unemployment, and real GDP is greater than full potential GDP. There is no change in real GDP, but there is a change in PL.

-------

* In reference to Graph A (at time 9:26)

* LRAS1=SRAS1=AD1 (point A), provides the equilibrium price level at PL1 and equilibrium level of output at Yp

* Yp = full potential GDP = full employment = natural rate of unemployment = (structural unemployment + frictional unemployment + seasonal unemployment)

* PL1 = inflation rate of 2% (target rate of inflation)

* Yp provides unemployment at 5%, which is the natural rate of unemployment

------

In reference to Graph B (at time 9:49)

* AD1=Keynesian AS (point A), provides an equilibrium price level at PL1 (demand-pull inflation) and equilibrium level of output (real GDP) at Yp (Section 2 of Keynesian AS)

------

In reference to Graphs A and B (at time 9:57)

* Assuming strong household and business confidence leading to increased consumption and investment spending

* Assumed increased government spending

* AD1 increases to AD2

Graph A (at time 10:13)

* AD2=SRAS1 (Point B)

* PL increases from PL1 to PL2 (demand-pull inflation)

* Real GDP increases from Yp to Yinf leading to unemployment being less than the natural rate as a result of an increase in the quantity of SRAS from Point A to Point B

Graph B (at time 10:51)

* AD2=KAS (Point B)

* PL2, Yinf

------

* Application of contractionary fiscal policies (at time 11:32)

* Central government increases income and corporate taxes leading to reduced consumption and investment spending

* Central government decreases government (G) spending

* Consumption (C) and investment (I) spending decreases

* (C), (I), (G) are determinants of AD, thus as C, I, G decrease, AD2 decreases to AD1

* AD1=SRAS1 (point A) or AD1=KAS, provides a short-run equilibrium price level at PL1 & equilibrium level of output at Yp

* A decrease in AD leads to a decrease in the quantity of SRAS (or KAS) from Point B to

Point A thus firms begin to fire resources such as labor, land, & capital

* Unemployment increases at Yp thus unemployment at the natural rate of unemployment signaling that the national economy is at full potential GDP (full employment)

* A decrease in the price level from PL2 to PL1 signals the reduction of demand-pull inflation

The demand-side policy applied leading to the decreased AD is contractionary fiscal policy, which is closing an inflationary gap.

Demand side fiscal policies includes changes in income taxes, corporate taxes, and/or wealth taxes, as well as changes in government spending on public goods and services by the central government as a means to influence aggregate demand.

Contractionary demand side fiscal policies would include the central government increasing income taxes, corporate taxes, and/or wealth taxes as well as decreasing government spending on public goods and services to encourage increased consumption and investment spending.

Note:

IB Econ Paper analysis of the economic model at time 8:01

----------------------

Analysis: Creation and elimination of an inflationary gap (demand-pull inflation) via contractionary fiscal policies

* Graph A: Monetarist model: Creating and eliminating an inflationary gap via contractionary fiscal policies

* Graph B: Keynesian model: Creating and eliminating an inflationary gap via contractionary fiscal policies

* X-axis measures real GDP

* Y-axis measures price level (PL)

------

* In references to Graph A (at time 8:32)

* Aggregate Demand 1 = AD1 = C+I+G+(X-M)

* AD is downward sloping as a result of the following: wealth effect, interest rate effect, and international trade effect

* Short Run Aggregate Supply 1 = SRAS1

* SRAS is upward sloping since as the PL rises with costs of production held constant in the short-run, the profit margin for firms increases thus increasing the incentive for firms to increase the quantity of output supplied

* Long Run Aggregate Supply 1 = LRAS1

* LRAS represents the long-run average level of output within a national economy when factors or production (inputs) are fully employed

------

* In reference to Graph B (at time 8:46)

3 sections of the Keynesian AS curve:

Section 1: illustrating recessionary gaps where unemployment is greater than the natural rate of unemployment (spare capacity), and real GDP is less than full potential GDP. There is a change in real GDP, but no change in PL.

Section 2: illustrating full employment equilibrium where unemployment = natural rate of unemployment, and real GDP at full potential GDP. There is a marginal change in real GDP, and a marginal change in PL.

Section 3: illustrating an inflationary gap where unemployment is less than the natural rate of unemployment, and real GDP is greater than full potential GDP. There is no change in real GDP, but there is a change in PL.

-------

* In reference to Graph A (at time 9:26)

* LRAS1=SRAS1=AD1 (point A), provides the equilibrium price level at PL1 and equilibrium level of output at Yp

* Yp = full potential GDP = full employment = natural rate of unemployment = (structural unemployment + frictional unemployment + seasonal unemployment)

* PL1 = inflation rate of 2% (target rate of inflation)

* Yp provides unemployment at 5%, which is the natural rate of unemployment

------

In reference to Graph B (at time 9:49)

* AD1=Keynesian AS (point A), provides an equilibrium price level at PL1 (demand-pull inflation) and equilibrium level of output (real GDP) at Yp (Section 2 of Keynesian AS)

------

In reference to Graphs A and B (at time 9:57)

* Assuming strong household and business confidence leading to increased consumption and investment spending

* Assumed increased government spending

* AD1 increases to AD2

Graph A (at time 10:13)

* AD2=SRAS1 (Point B)

* PL increases from PL1 to PL2 (demand-pull inflation)

* Real GDP increases from Yp to Yinf leading to unemployment being less than the natural rate as a result of an increase in the quantity of SRAS from Point A to Point B

Graph B (at time 10:51)

* AD2=KAS (Point B)

* PL2, Yinf

------

* Application of contractionary fiscal policies (at time 11:32)

* Central government increases income and corporate taxes leading to reduced consumption and investment spending

* Central government decreases government (G) spending

* Consumption (C) and investment (I) spending decreases

* (C), (I), (G) are determinants of AD, thus as C, I, G decrease, AD2 decreases to AD1

* AD1=SRAS1 (point A) or AD1=KAS, provides a short-run equilibrium price level at PL1 & equilibrium level of output at Yp

* A decrease in AD leads to a decrease in the quantity of SRAS (or KAS) from Point B to

Point A thus firms begin to fire resources such as labor, land, & capital

* Unemployment increases at Yp thus unemployment at the natural rate of unemployment signaling that the national economy is at full potential GDP (full employment)

* A decrease in the price level from PL2 to PL1 signals the reduction of demand-pull inflation

Комментарии

0:13:59

0:13:59

0:09:19

0:09:19

0:08:15

0:08:15

0:12:24

0:12:24

0:29:58

0:29:58

0:14:03

0:14:03

0:26:44

0:26:44

0:11:42

0:11:42

0:09:25

0:09:25

0:09:26

0:09:26

0:05:21

0:05:21

0:07:31

0:07:31

0:06:35

0:06:35

0:00:47

0:00:47

0:52:58

0:52:58

0:31:06

0:31:06

0:09:58

0:09:58

0:51:20

0:51:20

1:36:53

1:36:53

0:01:46

0:01:46

0:07:09

0:07:09

0:12:42

0:12:42

0:50:36

0:50:36

0:51:04

0:51:04